BYD unveils a game changer for the mass market adoption of electric cars. Its new lithium batteries and charging system can deliver 5-minute fast charging providing 400 km of range. It can be quicker now to recharge your EV than to go to a gas station to refill your gas tank. Can we talk about the end of "Range Anxiety" already?

This innovation can address the last hurdle on the way to a mass market for electric cars and this breakthrough technology can supercharge the lithium market again. Cars with Internal Combustion Engines are losing the last advantage. We are getting very close to "The End of the Ice Age".

BYD overtook Tesla as a leader in EV sales last year and now is getting another edge in the competition. BYD's new lithium battery degradation will be an important parameter to monitor now and the speed of rollout for this new charging system will determine the further advance in the EV race.

"The main secret of success is cost. BYD produces "insanely cheap" electric cars. BYD launched the cheapest Seagull electric car with a starting price under $10,000. The strong domestic market in China and government support helped launch BYD into its orbit. Now, with advanced technology and lower prices, they are aiming for global markets."

This is another set of fantastic news for our Company. Last month, at TNR Gold, we celebrated Ganfeng's inauguration of the start of production at Mariana Lithium. Phase I will produce 20,000 Lithium chloride annually. TNR Gold holds NSR Royalty on Mariana Lithium, and the links below provide you with more information on this giant Ganfeng Lithium project in Argentina.

We are building The Green Energy Metals Royalty and Gold Company. TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on the Mariana Lithium Project with Ganfeng Lithium, Los Azules Copper, Gold and Silver Project with McEwen Mining and Batidero I and II Properties of Josemaria Copper-Gold Project with Lundin mining.

McKinsey sees lithium demand stabilising and expects the next upcycle: "Lithium prices appear to have bottomed, with demand growth accelerating beyond electric vehicles due to rapid expansion in stationary storage."

As we have discussed, Energy Storage will drive the next chapter of Lithium demand, and humanoid robots will be coming next into the picture with every new headline about groundbreaking technological progress. Today, we can dive into more details to better understand the Lithium market demand and supply.

According to Albemarle, long-term secular growth is intact: Lithium market demand is expected to increase 2.5X from 2024 to 2030 - from 1.3M T LCE to 3.3M T LCE per year. Projected Lithium demand is a healthy CAGR of 15-20%, while recent reductions to Lithium investments and expansions may create mid-term supply risk.

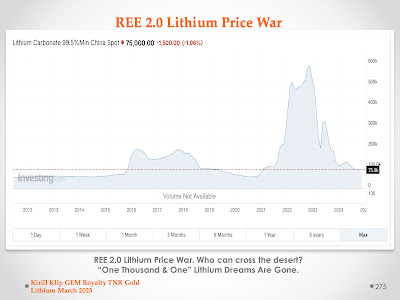

The next chart demonstrates the most important driver for the supercharging Lithium market again. Albemarle states that current Lithium market prices are well below re-investment economics and unsustainable. A substantial part of the cost curve is operating below breakeven. Higher Lithium prices are required over the next decade to support the over 100 new projects needed to meet anticipated demand.

Lower Lithium prices are the best cure for the low Lithium prices. To meet the projected demand, we need much higher Lithium prices, otherwise, a lack of investments and expansions will lead to deficits. Supply and price shocks are imminent. The cheaper EVs will supercharge the Lithium market again, and China holds the key to this success with companies like BYD leading the seismic shift in the marketplace.

Last month, at TNR Gold, we celebrated Ganfeng's inauguration of the start of production at Mariana Lithium. Phase I will produce 20,000 Lithium chloride annually. TNR Gold holds NSR Royalty on Mariana Lithium, and the links below provide you with more information on this giant Ganfeng Lithium project in Argentina.

The Mariana lithium project, located in Argentina, will be one of the first to deliver royalty payments for TNR, potentially as early as March 2025. At current spot lithium prices, analysts project annual royalty revenue of approximately $1.2 million for TNR.The timing is particularly advantageous as lithium prices are currently hovering around $10,000 per ton—near the break-even point for many large-scale development projects. Fundamental Research anticipates a rebound in lithium prices to at least $15,000 per ton, which would significantly enhance the economic viability of projects like Mariana and spur further development across the sector." (Angela Harmantes)

McKinsey’s said lithium prices appear to have bottomed, with demand growth accelerating beyond electric vehicles due to rapid expansion in stationary storage.The comments, made during a Bloomberg-hosted review, is similar to Albemarle’s estimate that stationary storage now accounts for about 20% of lithium demand.McKinsey was optimistic about western automakers adopting advanced battery pack designs, boosting energy density and enabling EVs with over 600 miles of range and sub-10-minute charging times.Such improvements could drive the next lithium upcycle by reaccelerating western EV adoption." (Investing.com)

Fast-increasing demand for battery raw materials and imbalanced regional supply and demand are challenging battery and automotive producers’ efforts to reduce Scope 3 emissions."

(McKinsey and Company)

No comments:

Post a Comment