This is how China operates, planing is going for decades and not just for the next Q filing, best projects are carefully chosen and taken out when the prices of commodities are depressed. Once the decision is made after very careful DD and consideration, projects will be moved forward step by step aiming at the supply of commodities for already existing demand in China. I know it first hand from our strategic partnership with Ganfeng Lithium.

When will we make another one on our Shotgun Gold project or Los Azules Copper Royalty - I cannot tell you, but we are working hard to make it. Why do they need them and why in Latin America, like Los Azules Copper of McEwen Mining? Please find a few links to build the big picture:

Real Economic Stimulus: China To Build $242bn High-speed Railway - Moscow To Beijing In 2 days.

Here comes the real economic stimulus from China. This enormous undertaking will provide jobs and will require massive amount of construction materials and metals for this infrastructure. Actually, China is talking about linking Singapore and U.S. Once even the shale oil will be gone, high-speed railways will allow the intercontinental travel in the future.

Commodities: China To Boost Investment In Latin America To $250 Billion Within Decade.

"We can see how China is positioning itself on the global chessboard in order to preserve the stability and economic growth in these challenging times. After announcement of $1 Trillion infrastructure development plans now comes the very logical step to secure commodities supply from Latin America to implement these plans. Read more."

"Now we can put all China's world-wide acquisitions of the metal projects in the perspective. This huge stimulus plan for infrastructure development will need a secure supply of metals and China is already on the road to get it!Read more."

TNR Gold Los Azules Copper: Chinese M&A - Watch Out For Las Bambas Effect.

"Frik Els provides a very good insight into the Chinese deal culture and mining M&A particularly. Las Bambas deal is not only the very good indicator of the turning mining cycle, but also provides guidance for the smaller companies in China to go on The Hunt For Copper and other commodities. You can witness this approach in our particular case of Strategic Commodities with International Lithium and Ganfeng Lithium as well. Read More."

Mining:

MMG to begin pre-extraction at Las Bambas despite copper rout

Cecilia Jamasmie | January 29, 2015

Construction of Las Bambas, capable of an output of more than 2 million tonnes in the first five years of its opening, was 80% complete at the end of 2014.

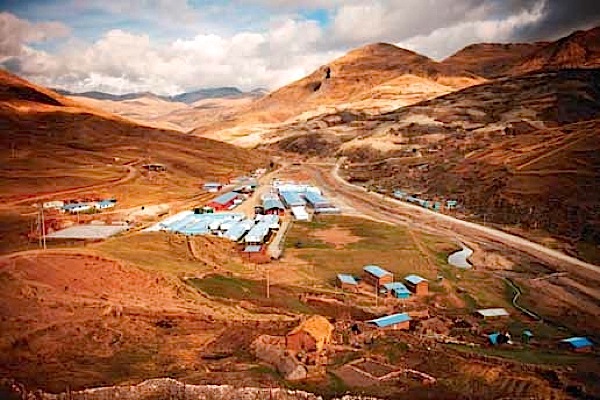

Copper weak prices, with the metal approaching a fresh five-year low early this week, have done nothing to discourage completion of MMG’s Las Bambas in Peru, one of the world's biggest mines of the red metal.

According BNamericas (in Spanish), construction of the US$7bn massive project, acquired from Glencore (LON:GLEN) in August 2014, is going strong and MMG expects production at Ferrobamba, one of the four deposits that make up the operation, to start early next year.

Glencore had to sell the project or other assets by September in order to win China's approval for its takeover of miner Xstrata in 2013, as Beijing feared the merged group would hold too much sway over global copper supply.

Construction of Las Bambas, capable of an output of more than 2 million tonnes in the first five years of its opening, was 80% complete at the end of 2014, and MMG expects that between $2.7 billion and $3.2 billion will have to be spent between August last year and when the first production of copper concentrate starts. Mining."

No comments:

Post a Comment