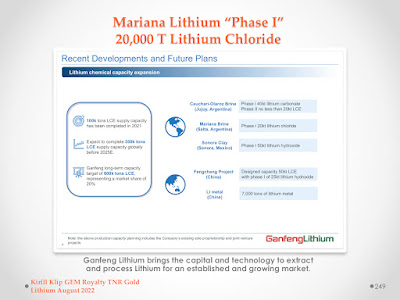

"For all TNR Gold shareholders, the following chart from the Ganfeng Lithium presentation is particularly important. The production facilities of 20,000 T of Lithium Chloride per year are called "Phase 1".

"TNR retains a 1.35% NSR royalty on the Mariana Lithium project that is being developed by Ganfeng Lithium in Argentina. We also hold a 0.36% NSR royalty on the Los Azules copper project that is being developed by McEwen Mining in Argentina. In addition, TNR holds a 7% net profits royalty on the Batidero I and II properties of the Josemaria project that is being developed by Lundin Mining in Argentina. TNR also provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska.

In February 2023, LRC valued only a portion of the Company at US $9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project in Argentina for US $9 million. LRC’s recent offer of CAD $15 million (approximately US $11 million) for the entire Company was opportunistic and financially inadequate. The duty of the board is to maximize the potential value of our assets and our Company’s valuation for all of our shareholders, and the fair treatment of all shareholders. The special committee will help the board achieve these aims by evaluating opportunities in the most streamlined, efficient manner possible. We are engaging with multiple parties proposing much higher potential valuations for our assets than LRC’s recent proposal, and these are the opportunities that the special committee will focus on first."

"How to spot the next M&A target? What if you learn that insiders of major Royalty companies have bought personal stakes in a small but very promising company holding royalties in lithium, copper, gold and silver projects under development by industry leaders like Ganfeng Lithium, Rio Tinto, McEwen Mining and Lundin Mining?"

My Vision for TNR Gold and Strategy: Share Buyback, Potential Valuations, and Shotgun Gold Project Spinout

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Kirill Klip, Executive Chairman TNR Gold Corp.

"A lot of our investors have been asking me recently, what is my personal Vision for TNR Gold, what is the future of our Company and what are my personal goals to achieve for TNR Gold."

"Our Company has reached major milestones this year after the full repayment of the investment loan and all recent developments in the marketplace."

"I would like to share with you my personal Vision for TNR Gold’s future.

The Company is of the view that the recent market prices of its Shares do not properly reflect the underlying value of the Shares. I personally believe that the current market price is grossly undervaluing the intrinsic value of TNR Gold’s assets."

"The Governor of Salta, Gustavo Sáenz and directors of the Ganfeng mining company, evaluated the economic and social impact of the Mariana lithium project, which will generate more than 3 thousand jobs." (Google Translate)

"Representatives of the company Litio Minera Argentina, local exploitation subsidiary of the “Mariana” project of the Chinese company Ganfeng Lithium, told Radio Salta about their work experience.

The firm with three projects in development participated in the cycle “Let's talk about what's coming” organized by the newspaper El Tribuno, last few days.

They have the Mariana project, -the largest of the three-, in second place is a project located in the Llullaillaco salt flat, in the Los Andes department and in last place is another project in Incahuasi, near Tolar Grande.

“Extracting lithium from brine is the friendliest to the planet,” explained Sergio Mastnak, Senior Manager of Human Development and Finance at Litio Minera Argentina SA.

Mastnak announced that when the three lithium extraction projects are underway, direct employees will reach a thousand people.

“We are having a hard time finding geologists and engineers, who we must look for in other provinces,” he said.

He commented that obtaining lithium production from the “Mariana” project will begin to be seen in the second half of 2024." (Google Translate)

No comments:

Post a Comment