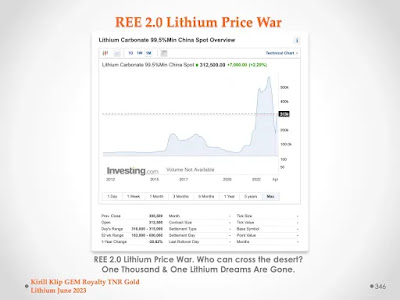

Lithium price shocks are not over yet. Lithium REE War 2.0 could not have come at the worst possible moment for so many Lithium Dreamers. The “One Thousand and One” Lithium projects hyped by junior miners are gone, even if their investors who are still smoking hopium have not realised it yet.

There is only the word Lithium in the names of some lithium companies left and no real Lithium resources which can be economically produced in the next 10 years. Companies are getting cautious about deploying capital in Lithium mining and production after so many failings in the young industry. They will rather secure a stable supply from the already established players.

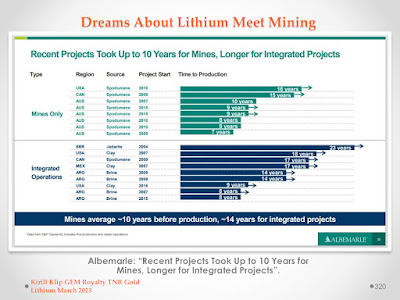

“Tsunami of Battery Grade Lithium” leading to oversupply will never materialise. Most projects are late, over budget and reaching the number plate of production capacity for Battery Grade Lithium slowly over many years.

"Last time Goldman Sachs "was worried" about your investments in the Lithium Universe and called the coming tsunami of the new Battery Grade Lithium Supply they were buying stakes in the Lithium companies at the same time while retail was selling in panic.'

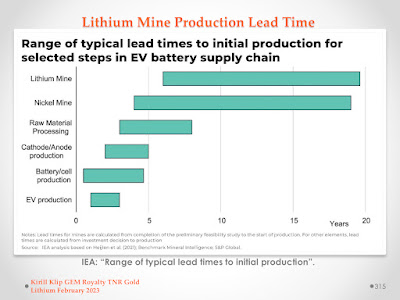

"The problem with all estimations for the future supply in mining is the difficulty of the process to put new mining operations in place, particularly in a sustainable way. In the case of Lithium, we are dealing not only with mining operations but with literal "chemical soup", particularly in the case of Lithium Brine Operations. Every single project has a unique chemistry. Only a few companies in the world were able to put online successful Lithium operations."

"This is where science meets Wall Street and Bay Street hype. Lithium projects are always delayed, they are never on budget and only a few companies managed to organise operations to reach the previously announced annual capacity production of Battery Grade Lithium."

"Investors must remember that a lot of "Lithium companies" have only the word Lithium in their name, but not any real Lithium resources which can be produced economically in the next 10 years. The flood of money following the new Lithium all-time high of over USD$85,000 in China last year was chasing Bay Street Lithium Dragons all over the junior mining space."

"As we discussed before in my video, Lambs are getting slaughtered while chasing Lambos: "Chasing Crypto Dragons And The World Just Before The Internet: "I Pump, But I Don't Dump" - Tesla Energy rEVolution and Lithium. Always carefully check all your dinner invitations - you could be the main dish to be served."

"Now, these Dragons flew away with investors' money following Crypto Dragons. A lot of investors will be burnt again, and retail will start chasing the new wild dreams to become rich overnight. Memories about "One Thousand and One" junior mining Lithium projects will stay as monuments for the happy times."

"Dreams about Lithium meet mining realities. Only a few giant companies will be able to withstand Goldman Sachs and Ark Invest manipulations with their worries about Lithium oversupply. They will continue increasing their domination by acquiring the best Lithium projects."

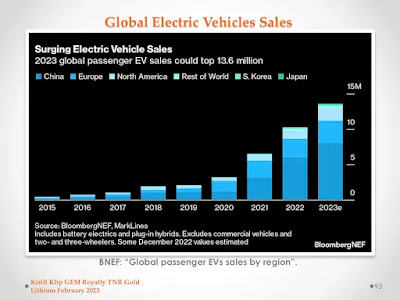

Resource Nationalism will be another wake-up call for all daydreaming about Africa's riches. On the other side of demand, EVs sales jumped over 14% globally in 2022 and still rising exponentially. After 20% electric cars will go truly mainstream.

Lithium Majors understand it and steadily invest capital in the best projects to increase capacity and their market share, while carefully painting the “Lithium price curve” and driving out of business so many aspirational speakers. You have to choose wisely and not participate in the digital divide between you and your money. There were eToys and AtHome before we all got Amazon and Google. DYOR and stay safe. The world is changing. Real Assets, Real People. #MiningAllianceOfTrust.

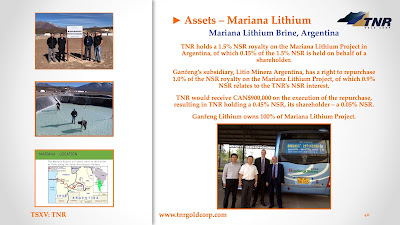

TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on the Mariana Lithium Project with Ganfeng Lithium. I consider my personal investment in TNR Gold, as a unique entry point into the state-of-the-art vertically integrated lithium business being built by Ganfeng Lithium for the 21st century.

Lithium Royalty Corp IPO Prospectus

We are building The Green Energy Royalty and Gold Company and participating in the creation of secure supply lines feeding The Switch and Tesla Energy rEVolution.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, and stay safe and prosper. Join rEVolution!

TNR Gold Investor Presentation - Building The Green Energy Metals Royalty and Gold Company from Kirill Klip

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

No comments:

Post a Comment