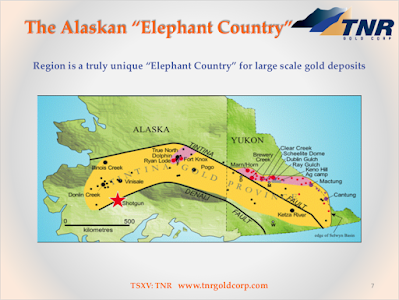

NovaGold CEO Gregory Lang provides us with an update from "The Alaskan Elephant Country" on the recent developments at Donlin Gold. Today you can read in-depth about the largest drilling program to date at this giant Gold project on the US soil and the update on the ongoing permitting progress. TNR Gold shareholder NovaGold and Barrick Gold are moving Donlin Gold Mining Camp development forward and you can find below for your own research more information about our Shotgun Gold Project and the strategy for its development.

CEO Mark Bristow has confirmed that Donlin Gold is the key asset for Barrick Gold and that they like what they see in the largest drilling program to date on the property. The decision about $22 billion new railway connecting Alaska and Alberta will bring new infrastructure development to Alaska adding another piece of the puzzle to the making of the Major Gold Mining Camps on the US soil.

Now you can make your own research on TNR Gold and our Shotgun Gold Project and find out why I am acquiring shares in our Company at every opportunity I have and why NovaGold is holding a stake in TNR Gold. Links on the article will allow you to go as deep as you like for your own research. Buckle up and stay safe during your journey! Join and follow TNR Gold.

"And, given the attractiveness of the third string to TNR’s bow – the Shotgun Gold project in Alaska, the company is still very definitely an exploration company.Indeed, according to Kirill Klip, the company’s chief executive, the main focus of effort over the coming months is likely to be on moving Shotgun forward to the point where a major company moves in and begins to help with development work there.So, is this the same model that proved so successful with Los Azules and Mariana?Not quite. This time round, with two potentially cash generative royalties in its back pocket, TNR is in a slightly stronger position. Klip’s aspiration this time round is for TNR to retain a much larger stake. The near-term goals are simple enough.“We need to bring US$10mln in to drill the project very strongly,” says Klip.

“The first US$5mln to take the project from the current 700,000 ounce resource up to the two million ounce mark, the rest to drill out five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”At Shotgun the thinking is that there may be upwards of five million ounces of gold in the ground, and there is precedent. At this stage the geology shows remarkable similarity to the 39mln ounce Donlin gold project in southern Alaska, which is owned jointly by Novagold Resources Inc (TSE:NG) and Barrick Gold (NYSE:GOLD).“We are talking about a high tonnage bulk system,” says Klip. “There are no nuggets, it’s very uniform.”

Among the notable intercepts the company has 242 metres grading 1.25 grams gold per tonne, 209 metres at 1.02 grams, and just under 47 metres at 1.14 grams.What’s more, the gold that’s been identified thus far sits at the top of a ridge, meaning that the stripping ratio for any mine will be low, which in turn will keep costs down.

The upside is clear. Indeed, Novagold sees it well enough, since it retains a significant stake in TNR, and former Novagold director Greg Johnson now sits on the TNR board. How long it will take the rest of the market to wake up remains to be seen.Nonetheless Klip is confident that this is a company that’s going places.“We are not dreamers,” he says. “We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”

Gold In The USA, Alaskan Elephant Country: TNR Shotgun Gold Project In The Donlin Gold Mining Camp.

Thomas Kaplan was on his crusade with all guns blazing after short-sellers punished NovaGold into selling from the high of $4 Billion market cap valuation in April. The best way to address all doubts about your project is to find more Gold. NovaGold is doing exactly what is prescribed and in cooperation with Mr Market who was pushing Gold to a new all-time high of $2,078 in August NovaGold is back to $12 dollars mark again.

Discussions about the potential giant M&A for the Gold in the USA are back. Now you can find out by yourself in details from the Q3 Results Earnings Call transcriptand NovaGold presentations, why I do believe that TNR Gold will greatly benefit with our Shotgun Gold from the Donlin Gold Mining Camp development on the US soil. Do your own research as usual and you have all the links for your information below.

2020-10-01 NOVAGOLD Q3 2020 Results and Project Update from NOVAGOLD

TNR Shotgun Gold Project In The Alaskan Elephant Country: Kinross Gold Starts M&A In Alaska To Secure Additional Supply.

Alaska Business:

"NOVAGOLD Reports ‘A Banner Quarter for Donlin Gold"

BY GREGORY A. LANG, NOVAGOLD PRESIDENT & CEO

The third quarter of 2020 may one day be seen as a game-changer in terms of the global recognition of the Donlin Gold project.

"From receipt of encouraging early drill results to Donlin Gold’s rising profile within Barrick’s project pipeline, we are extremely pleased with this series of developments. The recent progress comes at a time when appreciation of Donlin Gold’s attributes can only be heightened by Berkshire Hathaway’s investment into Barrick itself—and the increased scrutiny of Barrick’s portfolio that will ensue as more and more generalists follow its lead—constitutes an additional stroke of good fortune for NOVAGOLD."

No comments:

Post a Comment