"Bloomberg reports on Copper price advance to $10,000 per ton, following the BHP's $39 Billion "megabid" in an attempt to buy out Anglo American. Copper price was hitting high after high in recent months on its way to $5 per lb. Historically, Copper prices hit an all-time high of $5.0395 per lb in March 2022."

"Rob McEwen describes the opportunity to expand the deposit and the size of the giant Los Azules Project: "If you covert Copper, Gold and Silver at today's prices - you are looking at the equivalent of 70 Moz Gold deposit."

"McEwen Copper and McEwen Mining Inc. executives met with President Javier Milei to discuss the Los Azules copper project.On Tuesday, McEwen Mining’s Chief Executive Officer Robert McEwen, the VP of McEwen Copper & General Manager of Los Azules Michael Meding, General Counsel Carmen Diges, and VP of Corporate Development Stefan Spears had the pleasure to meet with the president of Argentina, Javier Milei. They discussed the current economic and legislative progress made by the Milei government and the advancements towards the development of the large Los Azules copper mine located in the department of Calingasta in San Juan.During the meeting, Mr. Meding explained that the objective of the current works at Los Azules is to obtain all the technical information necessary to publish a feasibility study early next year. Currently, Los Azules has 22 drilling rigs operating, which makes it the largest such fleet in the country and one of the largest worldwide.The Company is planning to begin construction of the mine in 2026 and start production in 2029 if the necessary environmental permits are received and financing is in place. Los Azules submitted its Environmental Impact Report in April 2023 and it is currently under evaluation by San Juan’s mining authorities.Mr. McEwen described to the President that Los Azules is a solid project that will be developed on the basis of regenerative environmental principles, using innovative technologies to produce pure copper for industrial use that will contribute to closing the gap of the significant deficit in copper production required for the electrification of transportation and the change towards a greener future.In this regard, he highlighted that in order to move forward with multi-billion dollar investments in the Los Azules project free access to foreign exchange and clear rules are required.After the meeting, Rob McEwen said that "Argentina has a great opportunity and significant potential to become a mining leader, not only at a regional but also at an international level, and that is what we talked about with President Milei”. (McEwen Copper LinkedIn)

"(Bloomberg) -- Central Puerto SA, Argentina’s biggest power supplier, is in talks to invest in Canadian miner McEwen Copper Inc.’s Los Azules project, according to people familiar with the matter.After recently signing a deal for a stake in the Diablillos silver-gold project in Salta province, Central Puerto is committed to getting involved in a second mining venture, according to one person, who like others didn’t want to be named discussing private negotiations. The company is eyeing Los Azules as well as other gold and silver sites.Los Azules, in San Juan province, is one of several Argentine copper projects in different stages of development that could turn the country into a major supplier of the wiring metal in a decade. McEwen wants to start construction of its open pit in 2026, but first it is seeking a capital injection of $130 million to keep exploration work on track.Billionaire Eduardo Eurnekian’s group, Corporacion America SA, has also been looking at Los Azules, according to people familiar.Central Puerto produced 15% of all of Argentina’s electricity last year, more than any other company, according to its annual report. It continues to spend on new power plants, but has also been diversifying its commodities portfolio with investments in forestry and, now, mining. About 27% of the company is owned by a handful of wealthy Argentines — Guillermo Pablo Reca and Eduardo Jose Escasany, from the banking industry, and the Miguens Bemberg family led by Carlos Jose Miguens, who already has mining interests.The power supplier’s incursion into mining comes amid a broader push by local outfits. Recent investment activity by Argentines includes real-estate mogul Eduardo Elsztain’s purchase last month of a stake in a gold project; Jose Luis Manzano’s winning offer to revive a former Vale SA potash site, a tender in which Corporacion America also bid; and moves into lithium by three national oil drillers.Argentina shares vast mineral resources in the Andes with Chile, the world’s biggest copper exporter. But a mix of unpredictable politics and environmental opposition has prevented Argentina from unearthing many resources on its side of the mountains.President Javier Milei, who took office in December on a platform to open up business, is seeking legislative approval for tax, currency and customs benefits for big, long-term investments like mining projects. Milei also wanted to scale back protections for glaciers, which impede some exploration in the Andes, but scrapped the plans as part of a bid to make his aggressive reforms more palatable."

TNR Gold NSR Royalty Holding, Rob McEwen: "Los Azules Copper - Equivalent to a Giant Gold Project"

"The Los Azules royalty, according to some calculations, may be worth as much as US$30mln. Rob McEwen himself holds a 1.25% NSR royalty over Los Azules, and he’s been putting some pretty punchy numbers around his own interest in his recent video presentations.On the assumption of production of 182,000 tonnes of copper per year from Los Azules, and a ballpark copper price of US$10,000 per tonne, TNR could end up receiving income of upwards of US$6.6mln per year from its royalty." (Alastair Ford)

"We have two great videos from McEwen Mining and Rob McEwen to share with you today. TNR Gold shareholders have a new potential valuation reference point for the TNR Gold GEM Royalty portfolio. Rob discusses the Gold and Copper markets and gives great details about different Copper projects in Argentina and their valuations."

In February 2023, Stellantis invested ARS $30 billion, and with additional investment of ARS $42 billion made after the new preliminary economic assessment (PEA) publication, has a total investment of ARS $72 billion.

An aggregate of US $65 million in McEwen Copper was also invested by Rio Tinto’s Venture Nuton in 2022 and 2023,” stated Kirill Klip, TNR’s Chief Executive Officer. “TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, whose aim is decarbonizing mobility, and mining industry leaders such as Rob McEwen, whose vision is ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

“The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

“The new president of Argentina introduced important government policies aimed at supporting business and unlocking the country’s economic potential. Mining is being recognized as an integral part of this economic development plan providing jobs and enriching local communities.

“Strong team performance of McEwen Copper is accelerating the advance of Los Azules Project towards completing a feasibility study. The Los Azules Project PEA results highlighted the potential to create a very robust leach project, while reducing environmental footprint, and greater environmental and social stewardship sets the Project apart from other potential mine developments.

“It’s also very encouraging to see an updated independent mineral resource estimate that has increased significantly. These assay results not only validate previous drilling results but also confirm the continuity of mineralization and extend the mineralization.

“Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

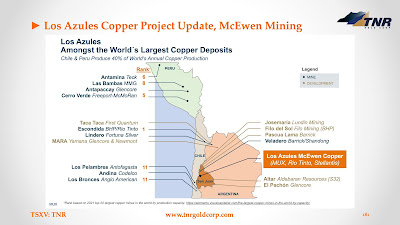

“Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

For all TNR Gold shareholders the part at 36" will be particularly interesting. According to Rob: "Osisko went into Ecuador recently and paid USD$50 million for 0.6% NSR Royalty on the deposit which is smaller than Los Azules. So, that will put just a Los Azules NSR Royalty worth maybe USD$100 million."

"Pursuant to this transaction, McEwen Copper will hold a 100% interest in the Los Azules copper project in San Juan, Argentina, and a 100% interest in the Elder Creek exploration property in Nevada, subject to a 1.25% net smelter return (NSR) royalty on both assets payable to McEwen Mining." McEwen Mining NR July 06, 2021.

"MONTRÉAL, Nov. 07, 2022 (GLOBE NEWSWIRE) — Osisko Gold Royalties Ltd (“Osisko”) (OR: TSX & NYSE) is pleased to announce that it has entered into a binding agreement with SolGold plc (“SolGold”) (SOLG: TSX & LSE) with respect to a US$50 million royalty financing (the “Transaction”) to support the advancement of SolGold’s Cascabel copper-gold property in northeastern Ecuador.

As part of the Transaction, Osisko will acquire a 0.6% net smelter return royalty (the “NSR”) covering the entire 4,979 hectare Cascabel property, including SolGold’s world-class Alpala project for which SolGold released the results of a pre-feasibility study in April of 2022 (the “PFS”)."

McEwen Mining holds 1.25% NSR Royalty on Los Azules Copper which could be valued at USD $100 million based on the Royalty deal made by Osisko Gold Royalties, according to Rob McEwen. TNR Gold Holds 0.4% NSR Royalty on the giant Los Azules Copper, Gold and Silver project with McEwen Mining, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder.

TNR Gold's 0.36% NSR Royalty could be valued at USD $30 million, based on Rob McEwen's estimations analysing the recent Osisko Gold Royalties deal with SolGold in Ecuador. In the Alastair Ford article, you can find more information about TNR Gold and benchmarks for our GEM Royalty portfolio.

No comments:

Post a Comment