Guest Post:

TNR Gold GEM Royalty Story: Copper, Gold and Silver FOMO Electrified by Lithium Rush

Konstantin Klip

We have closed our Mariana Lithium NSR deal with Lithium Royalty Corp. Now TNR Gold is in a strong financial position. By monetising only part of our Royalty we have confirmed an important benchmark for the valuations of our Royalty Holdings for the market. During our negotiations, we have generated a significant industry interest in our Company and TNR Gold's assets.

Kirill has spent many a post writing about ‘

the divine match made in Heaven’. As we scroll through and through, parsing signal from noise, could it be that this message was prophesied more than a century ago? Could we look back and realise that well, it really seemed quite obvious when viewed in the grand scheme of things?

But where do we find this match? Where do we find this wonderful wedding of state and resource? For the matter of this article, we’ll be looking at the world’s cradle of "white gold'; the "lithium triangle", the peak of the world’s (exceptionally flat) plains of lithium.

And while a certain nation (rhymes with Chilli) is perhaps a little confused and takes my metaphor too literally; coming dangerously close to nationalising its resource under the state, our focus is on the nation that has managed to demonstrate the fine balance between helicopter nurture and healthy hands-off parenting.

Even though multiple projects and geographies share similar attributes (lithium brine in the case of South America), only when time passes do we see the great divide in risk.

With recent events, it's easy to choose when comparing Argentina to neighbouring Chile, where our sector’s worst nighttime bogeyman of resource nationalisation is heralded by a far-left socialist & communist coalition prevailing in political elections.

Companies like Ganfeng Lithium and McEwen Mining are investing many millions of dollars to bring giant projects like Mariana Lithium and Los Azules Copper, Gold and Silver into the next stage of development. By now Argentina has received many votes of confidence in its future. Rio Tinto joined the lithium race with the lithium giants like Ganfeng and buys Rincon Brine Project for US$825 million.

If

TNR Gold can do one thing well, it's to identify underappreciated assets and squat on them until pop hype and fanfare wake up the hatchling within. But there’s a certain poetry to this business model; TNR must be warmed in turn by those looking for underappreciated assets, so participating in this type of venture requires a certain kind of paternal patience, no matter the blizzard coming.

We see the same again in TNR’s choice of investments. Take Argentina many years back, for instance, where the nation was criticised for an unconducive investment climate that prevented a timely transformation of lithium resources into commercially viable reserves.

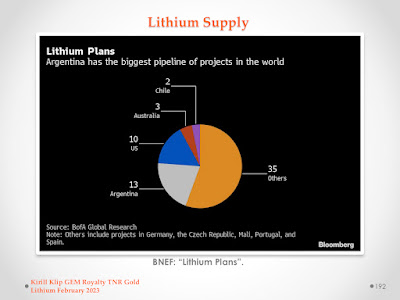

Now, however, Argentina provides the most promising case for the expansion of the lithium industry as it seeks opportunities to expedite its economic recovery. It possesses the world’s second-largest identified lithium resources (behind only Bolivia), and the third-largest quantity of commercially viable lithium reserves behind only Chile and Australia.

"Argentina is the most promising case for the expansion of the lithium industry, as it is looking for opportunities to accelerate the recovery of its economy," said Ryan C. Berg, a fellow at the Washington-based Center for Strategic and International Studies, in an August 2021 report.

Ganfeng Lithium, for example, is the majority stakeholder in Argentina’s Caucharí-Olaroz operation, which is set to begin production in the first half of this year and should become one of the world’s top lithium production facilities. Additionally, Chinese investment in Argentina’s lithium industry will be facilitated through its Belt and Road Initiative, which Argentina joined in 2022.

Similarly, in Chile, China’s Tianqi Lithium became the second-largest shareholder in SQM, Chile’s largest lithium mining company, holding 23.8 per cent of shares. Chinese companies Ganfeng Lithium and Tianqi Lithium now represent two of the top three lithium mining companies in the world.

Talk is abound as lithium, that "white gold", has now become pop for the mainstream. In February 2021, the Council of the Americas, a U.S. organization that seeks to promote democracy and free trade in the region, predicted that the global lithium market will increase fivefold in the next 35 years. This will have consequences in Argentina, Bolivia, and Chile — the so-called lithium triangle — where, according to the U.S. Geological Survey, 58 per cent of the world’s lithium reserves are located.

"EV market faces decades of strong, compound growth. Any supply chain that relies on getting raw materials out of the ground, it is going to be a supreme challenge to keep up with year after year of high compound growth," said Fastmarkets. "Lithium production must quadruple."

There is a greater understanding of the lithium market from the "investment community" regarding how to identify a good prospect. Opportunities for value investment; that very definition of underappreciation, are closing rapidly in the sector. Nowadays many a napkin is left unattended with lithium royalty evaluations.

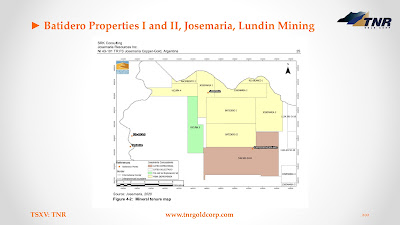

Now a third column marches into view for TNR Gold, as we highlight a little-known position of ours with Batidero I and II Property Royalties of Lundin Mining's Josemaria Copper-Gold Project.

‘The Josemaria project is among the top-ten open-pit copper projects in the Americas in term of total mineral reserves, according to Rockandel. Once in production, it is expected to churn out over 130,000 tonnes of copper, nearly 225,000 oz. of gold and 1 million oz. of silver a year over a 19-year mine life, based on a November 2020 feasibility study. The project is expected to start commercial production in 2026.

The feasibility study estimated the project would generate a post-tax net present value of $1.53 billion and a post-tax internal rate of return of 15%.’

Josemaría is going to generate enormous opportunities; the managing minister assured this project will lead to another larger project, Filo del Sol. That would be spectacular, a new era of copper would open in Argentina."

Our business model provides an exceptionally valued entry point into the creation of a critical material supply chain like copper and lithium energy metals which are powering the EV revolution and the gold and silver industry which is providing the ultimate hedge during this part of the economic cycle.

"

Shotgun Gold is a Project located in South West Alaska, USA, in the same regional area as Novagold’s Donlin Gold Project. Lang’s & Baker’s 2001 academic study specifically identifies both projects as "major porphyry granite-related gold deposits" that are related to a widespread magmatic gold mineralising event. Riveting stuff. What it implies in layman’s terms is that both projects arose from the same geological kitchen sink, leading one to the supposition that they should both possess similar favourable geological properties."

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

No comments:

Post a Comment