“I am very pleased to see this very exciting and significant development for the Los Azules Copper Project and personal support by Rob McEwen of the newly created McEwen Copper,” stated Kirill Klip, TNR’s Executive Chair. “It’s very encouraging to see a large 53,000-metre drilling program following the personal commitment from Rob McEwen and his investment of US$40 million to advance the rapid development of this giant copper, gold and silver deposit in an appropriate corporate structure which will allow financing and further development of the Los Azules Copper Project.

TNR Gold holds a 0.36% NSR royalty on the entire Los Azules project containing copper, gold and silver metals. TNR Gold does not have to contribute any capital for the development of the Los Azules Copper Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Proactive:

TNR Gold likely to be a big beneficiary as McEwen Copper starts to get things moving at Los Azules

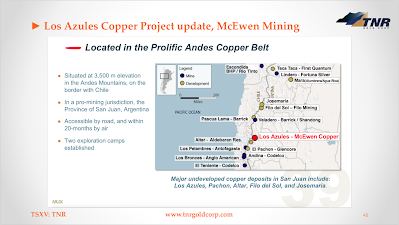

How likely is it that the giant Los Azules copper, gold and silver project in Argentina could get even bigger?

The question is material for TNR Gold Corp (TSX-V:TNR, OTC:TRRXF), which owns a 0.36% net smelter royalty across the whole project, and it’s becoming pertinent too because things are at last starting to happen at Los Azules.

During the summer of 2021 Rob McEwen, the investment titan behind McEwen Mining, put together a new vehicle called McEwen Copper, which he plans to list within 12 months. The idea is to use McEwen Copper to take Los Azules into production.

And, lest anyone doubt the seriousness of his intent, McEwen himself put US$40mln of his own money into the new vehicle, which will initially be seeded with a total of US$80mln.

It’ll take a lot more than that to get Los Azules built, but the show is now on the road, and TNR Gold can start looking forward to what’s likely to be substantial and sustained cash flow from its royalty.

How much cash flow?

A preliminary economic assessment was conducted on Los Azules in 2017 which showed the project would likely become the world’s 25th largest copper producer on commencement of mining.

Based around the numbers then produced and a US$3.00 copper price it was estimated that TNR would likely receive annual income of around US$3.5mln.

The copper price is around 30% higher than the assumption used in the 2017 calculation, and there’s also the question of the eventual size of the project once further work has been done - a 53,000 metre drilling programme is about to get underway.

So all told, TNR’s income looks likely to be very substantial indeed.

But what’s it worth in today’s money?

The question is somewhat hypothetical, since TNR’s chief executive Kirill Klip doesn’t seem inclined to sell the asset, and is currently hold his cards close to his chest on that score.

On the other hand, it ought to have a bearing on TNR’s own market capitalisation, especially now that after a long period of activity Los Azules has come alive again.

One way of working it out is to look at similar deals. There aren’t many around of course, but last year’s acquisition by Nova Royalty Corp of a 0.24% net smelter royalty on the First Quantum’s Taca Taca project in Argentina does provide a baseline.

Nova Royalty Corp paid US$12.75mln for a smaller-sized royalty than TNR’s - which, remember is 0.36% NSR - and at a time when the copper price was much lower.

Some in the market calculate that TNR’s royalty on Los Azules ought to be worth at least US$20mln on that basis, and probably considerably more.

McEwen himself has argued that Taca Taca serves as a good proxy for Los Azules.

And, when you consider that TNR’s own market capitalisation is currently a mere C$9.4mln, it starts to become clear just how much value is on offer.

Because remember, Los Azules isn’t TNR’s only asset.

It also owns a royalty on the huge Mariana lithium project in Argentina that’s own by Ganfeng Lithium and which is now going into construction.

And up in Alaska it continues to seek partners for the highly prospective and potentially huge Shotgun gold project.

So there’s plenty to be enthusiastic about.

Klip’s vision of creating a green energy metals royalty company is moving forward and, what’s perhaps the nicest thing for TNR shareholders, it’ll be McEwen Copper that will doing the heavy lifting when it comes to spending money and not TNR.

All TNR has to do is ride along and rake in the cash when it starts to flow.

“Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering the Tesla energy revolution, and the gold industry which is providing the ultimate hedge during this part of the economic cycle,” says Klip.

“Our shareholders are participating in the building up of TNR as the go-to green energy metals royalty and gold company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle, starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining and Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

No comments:

Post a Comment