TNR Gold is moving quickly on its path to transitioning from a project-generating junior mining company into a cash-flow-generating royalty company. We believe that the recent market prices of our shares do not properly reflect the underlying value of the shares and that this transformation will bring the necessary catalyst to crystalise the potential valuation of our assets for investors in the marketplace. Let's explore our company's rising value proposition.

Last year we repaid our investment loan in full, and our Company has no debt. TNR Gold bought back more than 6 million shares under the normal cause issuer bid.

We have celebrated major developments with all our royalty projects this year. Ganfeng Lithium reaffirmed that Mariana Lithium will start production of lithium chloride at the end of 2024 and this project will become the first cash-flow-generating royalty for TNR Gold.

In a major vote of confidence Rio Tinto, the world's second-largest metals and mining company invested an additional $35M in McEwen Copper bringing the total investment to $100M. Nowadays McEwen Copper secured a key environmental permit for the construction and operation of the giant Los Azules Copper project in Argentina! The company is talking about a construction decision that can be made as early as next year after the release of the feasibility study.

All three of TNR Gold's royalty projects are featured in the Argentina Secretariat of Mining investment feature. Our Company holds 1.35% NSR royalty on Mariana Lithium with Ganfeng, 0.36% NSR royalty on Los Azules Copper with McEwen Mining and 7% net profits royalty on Batidero I and II properties of Josemaria with Lundin Mining.

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

"We have closed our Mariana Lithium NSR deal with Lithium Royalty Corp. Now TNR Gold is in a strong financial position. By monetising only part of our Royalty we have confirmed an important benchmark for the valuations of our Royalty Holdings for the market. During our negotiations, we have generated a significant industry interest in our Company and TNR Gold's assets."

"And towards the end of last year, Lithium Royalty paid it US$9mln for a 0.5% royalty in the Mariana project. TNR retains a 1.35% royalty, and also holds 0.15% on behalf of a shareholder. What’s that worth, now that Mariana is less than a year away from production?Probably not much less than C$9mln, even allowing for the subsequent decline in the lithium price. After all, lithium could come back, the royalty remains in place, and a year is not long to wait in mining terms, assuming there are no delays.Even if it’s just the 0.45% royalty that TNR is likely to be left with if Ganfeng exercises its right to acquire the other 1% that TNR owns, that should still prove lucrative enough.Assuming a long-term lithium price of US$40,000 per tonne, pre-tax income is likely to amount to US$3.6mln a year.Equally, if the price returns to anything like the levels it was at last year, that number rises to over US$7mln per year.

And there’s likely to be more to come from Mariana, perhaps even before first production. An additional C$0.9mln will come into TNR if Ganfeng exercises its option to buy a further 1% of the royalty back off TNR, and the chances are, with a project this size, that it will.But is the Mariana royalty even the best asset inside TNR?" Alastair Ford

"Arguably not, since the Los Azules royalty, according to some calculations, may be worth as much as US$30mln. Rob McEwen himself holds a 1.25% NSR royalty over Los Azules, and he’s been putting some pretty punchy numbers around his own interest in his recent video presentations.

"On the assumption of production of 182,000 tonnes of copper per year from Los Azules, and a ballpark copper price of US$10,000 per tonne, TNR could end up receiving income of upwards of US$6.6mln per year from its royalty." Alastair Ford

TNR GOLD CORP.

> THE GREEN ENERGY METALS ROYALTY AND GOLD COMPANY.

"TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and the Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR Royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR Royalty and its shareholder holding a 0.05% NSR Royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

Mariana Lithium Project* measured and indicated resource: 4,410,000 T of LCE and 49,700,000 T of potash with the additional inferred resource: 786,000 T of LCE and 9,260,000 T of potash.

(Updated Mariana Lithium Project measured and indicated resource: 6,854,000 T of LCE with the additional inferred resource: 1,267,000 T of LCE – Company news release, July 14, 2021)

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

Los Azules Copper Project** indicated resource: 10.2 B lbs copper, 1.7 Moz gold and 55.7 Moz silver with the additional inferred resource: 19.3 B lbs copper, 3.8 Moz gold and 135.4 Moz silver.

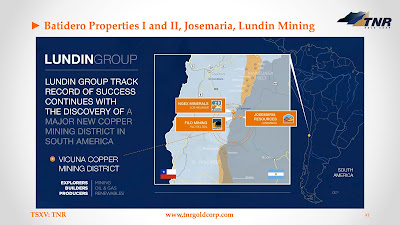

TNR also holds a 7% net profits royalty (“NPR”) holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources.

Shotgun Gold Project*** inferred resource: 705,960 ounces Au at 1.06 g/t, mineralization appears to be open at depth and along the strike.

The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I &II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

* “NI 43-101 Technical Report Update of Lithium Brine Mineral Resources; Mariana Project, Salar de Llullaillaco, Argentina” dated January 12, 2020. Prepared by Geos for Ganfeng Lithium.

** “NI 43-101 Technical Report – Preliminary Economic Assessment Update for the Los Azules Project, Argentina” dated October 16, 2017. Prepared by Hatch for McEwen Mining.

*** “NI 43-101 Technical Report on the Shotgun Gold Project, Southwest Alaska” dated May 27, 2013. Prepared by Nicholas Wyck and Allan Armitage for TNR Gold."

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

No comments:

Post a Comment