GEM Royalty TNR Gold Corp.

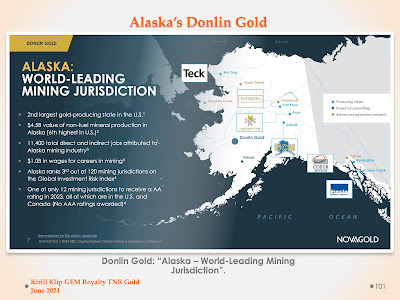

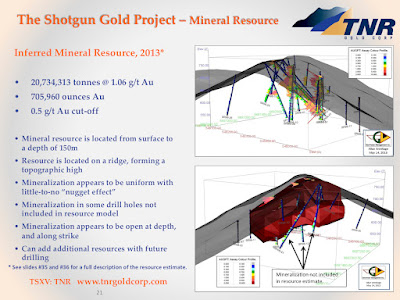

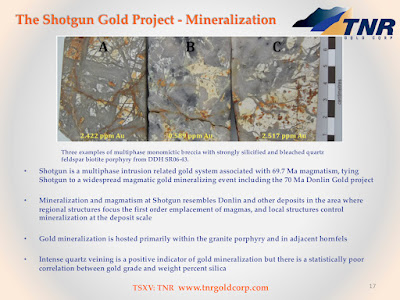

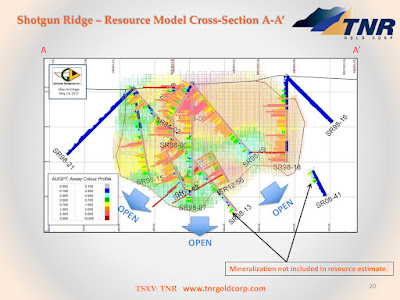

“TNR Gold Corp is your gateway to the green energy rEVolution and gold stability! We're building a leading green energy metals royalty and gold company, offering a unique entry into the supply chains powering the energy transition. With a 1.5% NSR royalty (of which 0.15% is held on behalf of a shareholder) on the Mariana Lithium Project in Argentina, operated by Ganfeng Lithium, and a 0.4% NSR (of which 0.04% is held on behalf of a shareholder) on the massive Los Azules Copper Project with McEwen Mining—backed by giants like Rio Tinto and Stellantis—we’re positioned for significant cash flows without the capital burden. Add to that our 90% stake in the Shotgun Gold Project in Alaska, near the Donlin Gold deposit, with 705,960 ounces of inferred gold resources, and we’re a diversified powerhouse. TNR delivers exposure to lithium, copper, silver and gold, blending blue-sky discovery with partnerships that drive value—perfect for investors seeking growth and a hedge in today’s economic cycle!”

Kirill Klip, Executive Chairman,

TNR Gold Corp.

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Kirill Klip, Executive Chairman TNR Gold Corp.

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

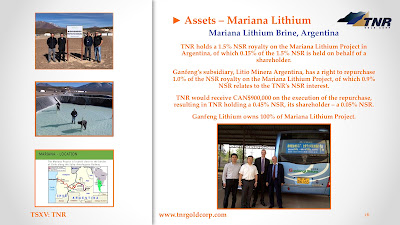

"Hi, I'm Kirill Klip, Chairman and CEO of TNR Gold Corp. We're at the forefront of the green energy metals sector, with royalty interests in world-class projects like the Mariana Lithium Project and the Los Azules Copper Project in Argentina. The demand for lithium, copper, and other critical metals is surging as the world accelerates its shift towards sustainable energy. At TNR Gold, we're strategically positioned to benefit from this trend, offering investors exposure to the future of energy while maintaining a strong foothold in the gold market. With recent advancements in our key projects, such as Ganfeng Lithium's starting production at Mariana Lithium and McEwen Mining securing environmental permits for Los Azules, we're poised to generate significant value through our royalty interests. My extensive experience in mining and my commitment to sustainable practices drive our mission to contribute to a greener future."

Kirill Klip, Executive Chairman,

TNR Gold Corp.

Angela Harmantes from Proactive is writing about the new report on TNR Gold from Fundamental Research Corp:

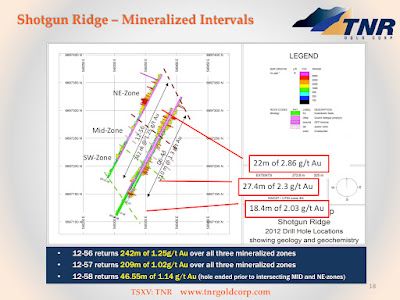

"TNR Gold’s portfolio spans various mining assets, with a key focus on its Shotgun gold project in Alaska and royalties in two advanced-stage projects in Argentina: the Mariana lithium project, owned by Ganfeng Lithium, and the Los Azules copper-gold project, held by McEwen Copper."

"TNR Gold is on the brink of generating significant royalty revenue from its stake in Ganfeng Lithium's Mariana lithium project in Argentina as it heads toward commercial production, Fundamental Research analysts believe.The analysts have raised their share price target for TNR from $0.24 to $0.28 per share, highlighting the imminent cash flow potential from this strategic investment."

(Angela Harmantes)

"TNR Gold is also positioned to benefit from its royalty interests in McEwen Copper's Los Azules project, a large copper-gold deposit in Argentina. The project recently secured an environmental permit for construction and completed a $56 million equity financing. Infill and expansion drilling have extended the mineralization at depth, with an updated resource estimate and feasibility study expected in the coming months.

Analysts estimate annual royalty revenue of $6.5 million from Los Azules, based on conservative copper price assumptions." (Angela Harmantes)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

"Exploration over our property has produced an intriguing target, late in the season. Initial results of a concession-wide regional mapping and sampling campaign have identified strong evidence of a large porphyry system 3 kilometers east of the Los Azules deposit. Porphyry-style veining and quartz vein stockworks with copper oxide mineralization have been recognized within this new target, with assay results pending."

"I like to look at some deposits converted into a Gold equivalent. This deposit is equivalent to 60 million ounces of Gold deposit. Cash costs are on the equivalent basis of just over $600/oz, and the overall cost is just over $1000/oz. It will be producing over 600,000 ounces of Gold per year. In my book, this is one of a hell Gold deposit! That's almost what the Timmins district, the most prolific Gold district in Canada has produced over the last 100 years." (Rob McEwen)

"Next Steps: Towards Feasibility and Construction

With the approval of the EIA, the upcoming feasibility study scheduled for the first half of 2025, and the approval of the application for admission to the RIGI, Los Azules has the potential to begin construction in early 2026, which will strengthen even further McEwen Copper’s position at the forefront of sustainable mining and as a major driver of economic and social development in San Juan." (McEwen Copper)

"Today, we have the opportunity to listen to Rob McEwen's presentation about the world's first regenerative green Copper mine in Argentina. This giant Copper, Gold, and Silver project is attracting increasing attention in the industry and among investors. TNR Gold is holding NSR Royalty on the entire Los Azules Copper Project, and our shareholders will benefit from the progress towards a feasibility study and the permit to build this mine."