"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman,

TNR Gold Corp.

GEM Royalty TNR Gold Corp.

“TNR Gold Corp is your gateway to the green energy rEVolution and gold stability! We're building a leading green energy metals royalty and gold company, offering a unique entry into the supply chains powering the energy transition. With a 1.5% NSR royalty (of which 0.15% is held on behalf of a shareholder) on the Mariana Lithium Project in Argentina, operated by Ganfeng Lithium, and a 0.4% NSR (of which 0.04% is held on behalf of a shareholder) on the massive Los Azules Copper Project with McEwen Mining—backed by giants like Rio Tinto and Stellantis—we’re positioned for significant cash flows without the capital burden. Add to that our 90% stake in the Shotgun Gold Project in Alaska, near the Donlin Gold deposit, with 705,960 ounces of inferred gold resources, and we’re a diversified powerhouse. TNR delivers exposure to lithium, copper, silver and gold, blending blue-sky discovery with partnerships that drive value—perfect for investors seeking growth and a hedge in today’s economic cycle!”

Kirill Klip, Executive Chairman,

TNR Gold Corp.

"Hi, I'm Kirill Klip, Chairman and CEO of TNR Gold Corp. We're at the forefront of the green energy metals sector, with royalty interests in world-class projects like the Mariana Lithium Project and the Los Azules Copper Project in Argentina. The demand for lithium, copper, and other critical metals is surging as the world accelerates its shift towards sustainable energy. At TNR Gold, we're strategically positioned to benefit from this trend, offering investors exposure to the future of energy while maintaining a strong foothold in the gold market. With recent advancements in our key projects, such as Ganfeng Lithium's starting production at Mariana Lithium and McEwen Mining securing environmental permits for Los Azules, we're poised to generate significant value through our royalty interests. My extensive experience in mining and my commitment to sustainable practices drive our mission to contribute to a greener future."

Kirill Klip, Executive Chairman,

TNR Gold Corp.

Angela Harmantas from Proactive is writing about the new report on TNR Gold from Fundamental Research Corp:

"TNR Gold’s portfolio spans various mining assets, with a key focus on its Shotgun gold project in Alaska and royalties in two advanced-stage projects in Argentina: the Mariana lithium project, owned by Ganfeng Lithium, and the Los Azules copper-gold project, held by McEwen Copper."

"TNR Gold is on the brink of generating significant royalty revenue from its stake in Ganfeng Lithium's Mariana lithium project in Argentina as it heads toward commercial production, Fundamental Research analysts believe.The analysts have raised their share price target for TNR from $0.24 to $0.28 per share, highlighting the imminent cash flow potential from this strategic investment."

(Angela Harmantas)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

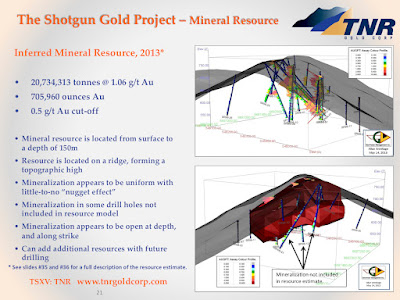

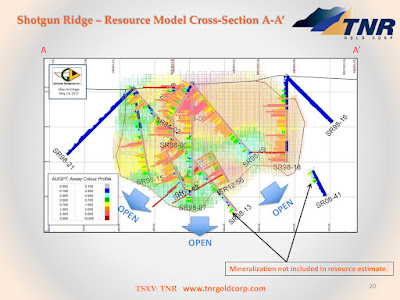

"Elsewhere, at the Shotgun gold project in Alaska, TNR is actively seeking a JV partner to advance the project to a Preliminary Economic Assessment (PEA). Shotgun hosts inferred resources totaling 706 Koz of gold at a grade of 1.1 grams per tonne. Analysts believe the project has expansion potential, with the Shotgun Ridge deposit remaining open along strike and at depth." (Angela Harmantas)

"NovaGold’s stock rallies 36% on its Paulson-backed purchase of a stake in Alaska’s Donlin gold-mine projectUpping his exposure to one of the hottest investments this year, billionaire investor John Paulson is teaming up with Canada’s NovaGold Resources Inc. to purchase a stake in an Alaskan gold-mining project.

NovaGold NG +39.21% CA:NG announced Tuesday that it has entered into a deal with Paulson Advisers LLC, which is a hedge fund under the investment company Paulson & Co., to buy Barrick Gold Corp.’sGOLD -2.35% ABX -2.47% 50% stake in Donlin Gold LLC, which runs an Alaskan gold-mining project of the same name, for $1 billion in cash.NovaGold’s stock rallied 36% on Tuesday, while Barrick Gold fell 2%.NovaGold will take a 20% stake in Donlin, and Paulson an 80% stake. NovaGold also has an option to buy outstanding debt owed to Barrick linked to the Donlin project for $90 million if that is done before closing of the deal, which is expected in the second or early third quarter of 2025. The debt will remain outstanding if that option isn’t exercised.“Donlin Gold is one of the most attractive development gold projects in the world. With 39 million ounces of gold at double the industry-average grade, and an optimal location in the prime jurisdiction of Alaska — already the second-largest gold-producing state in the United States — we believe that the project could create value for decades to come,” Paulson said in a statement.The billionaire has long been a gold fan and has exposure to several gold-mining companies through his family office, Paulson & Co. Those include stakes in NovaGold, as well as Seabridge Gold Inc.Paulson’s stake in the Donlin project comes as the price of gold has soared nearly 30% on investor concerns over the economy linked to President Donald Trump’s global tariff plans. More recently, concerns over the independence of the Federal Reserve have driven investors into gold and out of the dollarhe deal comes just two days after Oppenheimer technical analyst Ari H. Wald flagged four stocks from the VanEck Gold Miners ETF GDX -2.77% as offering better value than investing in gold itself.“We’ve maintained a bullish outlook on the price of gold since the start of 2024 and have preferred the commodity over the equities that mine for the commodity,” Wald said in a research note. ”Our relative preference has shifted toward the gold miners (GDX) based on a decade-long base positioned to inflect higher vs. spot gold.” (MarketWatch)"

"President Trump’s executive orders, impacting Alaska! This is unbelievably good news for the people of Alaska that believe in opportunity. President Trump delivered on his first day in office! This is why elections matter. What do they mean? It means Alaska is back in business! To the people of King Cove, it means they finally get the ability to get a road! For the State of Alaska it means ANWR and NPRA are back in business.. It means a timber industry in the Tongass National Forest can once again take place. It means Alaska can begin the process finally getting its remained acreage of land from the federal government! It could mean thousands and thousands of jobs, an additional opportunity for the great State of Alaska. On behalf of the Great State of Alaska… THANK YOU PRESIDENT PRESIDENT TRUMP!"

Governor Mike Dunleavy

UNLEASHING ALASKA’S EXTRAORDINARY RESOURCE POTENTIAL

"By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered:Section 1. Background. The State of Alaska holds an abundant and largely untapped supply of natural resources including, among others, energy, mineral, timber, and seafood. Unlocking this bounty of natural wealth will raise the prosperity of our citizens while helping to enhance our Nation’s economic and national security for generations to come. By developing these resources to the fullest extent possible, we can help deliver price relief for Americans, create high-quality jobs for our citizens, ameliorate our trade imbalances, augment the Nation’s exercise of global energy dominance, and guard against foreign powers weaponizing energy supplies in theaters of geopolitical conflict.Unleashing this opportunity, however, requires an immediate end to the assault on Alaska’s sovereignty and its ability to responsibly develop these resources for the benefit of the Nation. It is, therefore, imperative to immediately reverse the punitive restrictions implemented by the previous administration that specifically target resource development on both State and Federal lands in Alaska..."

TNR Gold – AmeriGold – Shotgun Gold

The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognises the growth potential and value to be added to the Shotgun project over time.

Our strategy presented to potential strategic partners involves the creation of a JV with one of the major gold mining companies, where our partner will be investing very substantial capital in the development of the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders will benefit from the strategic partner’s capital being invested “in the ground” and industry expertise, including operations in Alaska.

The Management is investigating the best value creation strategies for the Shotgun Gold Project and has put in place the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project JV operations after the contemplated potential spinout from TNR Gold.

This article is for information only and provides publicly available information and my personal Vision and valuation matrix of TNR Gold. I am the largest individual shareholder of our Company. Nothing in this blog post constitutes investment advice, offer, or solicitation of the sale of any securities. Please carefully read all our Legal Disclaimers and conduct your own due diligence as always.

Thank you for your support of TNR Gold!

Tesla Nicola rEVolution and Gold.

Proactive:

"TNR Gold’s track record of successful deals with majors like Ganfeng and McEwen Mining should stand it in good stead as manoeuvring continues on the Tintina gold belt.

“I believe the Shotgun gold project could become one of the main satellite gold projects of the Donlin gold camp,” says Kirill Klip, the chief executive and largest shareholder of TNR Gold Corp (CVE:TNR).

Shotgun is the flagship asset of TNR, and is located to the south of Donlin, just inside the boundary of the famous Tintina gold belt which arcs right across Alaska.

It’s a gold belt that has proved prolific in delivering up sizeable discoveries over the years, and now boasts a serious number of major producing mines, including at their forefront, the Pogo mine, owned by Northern Star Resources (ASX:NST) and the Fort Knox mine, owned by Kinross (TSE:K).

But Donlin takes things to another level again.

With its 39mln ounces of gold grading well over two grams per tonne, it’s one of the largest open pit deposits anywhere in the world.

Not surprising then that one of the biggest names in the industry, Barrick Gold (TSE:ABX), is playing a crucial role in bringing it on, alongside partner NovaGold (TSE:NG).

Will these two stay as partners for the duration, or will Barrick step in and buy out NovaGold?

Or, for that matter, will a third party, like Newmont, show up late at the party and try to initiate some sort of division of the spoils with Barrick along the lines of the current hard-won arrangement in Nevada?

These are matters for speculation just at the minute, but it might not be long before we see tangible corporate action.

And it’s not altogether out of the question that Shotgun will get caught up in it too.

After all, TNR has plenty of form in forming strong alliances with the world’s leading mining companies.

In an earlier phase of its existence it made two major discoveries in Argentina, the Los Azules copper project, now being brought forward by McEwen Mining (TSE:MUX), and the Mariana lithium project, now being brought forward by Ganfeng Lithium. After some adroit deal-making TNR managed to retain substantial royalties in these projects, such that when they come on stream it’s likely that Los Azules will contribute upwards of US$3.5mln per year to the TNR coffers, with Mariana providing a further US$1mln. However, the latter estimate was made by the analyst before Ganfeng announced an increase of the lithium resource at Mariana of more than 250%.

This background of successful deal-making with majors ought to provide TNR with a real advantage when it comes to assessing options for Shotgun in the coming months.

To some degree, it’s a fairly simple exercise for investors to form an idea of what the future holds, but in the case of Shotgun Klip is keen that TNR ends up retaining a 25% interest, rather than just a royalty.

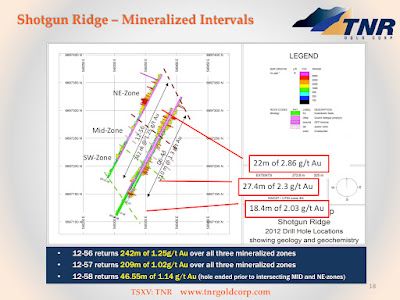

In this, he does have some room for manoeuvre, because Shotgun isn’t just another piece of prospective ground. Rather, the project already boasts an inferred resource of over 700,000 ounces of gold at Shotgun Ridge, and shows every sign of being able to deliver a markedly larger total than that, once the next major exploration programme delivers its results.

Shotgun Ridge is just one of multiple gold target areas controlled by TNR Gold. ‘Shot’, ‘King’ and ‘Winchester’ add to the collection to form a distinct gold district with five separate targets identified so far

When that will be though is the big question.

To take Shotgun up to the next level, Klip is clear that a major exploration spend is required – upwards of US$5mln and ideally closer to US$10mln. On one scenario he could go into the market and raise that money himself.

But here’s where his position as a major shareholder in the company becomes key.

“Even a US$5mln raise would be very dilutive to all our shareholders at this stage and will not guarantee success,” he says.

“We need to bring US$10mln in to drill the project very strongly.

The first US$5mln to take the project from the current 700,000 ounce resource up to the two million ounce mark, the rest to drill out the five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”

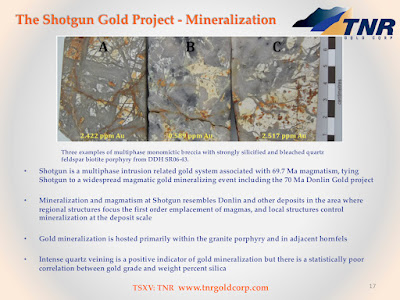

At Shotgun the thinking is that there may be upwards of five million ounces of gold in the ground, and there is precedent. At this stage the geology shows remarkable similarity to Donlin.

An academic study conducted in 2001 by Lang & Baker specifically identifies both projects as ‘major porphyry granite related gold deposits’ related to a singular widespread magmatic gold mineralising event that constitutes this horseshoe-like region.

The implication is that both projects arose from the same geographical kitchen sink, leading to the reasonable supposition that they should possess similar favourable geological properties.

“We are talking about a high tonnage bulk system,” says Klip. “There are no nuggets, it’s very uniform.”

Shotgun’s particular boon is in the details. Shotgun’s mineralisation has been shown to possess little-to-no ‘nugget effect’. A high ‘nugget effect’ means high variability between samples that are closely spaced. ‘No nugget effect’ implies a tight and uniform mineralisation of a bulk tonnage gold system. So there’s no need to dig up empty rock space as one does when chasing a vein so the stripping ratio for any mine will be low, keeping costs down.

Among the notable intercepts already banked, the company boasts 242 metres grading 1.25 grams gold per tonne, 209 metres at 1.02 grams, and just under 47 metres at 1.14 grams.

What’s more, the gold that’s been identified thus far sits at the top of a ridge, meaning that the stripping ratio for any mine will be low, which in turn will keep costs down.

“I’m in the business to get the maximum out of this new gold bull market. We’ve been waiting for it for nearly ten years after 2011. I just need to get the best deal,” says Klip

“We are not dreamers. We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”

Not for him as a shareholder the dilutive effects of repeated equity fundings to support exploration. His favored option – of bringing a major in – would in the end, he calculates, mean that current shareholders end up retaining more of the project, and hence more of the value, in the long-term.

Will the strategy work?

Well, it already shows every sign of doing so.

“A deal could happen any day,” says Klip.

“Literally. We are seeing interest. But we are not in any hurry. The interest at the moment is from mid-sized companies. I do not like to commit to shallow money with sums that look great on paper but come from parties that lack the appropriate technical and financial depth with consistent follow-through in the years following the deal. We hold the high ground. We want to be patient and attract the best of the best, like we did with Ganfeng Lithium years ago - one of the top gold major company to make sure that we can get the absolute most of Shotgun’s resources in development.”

For now, the company is actively introducing Shotgun Gold to potential partners and is much more open to drilling the entirety of these prospects in a strong fashion so that it can expand the known area of mineralisation and conclusively assess the project’s top-end valuation.

And it’s in this context that the royalty portfolio cleaves once more into view. These are serious assets, and they promise cashflow in the near-term. There’s significant value in the company on their strength alone. All of which means that TNR isn’t like some other juniors, desperately lurching from one equity raise to the next simply to keep going. There’s far more to it than that. In fact, there’s a carefully thought out strategy that looks likely to reap significant benefits for shareholders in the near-to-medium term."

No comments:

Post a Comment