Forbes Argentina provided us with the opportunity to learn more technical details about the progress of the Mariana Lithium Project development by Ganfeng in Argentina. Sebastian Vaca, the Construction Manager of the Mariana Project of the Ganfeng Lithium, shares with TNR Gold shareholders the positive news from the construction site in Salta.

"We have more positive news for all TNR Gold shareholders about Ganfeng's progress at the Mariana Lithium Project coming from Salta, Argentina. Following the reports about the recent meeting of Governor Gustavo Sáenz with the Ganfeng Lithium Team, Adriana Bekerman (Vice President of Engineering and Operations of Ganfeng Lithium – Argentina) describes the recent developments at the Marina Lithium Project and highlights the opportunity that lithium represents for the economic and social growth of communities in Salta."

"We have important news for all TNR Gold shareholders and another confirmation about the ongoing progress at the Mariana Lithium Project coming from Argentina. Governor Gustavo Sáenz received President Li Liangbin and Vice President Wang Xiaoshen of the Ganfeng Lithium - "According to the Company's forecasts, Mariana will go into production next year".

Now you can better understand my Vision for TNR Gold and why insiders are buying shares of TNR Gold and we have announced our share buyback program.

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

TNR Gold Shares Details Behind Latest Share Buy Back Program

"The Company is of the view that the recent market prices of its Shares do not properly reflect the underlying value of the Shares. The Company has available cash from its sale of a portion of the Mariana Royalty sale and after repayment of outstanding debt. No insiders of the Company intend to participate in the Bid."

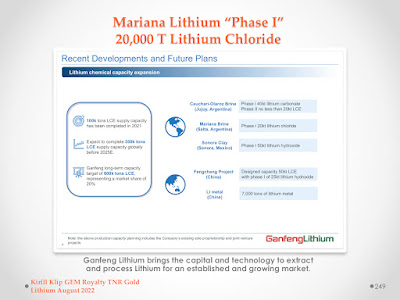

"For all TNR Gold shareholders, the following chart from the Ganfeng Lithium presentation is particularly important. The production facilities of 20,000 T of Lithium Chloride per year are called "Phase 1".

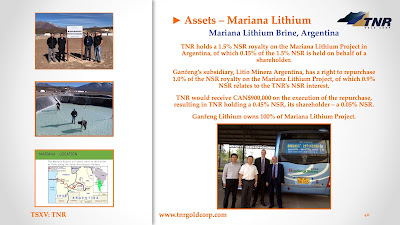

TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on the Mariana Lithium Project with Ganfeng Lithium. I consider my personal investment in TNR Gold, as a unique entry point into the state-of-the-art vertically integrated lithium business being built by Ganfeng Lithium for the 21st century.

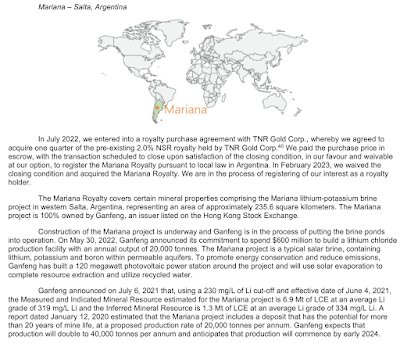

Lithium Royalty Corp IPO Prospectus

We are building The Green Energy Royalty and Gold Company and participating in the creation of secure supply lines feeding The Switch and Tesla Energy rEVolution.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, and stay safe and prosper. Join rEVolution!

TNR Gold Investor Presentation - Building The Green Energy Metals Royalty and Gold Company from Kirill Klip

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

Forbes Argentina:

Sebastián Vaca, From Ganfeng: "We Want to Be the Main Lithium Producer in Argentina and the World"

Fernando Heredia

"In an interview with Forbes, the Construction Manager of the Mariana Project of the Ganfeng mining company, tells about the plans of the Chinese company in Argentina and talks about the possibility of manufacturing batteries in the country.

The mining giant Ganfeng sought out a pure strain from Salta to lead the construction teams of its projects in Argentina, where this province stands out from the rest of those that are part of the lithium triangle in the company's investment portfolio.

"I was born in Salta, raised in Salta, I studied in Salta, I did a large part of my career here and I think it is a particularly attractive province for mining because of the boost that is being given to it through many laws". This is how the Construction Manager of the Mariana Project, Sebastián Vaca, introduces himself to Forbes, before beginning an interview during his time at the International Lithium Seminar.

- What is the role that the company has worldwide and why did you decide to bet on Argentina?

Ganfeng is headquartered in China, it is one of the top 3 in lithium production and not only that, but we are covering everything from extraction to manufacturing and recycling of lithium batteries. We aim to be number one in lithium production. In the case of the Mariana Project in the Salar de Llullaillaco, the production that we will obtain is Lithium Chloride.

- What is the difference between lithium carbonate, hydroxide and chloride?

All products are lithium salts. The production process differs widely between them. The main difference lies in the chemical elements with which lithium is combined. The choice to produce one or the other brand on the entire market. In general, the 3 products can be used to produce Lithium batteries and the product they need depends on each company.

- What state is the Mariana Project in? What is the production expectation?

Mariana officially started construction last year in May 2022, that's when we did the construction inauguration ceremony. We are now in the construction stage. This project has two stages. In the salt flat, what we do is evaporation and a first part of the process where we obtain a pre-concentrated brine. This, later, will be transported to the Güemes industrial park, where we have already started the construction of the plant that will carry out the second stage of the process where we will obtain lithium chloride. So, we have been officially under construction since May of last year and we are making the pre-evaporation pools, there are 1,400 hectares of pools, soil movement and lining with geomembranes and geotextiles, which we have already executed about 45% to 50% of all. these pools, which is very good progress. At the end of last year, we started filling the pools, that is, we can say that we are in the "pre-production stage". When we begin to fill the pools with brine, we start pre-production because it is the initial stage to obtain the concentrated brine. We are also building the plants, the buildings, where the brine will enter, which as I was saying is where we are going to finish pre-processing the brine in Mariana to send it to Güemes and complete the entire process and obtain the lithium chloride that is in this case our final product. We start pre-production because it is the initial stage to obtain the concentrated brine. We are also building the plants, the buildings, where the brine will enter, which as I was saying is where we are going to finish pre-processing the brine in Mariana to send it to Güemes and complete the entire process and obtain the lithium chloride that is in this case our final product. We start pre-production because it is the initial stage to obtain the concentrated brine. We are also building the plants, the buildings, where the brine will enter, which as I was saying is where we are going to finish pre-processing the brine in Mariana to send it to Güemes and complete the entire process and obtain the lithium chloride that is in this case our final product.

- What production capacity will it have?

The estimated initial production of the Mariana Project is 20,000 tons of lithium chloride.

- When will production start?

The idea is to go into production during the year 2024, approximately between the second and third quarters, we are thinking of already having part of the production.

- How are your other exploration projects coming along and what depends on whether they are done?

Like any mining project, there are times that may seem very long. In particular, what we have is the Incahuasi project, where advanced exploration is being carried out to determine the actual amount of resources that it has. And then another project that we acquired over the past year is Pozuelos-Pastos Grandes, which is a little further along, in the engineering development stage. The idea we have is that during the first quarter of 2024 it will already enter the construction phase.

Sebastian Vaca, Ganfeng

- Are you one of the companies with the most projects in the pipeline?

We have, as I told you, these three. In addition, Ganfeng is the majority shareholder of the Cauchari-Olaroz project in Jujuy, they are the owners of 51% of the private part and have a strategic participation as a shareholder in the Sal de la Puna project. And we are constantly looking for new projects that we can incorporate into our portfolio. Ganfeng's idea is to be the number one benchmark and for that we need a lot of resources to work on them and make them go from being simply a resource to a material asset.

- Are you looking to be the main producers in the world, but also in Argentina?

Exactly. We are not currently in production, but there are some projects that are in production, such as the one I mentioned about Minera Exar, Cauchari-Olaroz, which is not entirely ours. Ganfeng's idea is to be number one worldwide and obviously in Argentina as well.

- How many tons can you imagine producing?

This first project has 20,000 tons of lithium chloride as a target. I cannot give you the numbers for this expansion and the others for sure because they are in the exploration stages, but they will be in that order of magnitude or more. It all depends on how good the results are. Besides, Ganfeng is not only here in Argentina, but there are several other places where it has operations.

- What is the attraction you see in Argentina to make such a strong commitment?

Argentina is friendly with mining in general and in particular with sustainable lithium mining. Although in recent times there had been talk of the nationalization of lithium, we know that it is something that is not consistent with the Constitution, which are resources that depend on each of the provinces that own them. This, added to the fact that mining companies were given a boost in Salta through many laws and created a very positive environment for mining investment, is what makes mining particularly attractive at this time in Argentina and in particular in Salta. There are obviously many things still to improve, because unfortunately it is not all rosy, but compared to other places, other markets, other countries, it is still attractive to make mining investment in Argentina.

- You mentioned that the company, in addition to producing lithium, also produces batteries. How do you see Argentina to play a role in that link?

At this moment, the first link must be given a lot of impetus, because it is not something that is so simple either. It requires and demands a lot of manpower, a lot of work, and a lot of added value in going from the brine that is in a deposit in the salt flat to obtaining lithium chloride. Then, obviously, if it gets to the point of saying I can do and generate the complete battery, it would also be great and hopefully it really happens, that we can have all the necessary technology here in the country and the knowledge and human resources to do it. So, let's first focus on this first process, which is what is flourishing. And the other step is not going to be taken overnight. Of course it can be done, but it is not immediate. It requires a lot of effort, a lot of technology and other metals that we do not currently produce in the country and should be imported. At the moment, Country conditions and import conditions for all these inputs are quite complicated. There are many things to improve, such as the exchange rate, and the conditions in the country that are not so stable.

- Don't they rule it out for a second stage?

Under current conditions, we cannot give precision or be certain of this. I think it would be very beneficial for everyone, but you have to work a lot from all sides. From the mining companies, which are the ones who make the most of the investment; the provincial governments with whom we particularly have a very good relationship; and the national government, which is a little more in charge of providing certain macroeconomic conditions that allow for a good development of the project in general."

No comments:

Post a Comment