TNR Gold:

TNR Gold Update on Batidero I and II Property Royalties of Lundin MIning’s Josemaria Copper-Gold Project

Vancouver, British Columbia – April 28, 2022: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that Lundin Mining Corporation (“Lundin”) has completed a plan of arrangement pursuant to which Lundin acquired all of the issued and outstanding shares of Josemaria Resources Inc. (“Josemaria Resources”) and Josemaria Resources became a subsidiary of Lundin. TNR holds a 7% net profit interest royalty (“NPR”) on the Batidero I and II properties of the Josemaria copper-gold project located in San Juan, Argentina that is owned by Josemaria Resources.

In its news release dated April 28, 2022, Lundin stated:

“The addition of the Josemaria project to Lundin Mining’s portfolio solidifies our position as a leading base metals producer with high-quality copper exposure and significant growth. We look forward to building upon the excellent reputation of Josemaria Resources in San Juan and Argentina,” said Peter Rockandel, Lundin Mining President and CEO, “We are excited to lead the project through the remaining stages of development and into production to create significant value for all stakeholders…

“Josemaria Project Update

As announced by Josemaria Resources on April 11, 2022, the Mining Authority of San Juan, Argentina has approved the Environmental Social Impact Assessment for the Josemaria Project, marking a significant milestone in the project’s permitting process. Lundin Mining and the Josemaria project team are working with the national and provincial authorities to progress the project through the next stages of development. Discussions regarding commercial agreements and securing of additional sectoral permits are ongoing and anticipated later this year prior to a definitive construction decision.

The Josemaria project is progressing through basic engineering with procurement of long-lead equipment, including securing key items of crushing and processing. Study work is ongoing, including updating of cost estimates to be reflective of current conditions and evaluation of potential scope changes compared to plans envisaged in the Josemaria Resources 2020 Feasibility Study (“NI 43-101 Technical Report, Feasibility Study for the Josemaria Copper-Gold Project, San Juan Province, Argentina” dated November 5, 2020 (the “Josemaria Resources 2020 Feasibility Study”)). Lundin Mining aims to complete an updated Technical Report for the project in the fourth quarter of 2022. While this work has not yet concluded, the Company expects the initial capital expenditure estimate of the project to be greater than $4 billion. Effective post-closing, the Company intends to spend up to $300 million to advance the project ahead of a construction decision in the second half of 2022, including engineering, commitments for long lead items, preconstruction activities and drilling.

As part of the updated Technical Report, Lundin Mining plans to complete new Mineral Reserve and Resource estimates. Approximately 20,600 meters of drilling have been completed on the project since the most recent 2020 Josemaria Resources mineral estimates and 35,000 meters of additional drilling are planned to be completed ahead of the new estimates.

About Lundin Mining

Lundin Mining is a diversified Canadian base metals mining company with operations and projects in Argentina, Brazil, Chile, Portugal, Sweden and the United States of America, primarily producing copper, zinc, gold and nickel.”

Kirill Klip, TNR’s Chief Executive Officer commented, “Our 7% NPR holding on the Batidero I and II properties of the Josemaria Project held by Lundin Mining represents future growth potential for our royalty portfolio. We are also investigating potential new acquisitions while our main focus remains on the development of the Shotgun Gold Project in Alaska. The essence of our business model is to have industry leaders like Ganfeng Lithium, McEwen Mining and Lundin Group as operators on the projects that will potentially generate royalty cash flows to contribute and develop a significant long-term value for our shareholders.”

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality exploration projects around the globe. With the Company’s expertise, resources and industry network, it identified the potential of the Los Azules Copper Project in Argentina and now holds a 0.4% NSR Royalty on the project, which is being developed by McEwen Mining Inc, (TNR holds a 0.04% NSR on behalf of a shareholder).

In 2009, TNR founded International Lithium Corp. (“ILC”), a green energy metals company that was made public through the spin-out of TNR’s energy metals portfolio in 2011. ILC held interests in lithium projects in Argentina, Ireland and Canada.

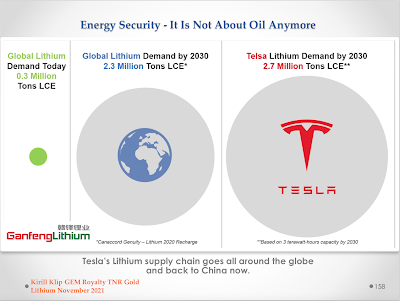

TNR retains a 2.0% NSR Royalty on the Mariana Lithium Project in Argentina with Ganfeng Lithium, (TNR holds a 0.2% NSR on behalf of a shareholder). Ganfeng’s subsidiary, Litio Minera Argentina, has a right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% relates to the Company’s NSR Royalty interest. The Company would receive $900,000 on the completion of the repurchase. The project is currently being advanced by Ganfeng Lithium International Co. Ltd.

TNR also holds a 7% NPR holding on the Batidero I and II properties of the Josemaria Project, which is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources Inc.

The Company’s strategy with Shotgun Gold Project is to attract a joint venture partnership with one of the gold major mining companies. The Company is actively introducing the project to interested parties.

At its core, TNR provides significant exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and Argentina (the Los Azules Copper and the Mariana Lithium projects) and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the results of McEwen Mining’s, Ganfeng Lithium’s, Josemaria Resources’ and Lundin Mining’s preliminary economic assessments, Feasibility Study, or Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine and mine closure plans and improvements in the financial performance of the Company. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financing will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium, Josemaria Resources and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."