Wood Mackenzie brings attention to the unfolding "Gold Reserves Crisis" as McKinsey calls it. The growing demand for gold from Central Banks, institutional investors and retail is facing the peak gold production and collapsing gold reserves of the major mining companies. Everything is being set for "The Perfect Storm" in the gold market:

"Exploration budgets were slashed following the fall in the gold price from the highs that were reached in 2011/2012 and they have since failed to recover. The slight rebound in exploration spend we have seen over the past couple of years has largely been focused on brownfield projects and near-mine development. This has not been sufficient to replenish mined ounces and as such peak gold supply is now a very real possibility. Wood Mackenzie."

M&A activity will only redistribute the well known and already developed reserves. The industry needs new major discoveries which are very few and far between. Years of the Gold Bear market have not only burnt alive the whole generation of investors but made mining companies extremely cautious with any exploration and investment activities. All exploration budgets were cut to the bone. The industry suffered not only dramatically reduced exploration budgets, but the return on the money invested in exploration produced very few major discoveries.

After the recent wave of M&A activities among the major gold miners, mining companies are increasingly entering into the JVs with junior miners in order to develop the new resource base:

"To secure their longevity as pillars of the gold industry, we have seen heightened M&A activity and miners focusing on their core assets. Whilst this may help to bolster balance sheets through improved operational performance and realised “synergies”, it seemingly does little to address the problem the industry is facing with regards to how to sustain current production levels. We have, as of late, noticed an uptick in some majors opting to increase their footholds in a select few juniors with promising exploration opportunities.Agnico Eagle, AngloGold Ashanti, Kinross and Newcrest are actively investing in, or entering into joint-ventures with junior gold companies to create long-term value. Wood Mackenzie"

News about Electrum Group partnering in the new venture with gold mining legends Rob McEwen and Eric Sprott for exploration in Alaska will ignite the new wave of interest to the juniors operating in Alaska. Alaska jumped to the 5th place among safe mining jurisdictions and giant 39 Moz Donlin Gold project is getting more and more attention. Electrum Group is the major shareholder of Nova Gold which is developing Donlin Gold in JV with Barrick Gold.

With gold prices reaching new highs this year some mining analysts are starting to apply the old metrics to value "gold in the ground" when comparing juniors and their projects. Nova Gold was trading as high as $2.4B reflecting its 50% stake in Donlin Gold. It gives more than $120 valuation per oz in the ground. All projects are different, but previous Gold Bull market valuations started at $20 per oz of the inferred resources - the very initial level of resources. New mining deals will give us a better sense of the valuations. Eric Sprott and Rob McEwen will make sure that Alaska is shining bright on the radars of investors now. Increased gold prices are making the great state of Alaska as one of the most attractive in the industry: "leverage in the place where you can keep the rewards". And their own gold price projections can bring real fireworks to the exploration opportunities. As always do your own research and you will have to pick up the winners.

TNR Gold is developing the Shotgun Gold project in the Alaskan elephant country near Donlin Gold mining district. On the links below you can find more information. Barrick Gold received crucial permits to advance Donlin Gold and this new developing mining district in the US can make the promise of "Gold In the USA" providing stable supply feasible again and it can become that solution to "The Gold Mining Reserve Crisis" McKinsey is talking about:

"The Company's strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR Gold ("TNR") is actively introducing the project to interested parties," commented Kirill Klip, Executive Chairman of TNR. "We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time."

Wood Mackenzie:

Gold exploration vital for future supply.

"In 2019, the flight to safe haven assets has happened amid concerns of a slowdown in the global economy and heightened geopolitical tensions. The final catalyst spurring the increase in gold price was central banks adopting a more dovish tone and the FED cutting interest rates. This coupled with the accumulation of negative yielding debt has thrust gold back into the spotlight.

Whilst the resurgent gold price has garnered a renewed sense of optimism in the gold industry, it has also shone a light on a structural issue that has been brewing for some time. Due to a lack of exploration spend, the gold industry is facing a potential period of secular decline in the long-term.

Exploration budgets were slashed following the fall in the gold price from the highs that were reached in 2011/2012 and they have since failed to recover. The slight rebound in exploration spend we have seen over the past couple of years has largely been focused on brownfield projects and near-mine development. This has not been sufficient to replenish mined ounces and as such peak gold supply is now a very real possibility.

Over the past couple of months, with gold breaking through $1,500/oz, it seems that exploration activity may be turning a bit of a corner. In late June, Agnico Eagle started an exploration drilling program at its Amaruq site in an effort to convert underground indicated resources. On September 4th, Polyus announced the completion of an exploration drill programme at its Sukhoi Log project that totalled 203,647 metres and are planning 30,000 metres of in-fill drilling in 2020.

Newcrest reported on September 10th that its exploration program on the Havieron Project, located 45km east of Telfer in Australia, has four operating drill rigs, which have cut 6,166 meters and a fifth drill will begin in September. It will, however, be some time before this activity translates into reserves and ultimately into production.

Proposed exploration budgets for the largest producers in 2019 remain fairly conservative compared to the levels reached in 2012. It would therefore seem unlikely that the trend in declining reserves will be abated this year.

Producers have been very vocal in reaffirming their strategy of cost control, portfolio management and capital discipline, particularly since the run up in the gold price. How steadfast miners will be to this strategy into 2020 and beyond, if prices continue to remain well supported, remains to be seen.

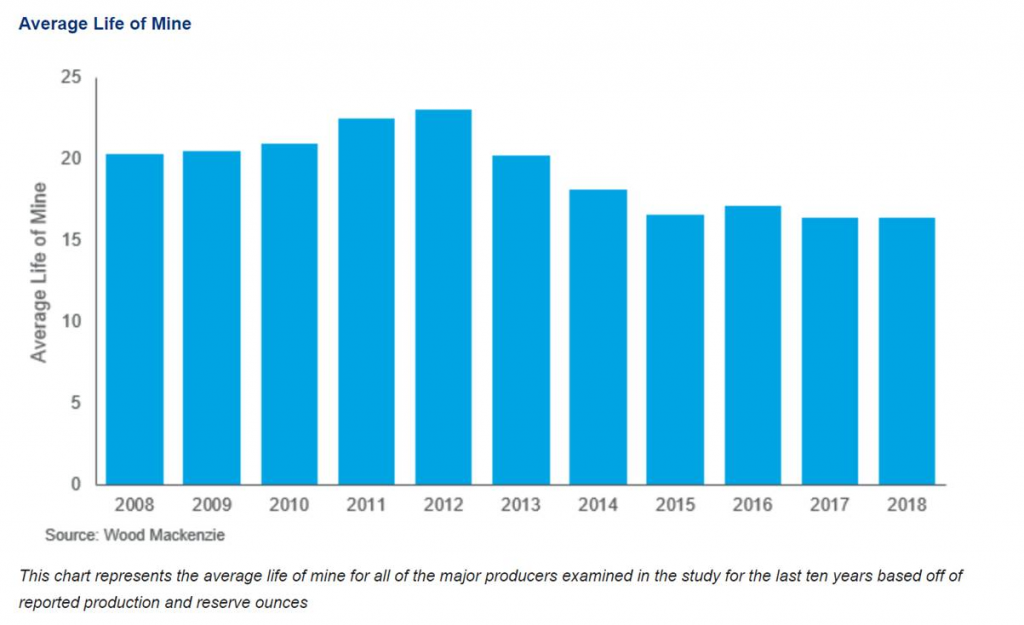

Due to insufficient exploration spend, gold reserves have depleted significantly with the global average mine life falling from 16 years in 2012, down to an estimated 11 years in 2018. However, the largest producers are not facing quite such an acute situation, with their collective average mine life still over 16 years. It is perhaps therefore not so surprising that they can afford a more calculated approach to replenishing reserves.

To secure their longevity as pillars of the gold industry, we have seen heightened M&A activity and miners focusing on their core assets. Whilst this may help to bolster balance sheets through improved operational performance and realised “synergies”, it seemingly does little to address the problem the industry is facing with regards to how to sustain current production levels. We have, as of late, noticed an uptick in some majors opting to increase their footholds in a select few juniors with promising exploration opportunities.

Agnico Eagle, AngloGold Ashanti, Kinross and Newcrest are actively investing in, or entering into joint-ventures with junior gold companies to create long-term value. Agnico Eagle announced a proposal on June 24, 2019 for an all-share acquisition of Alexandria Minerals Corporation at a $0.05 per share premium to the Chantrell Ventures Corp offer; however, O3 Mining acquired Alexandria on August 1, 2019. AngloGold Ashanti upped its stake in Pure Gold to 14.3% of the company on July 16, 2019, which owns the Madsen Gold Project in Red Lake, Ontario. Kinross purchased the near-surface, early-stage Chulbatkan project in Russia from N-Mining Limited for a total consideration of $283 million on July 31, 2019. Newcrest entered into a 70-30 joint venture with Imperial Metals on August 16, 2019, where Newcrest will be the operators of their Red Chris mine, a potential “Tier One” asset in British Columbia, Canada.

We expect to see this trend of increased M&A activity to continue, particularly amongst the more mid-tier gold producers as they look to solidify their own positions in the industry. This will likely encompass mergers with peers to unlock shareholder value and the acquisition of assets that majors have determined to be non-core. This may help to progress some later stage projects into production that have been sitting on the shelf for a number of years, but we are not anticipating a knee jerk reaction to current prices. Smaller projects which have a short payback period, in a low sovereign risk jurisdiction, are an attractive proposition and we could see a number of these projects being fast tracked into production.

Going forward, to address the predicament of declining reserves, if prices remain elevated miners may be inclined to review their reserve and resource price assumptions."