NEWS RELEASE

TNR Gold Responds to Withdrawal of the Unsolicited Non-binding Offer by Lithium Royalty

"VANCOUVER, British Columbia – October 31, 2023: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) wishes to comment on the announcement by Lithium Royalty Corp. (“LRC”) of its withdrawal of the unsolicited non-binding all-cash offer to acquire TNR Gold on October 27, 2023.

As announced by the Company on October 12, 2023, the board of directors of the Company (the “Board”) has formed a special committee comprised of independent directors (the “Special Committee”) in response to discussions with various interested parties regarding a potential strategic transaction with TNR. The Special Committee is considering and evaluating strategies to maximize shareholder value, including pursuing one or more strategic transactions and continuing to execute on the Company’s existing business plan.

As part of its mandate, the Special Committee was considering and evaluating any updates to the unsolicited and non-binding offer made by LRC to the Board on September 25, 2023, to acquire all of the issued and outstanding common shares of the Company for cash consideration of $0.08 per share (the “Offer”). As announced on October 3, 2023, the Board expressed that the presented Offer was an opportunistic, “low-ball” offer that was financially inadequate and not in the best interests of TNR or its shareholders.

Kirill Klip, Chief Executive Officer and Executive Chairman of TNR commented, “As a result of inbound interest from various third parties that are interested in pursuing a transaction with TNR, the board of directors decided that the appropriate action would be to establish a special committee of independent directors to review available opportunities and present them to the board once vetted. We welcome this increased attention on our fantastic company, and we believe shareholders, investors and strategic partners see that the current share price of TNR deeply undervalues the Company and its assets.

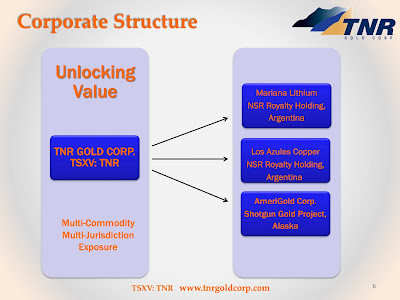

TNR retains a 1.35% NSR royalty on the Mariana Lithium project that is being developed by Ganfeng Lithium in Argentina. We also hold a 0.36% NSR royalty on the Los Azules copper project that is being developed by McEwen Mining in Argentina. In addition, TNR holds a 7% net profits royalty on the Batidero I and II properties of the Josemaria project that is being developed by Lundin Mining in Argentina. TNR also provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska.

The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties. TNR is also considering a plan to unlock additional value for our shareholders by the potential spin-out of its Shotgun Gold Project assets in Alaska, into a new public company. Should the spin-out occur, all shareholders of TNR will receive shares of the new public company.

In February 2023, LRC valued only a portion of the Company at US $9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project for US $9 million. LRC’s recent offer of CAD $15 million (approximately US $11 million) for the entire Company was opportunistic and financially inadequate. The duty of the board is to maximize the potential value of our assets and our Company’s valuation for all of our shareholders, and the fair treatment of all shareholders. The special committee is helping the board achieve these aims by evaluating opportunities in the most streamlined, efficient manner possible. We are engaging with multiple parties proposing much higher potential valuations for our assets than LRC’s recent proposal, and these are the opportunities that the special committee will focus on first.

Our shareholders have been patient with the Company, and they deserve fair and maximized value for their shares. The shareholders of TNR have known me for over 16 years of my tenure with TNR, they trust our board of directors and management. They know us and we know our shareholders. Other major shareholders do not agree to sell their holdings of TNR at the very low valuation proposed by LRC. We have spoken with numerous shareholders. They know the true potential of the Company’s assets and the bright potential for our Company.

The TNR team and its shareholders have supported the Company through all these years, even during the darkest days of the worldwide pandemic. We have built this strong, viable portfolio of assets including royalties in world-recognized projects containing lithium, copper, gold, and silver, under the management of such industry leaders as Rob McEwen, McEwen Mining, Rio Tinto, Stellantis, Ganfeng Lithium and Lundin Mining.

We are working on creating shareholder value and are not reducing value by accepting any deal presented. We are demonstrating our commitment to maximizing shareholder value and increasing TNR’s share price through actions such as the Company’s normal course issuer bid. We believe the formation of the special committee will assist the board in its next chapter of maximizing shareholder value. The bottom line is, we believe we can deliver a lot more value for our shareholders.

We would again like to thank all our shareholders for their support of the TNR Gold team and our company.”

The Company does not intend to comment further on this process except as required by applicable securities laws or the policies of the TSX Venture Exchange. No assurance can be given that any transaction will be announced. Furthermore, the Company cautions that there is no guarantee that the Company’s discussions will result in a transaction or if a transaction is undertaken, as to its timing or terms."

"Twelve days after Wayne created the document that formally created Apple, he returned to the county registrar's office filing an amendment formally withdrawing his name and involvement in the company". Wayne was later paid US$800 in exchange for relinquishing his equity stake in the company." (Google)

"THERE IS MAGIC, BUT YOU HAVE TO BE MAGICIAN TO MAKE THE MAGIC HAPPEN." SIDNEY SHELDON

"Resource investors drawn to the sector’s upside but nervous about the higher risk might want to consider royalty companies instead.Royalty companies act as alternative financiers to help fund exploration and production projects for explorers and miners in need of money but who do not want to issue more equity (company shares).In return for cash, royalty companies will receive a percentage of future production revenue. And, unlike traditional mining companies that are subject to input costs that vary (fuel, equipment, labour), royalty companies receive all their revenue from the agreements they negotiate and the cost of those revenues are the responsibility of a project’s owners/operators.As a result, royalty companies have high profit margins along with among the most revenue per employee of any industry.Also, whereas many junior mining companies have a single project in one country, royalty companies provide portfolio diversification by having agreements with several companies in different jurisdictions throughout the world. This reduces jurisdictional risk, project/production risk, and commodity-price risks that have plagued many mining companies in the past.Given that a royalty is a perpetual option on new discoveries made on the land by the operators, royalty companies offer substantial exploration upside for their investors at no additional costs. And, if the price of the commodity rises, it expands their profit margins even more seeing that the royalty is a fixed cost." (Proactive)

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

A lot of our investors have been asking me recently, what is my personal Vision for TNR Gold, what is the future of our Company and what are my personal goals to achieve for TNR Gold.

Our Company has reached major milestones this year after the full repayment of the investment loan and all recent developments in the marketplace.

I would like to share with you my personal Vision for TNR Gold’s future.

The Company is of the view that the recent market prices of its Shares do not properly reflect the underlying value of the Shares. I personally believe that the current market price is grossly undervaluing the intrinsic value of TNR Gold’s assets.

We demonstrate our commitment to maximising shareholder value and fair valuation of our Company and all assets in the TNR Gold portfolio. TNR Gold has announced and is conducting the share buyback program under approved by TSX Venture NCIB rules.

Insiders resumed their buying in the market when we were allowed to do so.

After much effort, our Company is in a strong financial position now. The recent corporate and market developments confirm the success of our corporate strategy and provide us with the opportunity to build real shareholder value reflecting the true magnitude of our assets.

The Company is experiencing a coming-of-age moment and we have generated a lot of interest among industry insiders in our Company and portfolio of TNR Gold’s assets. Our shareholders have been extremely patient with the Company, and they deserve correct, fair, and maximised valuations.

We are aiming to realise much higher potential valuations of our assets for all our shareholders and stakeholders. Below you can find my personal basic aspirational goals and estimations for the appropriate potential market valuations of TNR Gold’s assets and potential share price representations of such values.

Potential Valuations of TNR Gold Corp.

Valuations

|

Market-Based* |

Base Case** |

Positive Case*** |

|

USD$9M |

USD$22M |

USD$54M |

|

USD$30M |

USD$39M |

USD$59M |

|

USD$10M |

USD$21M |

USD$35M |

Total Assets Valuation

|

USD$49M CAD$64M |

USD$82M CAD$107M |

USD$148M CAD$194M |

Potential Share Price

|

CAD$0.29 |

CAD$0.48 |

CAD$0.87 |

*Mariana Lithium NSR valuation – based on LRC transaction. Los Azules Copper – Rob McEwen’s estimation of 1.25% NSR valuation of USD$100M based on the Osisko Gold Royalties transaction. Shotgun Gold 700,000 oz AU @ USD$15/oz.

** Mariana Lithium NSR valuation – 20,000T LiCl*USD$40,000/T*0.45%NSR*6. Los Azules Copper NSR valuation – 182,000T*USD$10,000/T*0.36%NSR*6. Shotgun Gold 700,000 oz AU @ USD$30/oz

*** Mariana Lithium NSR valuation – 40,000T LiCl*USD$50,000/T*0.45%NSR*6. Los Azules Copper NSR valuation – 182,000T*USD$15,000/T*0.36%NSR*6. Shotgun Gold 700,000 oz AU@USD$50/oz

The CAD$1M payable to TNR Gold by Ganfeng for 1% Mariana Lithium NSR buyback and exercising of options and warrants will provide the financing for TNR Gold’s working capital.

We do not need to finance TNR Gold by diluting the holdings of our shareholders.

NPR Royalty on Batidero I and II properties of the Josemaria Copper-Gold Project provides additional growth potential for TNR Gold’s Royalty Portfolio." Read more

"Another promising royalty name is TNR Gold Corp (TSX-V:TNR, OTC:TRRXF), a green energy metals royalty and gold company.TNR holds a 1.5% net smelter return (NSR) royalty on the Mariana Lithium Project in Argentina, which is 100% owned by Ganfeng Lithium. Construction of a 20,000 tons-per-annum lithium chloride plant at Mariana has already begun.As well, TNR Gold holds a 0.4% NSR Royalty on the Los Azules copper, gold and silver project, also in Argentina, being developed by McEwen Mining, which the company called the world’s nineth largest undeveloped copper project.The company also holds a 7% net profits royalty (NPR) on the Batidero I and II properties of the Josemaria Project in Argentina, which is being developed by Lundin Mining.Finally, TNR provides significant exposure to the gold sector through its 90% holding in the Shotgun Gold porphyry project in Alaska, near the Donlin Gold project that is being developed by Barrick Gold and Novagold Resources." (Proactive)

“The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time.”

TNR Gold:

NEWS RELEASE

TNR Gold Responds to Withdrawal of the Unsolicited Non-binding Offer by Lithium Royalty

VANCOUVER, British Columbia – October 31, 2023: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) wishes to comment on the announcement by Lithium Royalty Corp. (“LRC”) of its withdrawal of the unsolicited non-binding all-cash offer to acquire TNR Gold on October 27, 2023.

As announced by the Company on October 12, 2023, the board of directors of the Company (the “Board”) has formed a special committee comprised of independent directors (the “Special Committee”) in response to discussions with various interested parties regarding a potential strategic transaction with TNR. The Special Committee is considering and evaluating strategies to maximize shareholder value, including pursuing one or more strategic transactions and continuing to execute on the Company’s existing business plan.

As part of its mandate, the Special Committee was considering and evaluating any updates to the unsolicited and non-binding offer made by LRC to the Board on September 25, 2023, to acquire all of the issued and outstanding common shares of the Company for cash consideration of $0.08 per share (the “Offer”). As announced on October 3, 2023, the Board expressed that the presented Offer was an opportunistic, “low-ball” offer that was financially inadequate and not in the best interests of TNR or its shareholders.

Kirill Klip, Chief Executive Officer and Executive Chairman of TNR commented, “As a result of inbound interest from various third parties that are interested in pursuing a transaction with TNR, the board of directors decided that the appropriate action would be to establish a special committee of independent directors to review available opportunities and present them to the board once vetted. We welcome this increased attention on our fantastic company, and we believe shareholders, investors and strategic partners see that the current share price of TNR deeply undervalues the Company and its assets.

TNR retains a 1.35% NSR royalty on the Mariana Lithium project that is being developed by Ganfeng Lithium in Argentina. We also hold a 0.36% NSR royalty on the Los Azules copper project that is being developed by McEwen Mining in Argentina. In addition, TNR holds a 7% net profits royalty on the Batidero I and II properties of the Josemaria project that is being developed by Lundin Mining in Argentina. TNR also provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska.

The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties. TNR is also considering a plan to unlock additional value for our shareholders by the potential spin-out of its Shotgun Gold Project assets in Alaska, into a new public company. Should the spin-out occur, all shareholders of TNR will receive shares of the new public company.

In February 2023, LRC valued only a portion of the Company at US $9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project for US $9 million. LRC’s recent offer of CAD $15 million (approximately US $11 million) for the entire Company was opportunistic and financially inadequate. The duty of the board is to maximize the potential value of our assets and our Company’s valuation for all of our shareholders, and the fair treatment of all shareholders. The special committee is helping the board achieve these aims by evaluating opportunities in the most streamlined, efficient manner possible. We are engaging with multiple parties proposing much higher potential valuations for our assets than LRC’s recent proposal, and these are the opportunities that the special committee will focus on first.

Our shareholders have been patient with the Company, and they deserve fair and maximized value for their shares. The shareholders of TNR have known me for over 16 years of my tenure with TNR, they trust our board of directors and management. They know us and we know our shareholders. Other major shareholders do not agree to sell their holdings of TNR at the very low valuation proposed by LRC. We have spoken with numerous shareholders. They know the true potential of the Company’s assets and the bright potential for our Company.

The TNR team and its shareholders have supported the Company through all these years, even during the darkest days of the worldwide pandemic. We have built this strong, viable portfolio of assets including royalties in world-recognized projects containing lithium, copper, gold, and silver, under the management of such industry leaders as Rob McEwen, McEwen Mining, Rio Tinto, Stellantis, Ganfeng Lithium and Lundin Mining.

We are working on creating shareholder value and are not reducing value by accepting any deal presented. We are demonstrating our commitment to maximizing shareholder value and increasing TNR’s share price through actions such as the Company’s normal course issuer bid. We believe the formation of the special committee will assist the board in its next chapter of maximizing shareholder value. The bottom line is, we believe we can deliver a lot more value for our shareholders.

We would again like to thank all our shareholders for their support of the TNR Gold team and our company.”

The Company does not intend to comment further on this process except as required by applicable securities laws or the policies of the TSX Venture Exchange. No assurance can be given that any transaction will be announced. Furthermore, the Company cautions that there is no guarantee that the Company’s discussions will result in a transaction or if a transaction is undertaken, as to its timing or terms.

ABOUT TNR GOLD CORP.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-seven years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, and future potential transactions being considered by the Special Committee and the Board. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."

No comments:

Post a Comment