Barrick Gold and NovaGold are striking Gold again in the largest drilling program at Donlin from 2008 and they like what they see. Below you can find more information why I personally believe that the Donlin Gold project can grow into one of the largest in the world 50 million-plus oz Au resources Mining Camp on the US soil. And how TNR Gold's Shotgun Gold Project can potentially grow into one of the satellite Gold deposits which may benefit greatly from all the infrastructure of the Donlin Gold Mining Camp.

We extend our congratulations to TNR Gold shareholder NovaGold and their Donlin Gold JV partner Barrick Gold. JV partners of Donlin Gold have announced solid results from the largest drilling campaign since 2008 on the project. On the back of this news, it is time for us to discuss our own relationship with developing Donlin Gold Mining Camp and my own personal vision of how Donlin Gold project can potentially grow into a 50 million-plus oz Au resource project and become a major Gold Mining Camp in the world based on the U.S. soil.

Dr Tim Baker

How is this relevant, what is the relationship between Donlin and Shotgun Gold? My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

I am the largest shareholder of TNR Gold with 25% stake on a partially diluted basis, so my personal visions must be followed by your own research, including reading all legal disclaimers. There is no investment advice on my blog or any social media feeds and you should always consult a qualified investment adviser before making any investment decisions.

Dr Tim Baker

All visions, all great paths forward should be supported by solid science and Dr Tim Baker provides us today with sober scientific observations from his studies about the "Major Porphyry Intrusion-Related Gold Deposits" in the world. What follows is my attempt to translate the high-level geological and geochemical data collected by Dr Baker after studying for many years "Major Porphyry Granite Related Gold Deposits" in the world including Shotgun Gold into a few digestible ideas.

Dr Tim Baker

How are these "Elephants" - the giant porphyry Gold deposits - formed? Where should you look for these "Elephants"? And why a found "trunk of an Elephant" which snakes up all the way to the surface in Alaska, can leave many geologists awake at night at the right time of the Gold Cycle?

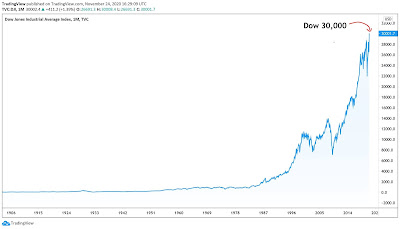

Stubbornly rising Gold prices are great seasoning for great projects nestled in safe, ready to grow mining jurisdictions like Alaska. Rising Gold price is what allows us, after all this time, finally move from the preparation stage and into action. Shotgun Gold Project is already part of academic research and scientific papers, now we are moving forward with our strategy to make its development the part of Gold industry studies to unlock its full potential.

Our preparations are set for this golden opportunity. We have the academic research and inferred resource has been already defined in produced Shotgun Gold NI 43-101 Technical Report. Gold Bull market finally brought us a favourable environment in which Eric Sprott doubles his "mental valuations" from $50 to $100 per oz Au in the ground. Barrick Gold warns of supply crisis and calls for consolidation, while VanEck International Investors Fund calls gold mining stocks "undervalued based on the statistical norm of share prices to cash flow … at a time when producers are on their best financial footing in recent history".

We all remember the very brave super-smart short-sellers that were so worried about losing a lot of money in this Gold Bull market that they produced a company-killer report about NovaGold which made many other investors worry about Donlin Gold, especially in regards to its economic viability and Barrick Gold's plans for this JV project with NovaGold. Thomas Kaplan came out with all guns blazing, sued the super-smart FUD producers and made the best move which can happen in the mining industry. Amid worldwide pandemic, NovaGold Donlin Gold Team conducted 23,400m in 85 holes of the largest since 2008 drilling campaign on the project.

NovaGold NR October 26, 2020.

CEO Mark Bristow has confirmed that Donlin Gold is a key project for Barrick Gold. Now the project will grow further, updated model and a new resource estimation are expected. Drilling intersections are spectacular with high-grade sections of 4.17m grading 80.6 g/t Gold starting at 123.48 drilled depth, including a subinterval of 3.15m grading 106.2 g/t gold starting at 124.5m drilled depth. Drill hole DC20-1872 was drilled to the depth of 632.8m and Gold mineralisation intersection of 6m was found from 603.23m to 609.23m grading 2.33 g/t. Now you can better understand why I am talking about the potential development of Donlin Gold project into 50 million-plus oz Au resources to become one of the largest Gold Mining Camps in the world based on the U.S. soil.

NovaGold NR October 26, 2020.

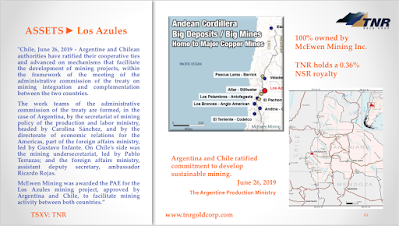

It is important to mention here that TNR' Shotgun Gold Project is a Porphyry Gold system as well, with a similar geo signature as Donlin Gold.

Dr Tim Baker

"Shotgun Gold is a multiphase intrusion-related system associated with 69.7 Ma magmatism, tying Shotgun Gold to a widespread magmatic Gold mineralising event including the 70 Ma Donlin Gold project. Mineralisation and magmatism at Shotgun Gold resemble Donlin Gold and other deposits in the area where regional structures focus the first order emplacement of magmas, and local structures control mineralisation at the deposit scale."

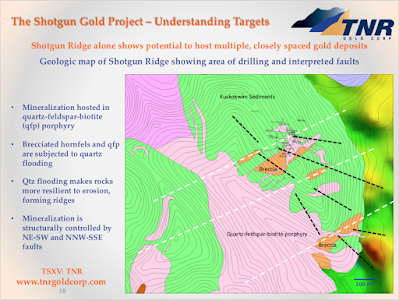

Shotgun Gold has seen very limited drilling of the total 7,000m. "Mineral resource is located from surface to a depth of 150m. The resource is located on a ridge forming a topographic high. Mineralisation appears to be uniform with little-to-no "nugget effect".

All Shotgun Gold inferred resource of 705,960 oz Au was defined at the Shotgun Ridge. "Mineralisation appears to be open at depth and along strike. Mineralisation from some drill holes was not included in the resource model. It can add additional resources with future drilling."

The next slide demonstrates very well the concept of an "Elephant and its trunk" which may be leading to "a hiding in the ground Elephant" when you study "Depth-fluids Models For IRGS" presented by Dr Tim Baker and TNR's Shotgun Gold exploration studies combining drilling results and 3D chargebility model.

All Shotgun Gold resource was defined just in one target at Shotgun Ridge. "Shotgun Ridge has untested structural intersections that may host significant Gold deposits. If the IP method is showing mineralization as interpreted, then the potential exists to expand the near-surface mineral resource in close proximity to the existing resource."

"Geology supports the target model. Only one of 5 targets is tested to date. 705,960 oz Au defined in one target with less than 5,000m drilling. Deposit is open at depth and along strike."

"Shotgun Ridge alone shows potential to host multiple, closely spaced gold deposits."

"Today we have Peak Gold Supply in the spotlight again. Majors have to buy new Gold projects in order to replenish their resources in the pipeline for development. Kinross Gold is acquiring 70% of the Peak Gold project and putting all our Shotgun Gold development Story into the new light of potential developments now:

"CALGARY - Kinross Gold Corp. is moving to secure additional supply for its Alaska gold operations by buying a controlling interest in the Peak Gold project from Royal Gold, Inc., and Contango Ore, Inc., for $125 million.

Toronto-based Kinross has agreed to pay Royal Gold about $66 million for its entire 40 per cent stake and $59.6 million for half of Contango's 60 per cent share, leaving Contango with a minority 30 per cent holding.

The miner says it plans to process ore from the open-pit Peak Gold mine at its existing Fort Knox mine, 400 kilometres to the northwest, to reduce costs and extend the life of the existing mill and infrastructure." BNN Bloomberg.

Shotgun Gold Project is located 190 km south from Donlin Gold, where our shareholder NovaGold is developing this giant project together with Barrick Gold."

Higher Gold prices and rising demand are pushing all industry insiders to adjust their strategy, the whole mining districts can be built around the central for particular mining camps facilities like Kinross is doing now. M&A and consolidation of the resources in the satellite deposits around such existing and developing mining infrastructure centres have already started. Developing Donlin Gold Mining Camp provides a unique opportunity for TNR's Shotgun Gold Project to grow with further exploration and potentially become a part of the one of the largest Gold Mining Camps on the U.S. soil. Now it is time for you to make your own research and make your own conclusions, stay safe.

Please always read legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blog. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.