Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that after many months of negotiations, we have successfully closed this transaction and achieved this major milestone for our Company. This is a further validation of TNR Gold’s business model. By monetizing part of our royalty holdings, we are providing an important benchmark for valuations of assets in our royalty portfolio and generating significant capital, while selling to LRC only a portion of our royalty holding on the Mariana Lithium Project. This strategic transaction with LRC allows us to significantly improve our working capital position and strengthen our balance sheet.

Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began last June, will start producing, in 2024, an estimated 20 thousand tons per year of lithium chloride. The Government of Salta has reported on Ganfeng Lithium’s announcement that the operational phase of the Mariana Lithium Project began in January 2023.

We believe that our royalty holdings are undervalued and their appropriate values are not reflected in the Company’s share price. This transaction clearly demonstrates it. We have received cash proceeds that were well above the Company’s recent market capitalization. Significant industry interest in our assets has been generated, and the Company is working on potential new strategic partnerships to provide further benchmarks for the market valuations of our royalty holdings.”

TNR Gold:

NEWS RELEASE

TNR Gold Closes Partial Mariana Lithium NSR Royalty Sale to Lithium Royalty Corp.

"Vancouver, British Columbia – February 2, 2023: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that, further to the Company’s news release dated November 23, 2022, it has successfully closed the July 2022 royalty purchase agreement with an Ontario limited partnership affiliated with Lithium Royalty Corp (“LRC”) for the sale of a portion of its net smelter returns (“NSR”) royalty involving the Mariana Lithium Project (“Mariana”). LRC has purchased from TNR a 0.5% NSR royalty for US$9,000,000, including 0.05% NSR royalty sold by TNR on behalf of its shareholder. This represents one-quarter of the NSR royalty held by the Company. LRC is an arms’ length party to the Company.

As disclosed in previous news releases, TNR sold the portion of the NSR royalty which is not subject to any buy-back rights. After the closing of the transaction with LRC, TNR will hold a 1.5% NSR royalty on Mariana, including a 0.15% NSR royalty held on behalf of a shareholder (which represents a 1.35% NSR held by TNR and a 0.15% NSR in favour of the shareholder).

Under the existing buy-back right, 1.0% of the Mariana NSR royalty can be purchased from TNR for aggregate payment of CAN$1,000,000 at any time within 240 days of “Commencement of Commercial Production” as defined in the underlying agreement. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the completion of a repurchase under the underlying agreement. If such purchase was made, TNR would hold a 0.45% NSR and its shareholder would hold a 0.05% NSR.

Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that after many months of negotiations, we have successfully closed this transaction and achieved this major milestone for our Company. This is a further validation of TNR Gold’s business model. By monetizing part of our royalty holdings, we are providing an important benchmark for valuations of assets in our royalty portfolio and generating significant capital, while selling to LRC only a portion of our royalty holding on the Mariana Lithium Project. This strategic transaction with LRC allows us to significantly improve our working capital position and strengthen our balance sheet.

Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began last June, will start producing, in 2024, an estimated 20 thousand tons per year of lithium chloride. The Government of Salta has reported on Ganfeng Lithium’s announcement that the operational phase of the Mariana Lithium Project began in January 2023.

We believe that our royalty holdings are undervalued and their appropriate values are not reflected in the Company’s share price. This transaction clearly demonstrates it. We have received cash proceeds that were well above the Company’s recent market capitalization. Significant industry interest in our assets has been generated, and the Company is working on potential new strategic partnerships to provide further benchmarks for the market valuations of our royalty holdings.”

ABOUT LITHIUM ROYALTY CORP.

Lithium Royalty Corp. is a North American royalty corporation focused on investing in high quality low-cost projects in the battery materials sector with an emphasis on lithium. LRC was founded in 2018 and has established itself as a leading financier in the lithium industry, having completed 22 royalties since inception exclusive of the transaction with TNR. Its investments are diversified across the world, with exposure in Australia, Argentina, Brazil, Canada, Serbia, and the United States. LRC is a signatory to the United Nations Principles for Responsible Investing and seeks to invest in companies with high environmental, social, and governance standards. Waratah Capital Advisors is the sponsor and general partner of LRC.

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-seven years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

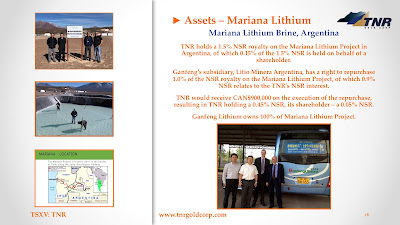

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the successful completion of sales of portions of the NSR royalties and decisions of the government agencies and other regulators in Argentina. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium, and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."

No comments:

Post a Comment