"TNR Gold shareholders can learn more about the project and McEwen Copper's progress in advancing it to the feasibility study. "We are looking to take it public in the first half of the next year, once we have a bankable feasibility study in hand and the permit to build", explains Rob. "We are currently making financing with the implied valuation for Los Azules Copper of just under One Billion US Dollars".

"The special features of the Los Azules project include a new architecture for mine construction and design. The project will be powered by energy from renewable sources, be carbon neutral and will feature a "people friendly" working environment boasting terraced living accommodation and food production." (ABN Newswire)

"Exploration over our property has produced an intriguing target, late in the season. Initial results of a concession-wide regional mapping and sampling campaign have identified strong evidence of a large porphyry system 3 kilometers east of the Los Azules deposit. Porphyry-style veining and quartz vein stockworks with copper oxide mineralization have been recognized within this new target, with assay results pending."

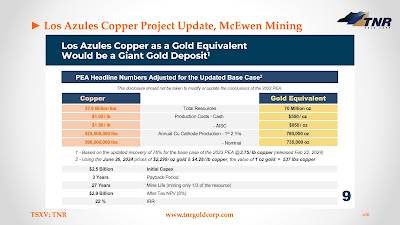

"McEwen Mining (NYSE: MUX) (TSX: MUX) said on Thursday that its McEwen Copper unit has secured an additional $35 million investment from Nuton, a leaching technology venture created by Rio Tinto, to support the feasibility study for its Los Azules copper project in San Juan, Argentina.In June, McEwen Copper announced a private placement financing of up to $70 million through the issuance of approximately 2.33 million shares at $30 per share. Under the first tranche, the McEwen unit received a $14 million investment its parent company and a $5 million investment from Rob McEwen, its chairman and chief owner.Nuton’s $35 million investment represents the second tranche of that financing, with the purchase of nearly 1.17 million shares. Two other investors also participated in this tranche for a total of $2 million.Together with the first tranche, McEwen Copper has now raised a total of $56 million for the Los Azules project.Los Azules projectLos Azules is an open-pit copper deposit located 80 km northwest of the town of Calingasta and 6 km east of the border with Chile at an elevation of 3,500 metres in the Andes Mountains. The extent of mineralization along strike exceeds 4 km and the distance across strike is approximately 2.2 km.The copper resource contains 10.9 billion lb. in ore that grades 0.40% copper in the indicated category and 26.7 billion lb. in material averaging 0.31% copper in the inferred category. This resource is expected to support average production of 322 million lb. of copper in cathodes per year over a projected 27-year life.According to a June 2023 preliminary economic assessment, Los Azules would have an estimated after-tax net present value (at a discount rate of 8%) of $2.7 billion and internal rate of return of 21.2%, based on an assumed copper price of $3.75/lb. Its payback period is 3.2 years.McEwen Copper is currently working a bankable feasibility study for the project, which is scheduled for publication in the first half of 2025.Shareholding updateThe copper subsidiary was created by McEwen Mining in mid-2021 with a view of maximizing the value of its copper assets. A year later, it received its first investment from Nuton, while also establishing a partnership with the Rio venture to assess the potential application of its heap leach technology at Los Azules.According to the companies, heap leaching would offer superior economic and environmental benefits over the conventional milling methods. The project is also expected to be powered by 100% renewable energy, with a commitment to reach carbon neutrality by 2038.Following the latest round of financing, Nuton now owns 17.2% of McEwen Copper on a fully diluted basis, nearly doubling its initial shareholding. Its other notable shareholders are: McEwen Mining (46.4%), Stellantis (18.3%), Rob McEwen (12.7%) and Victor Smorgon Group 3.0%.With the new share issuances, McEwen Copper now has approximately 32.8 million common shares outstanding, giving it a post-money market value of $984 million." (Mining.com)

TNR Gold NSR Royalty on Los Azules: "Rob McEwen Speaks with ABN Newswire about the Los Azules Copper Project in Argentina"

Today, we have another great opportunity to listen to Rob McEwen discussing the latest news about the development of the giant Los Azules Copper, Gold and Silver Project in Argentina. This project is the 4th largest undeveloped Copper Project which is not controlled by a major mining company.

TNR Gold shareholders can learn more about the project and McEwen Copper's progress in advancing it to the feasibility study. "We are looking to take it public in the first half of the next year, once we have a bankable feasibility study in hand and the permit to build", explains Rob. "We are currently making financing with the implied valuation for Los Azules Copper of just under One Billion US Dollars".

Rob discusses his concept of the "The World's First Regenerative Green Copper Mine in Argentina" in detail.

"The special features of the Los Azules project include a new architecture for mine construction and design. The project will be powered by energy from renewable sources, be carbon neutral and will feature a "people friendly" working environment boasting terraced living accommodation and food production." (ABN Newswire)

Discussing the latest drilling results from Los Azules Copper, Rob highlights the discovery of the new large porphyry system.

"Exploration over our property has produced an intriguing target, late in the season. Initial results of a concession-wide regional mapping and sampling campaign have identified strong evidence of a large porphyry system 3 kilometers east of the Los Azules deposit. Porphyry-style veining and quartz vein stockworks with copper oxide mineralization have been recognized within this new target, with assay results pending."

"Mr McEwen outlines the status of McEwen Mining's producing gold and silver assets, and enlarges on the development of the multi-generational copper project in Argentina, "The Los Azules Copper Project". The special features of the Los Azules project include a new architecture for mine construction and design. The project will be powered by energy from renewable sources, be carbon neutral and will feature a "people friendly" working environment boasting terraced living accomodation and food production. In addition, the production from the Loz Azules mine will be LBMA copper plate, making the copper output attractive from an Environmental and Social Governance (ESG) perspective.The copper resource at Loz Azules, from current published numbers, exceeds 60 million ounces of gold equivalent, making this project in the top ten undeveloped copper resources globally."

I highly recommend watching the previous video with Rob McEwen, so that you can better understand the latest developments with the Lundin Mining Group's copper projects in Argentina and their comparison to the Los Azules Copper Project.

Rob discussed in detail the bold pro-business reforms in Argentina and how they positively affect Los Azules Project's economics. The discussion went into Rob's insights into Copper and Gold markets and the latest trends in mining industries.

"Today you can better understand the idea of Green Copper and why I believe that Argentina has everything to become the Power House of the Tesla Energy rEVolution. Rob McEwen presents his truly extraordinary vision for the world's first regenerative Green Copper mine at Los Azules in Argentina."

The news release issued by McEwen Mining on August 8, 2024, stated:

“McEwen Copper Inc., 48.3% owned by McEwen Mining Inc. (NYSE, TSX), is pleased to comment on the excitement in Argentina that includes:

Infill Drill Highlights:

AZ24375: 217 meters of 1.11 % Cu, incl. 100 meters of 1.32 % Cu

AZ24335: 158 meters of 0.84 % Cu, incl. 78.5 meters of 1.10 % Cu

AZ24403: 276 meters of 0.86 % Cu, incl. 160 meters of 0.96 % Cu

AZ24320: 146 meters of 0.89 % Cu

AZ24332: 119.6 meters of 0.72 % Cu

- Remarkable new legislation introduced by President Milei to encourage large domestic and foreign investments in the country;

- A US$4.4 Billion transaction led by BHP, the world’s largest mining company, and Lundin Mining to acquire two copper deposits located in the same province in Argentina as Los Azules;

- At Los Azules, infill drilling during the 2023-24 season upgraded the resource categories, validated the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules Feasibility Study is now complete, and the study remains on track for delivery in early 2025.

Powered by Tesla Energy rEVolution: TNR Gold Los Azules Copper NSR Royalty Holding with McEwen Mining Presentation

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Kirill Klip, Executive Chairman TNR Gold Corp.

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

TNR Gold Los Azules NSR Royalty: McEwen Copper Is Planning The World's First Regenerative Green Copper Mine in Argentina

Today you can better understand the idea of Green Copper and why I believe that Argentina has everything to become the Power House of the Tesla Energy rEVolution. Rob McEwen presents his truly extraordinary vision for the world's first regenerative Green Copper mine at Los Azules in Argentina.

"Goldman Sachs is talking about Copper price reaching $6.8 per lb driven by the deficit in the market. "If Copper goes to $6 per lb it will put a few smiles on the faces of people around here", Rob explains. "There is a large gap between supply and demand is developing according to Goldman Sachs. And if China comes back on stream, they are the big buyer of Copper... so we could see that number. I will be very happy as Los Azules is projected to be producing copper at $1.7 per lb."

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"TNR Gold's 0.36% NSR Royalty could be valued at USD $30 million, based on Rob McEwen's estimations analysing the recent Osisko Gold Royalties deal with SolGold in Ecuador. In the Alastair Ford article, you can find more information about TNR Gold and benchmarks for our GEM Royalty portfolio."

"As I wrote before, if TNR Gold can do one thing well, it's to identify underappreciated assets and squat on them until pop hype and fanfare wake up the hatchling within. But there’s a certain poetry to this business model; TNR must be warmed in turn by those looking for underappreciated assets, so participating in this type of venture requires a certain kind of paternal patience, no matter the blizzard coming." (Konstantin Klip)

No comments:

Post a Comment