Guest post:

Gold in the USA, the Alaskan Elephant Country: the Pitch for Elevation to Climb a Huge Wall of Worry, Ignition Stage - TNR Shotgun Gold

The TNR Gold Team commenced 2026 on a highly positive trajectory, having achieved a spectacular 240% increase in the Company's share price throughout 2025. This strong performance culminated in an intraday high of $0.19 on January 26, 2026.

TNR Gold's CEO recently shared an update outlining his personal vision for the Company and clearly defined strategic goals. Our TNR Gold Team is fully committed to pursuing and realising these objectives, with a continued focus on delivering value to shareholders through disciplined execution and strategic initiatives in the green energy metals and royalty space.

On January 30, 2026, gold entered the much needed helathy consolidation stage, which we have been talking about and underwent a significant correction, often characterised in mass media coverage as a "brutal" pullback amid profit-taking, a firmer U.S. dollar, and shifting expectations around monetary policy. Spot prices fell sharply, representing a decline of around 9% from the prior session's levels."

"As a reminder of the Big Picture View, all our readers should take into account that the broader context remained constructive: gold recorded a new all-time high monthly close for January at $4,893, underscoring the strength of the underlying trend even after the sharp retracement. This performance highlights gold's role as "The Ultimate Hedge" - a resilient asset amid evolving macroeconomic dynamics, with the metal maintaining substantial year-to-date gains and positioning for potential further advances as market participants monitor inflation, policy developments, and global risks."

"Gold has demonstrated incredible performance in the 21st century, providing "The Ultimate Hedge" for all portfolios constructed with stocks, bonds and crypto assets. Asian societies understand the unique qualities of gold very well."

"New fortunes will be created in the gold mining junior space. Nobody knows the future, but history teaches us about manias. "Irrational Exuberance" spills over from AI & crypto into real assets and solid values that some junior miners can represent now."

"Gold's next move is to climb to the next elevated level on its way to $10,000 after the healthy consolidation stage to digest the incredible gains gold has made this year already and its surge over $5,000."

This coming wave of M&A among gold producers and the success of investments by Rob McEwen, Erik Sprott, and other prominent gold entrepreneurs in promising new projects will drive the next stage of remarkable gains for intelligent investors.

With the rising gold price and a new era for the development of natural resources on US soil, particularly in Alaska, the Shotgun Gold Project is coming very close to its launch on the new orbit of valuation and development.

Smart money is accumulating the best Gold Stories to climb over a huge wall of worry following another major leg up for this Gold Bull Market, propelled by the debasement of all currencies.

Imagine tapping into Alaska's gold-rich Tintina Gold Belt, where TNR Gold's Shotgun Project shines with an inferred resource of 706,000 ounces at 1.1 grams per tonne. Located just 190 km south of the world-class Donlin Gold Project. Shotgun Gold offers a prime opportunity for a major mining partnership. With its advanced exploration stage, multiple high-potential targets, and geological similarities to nearby giants, this project is poised for growth.

Kirill Klip, Executive Chairman

TNR Gold Corp.

Shotgun Gold is a Project located in South West Alaska, USA, in the same regional area as Novagold’s Donlin Gold Project.

Lang’s & Baker’s 2001 academic study specifically identifies both projects as "major porphyry granite-related gold deposits" that are related to a widespread magmatic gold mineralising event. Riveting stuff. What it implies in layman’s terms is that both projects arose from the same geological kitchen sink, leading one to the supposition that they should both possess similar favourable geological properties.

To that effect, Shotgun’s general mineralisation style resembles the neighbouring Donlin Gold project. For instance, Shotgun’s particular intrusion is associated with 69.7Ma magmatism, while Donlin Gold holds 70ma magmatism.

Shotgun’s particular boon is in the details. Shotgun’s mineralisation has been identified to possess little-to-no "nugget effect". A high ‘nugget effect’ means high variability between samples that are closely spaced. "No nugget effect" implies tight-fisted uniform mineralisation of a bulk tonnage gold system. There’s no need to dig up empty rock space, so the stripping ratio for any potential mine will be low, keeping costs way down.

What’s more, when a system’s topographical layout lines up neatly at the top of a ridge-like Shotgun's, it means the extraction of resource systems in similar conditions is very efficient - there is no need to remove layers of empty waste rock by tentatively stripping the ridge. Instead, one decisively takes the top of the hill in its entirety. Shotgun’s targeted bulk tonnage gold system runs from the very surface down to *at least* a depth of 150m (Open). "Open" means exploration to date has not identified the end of the mineralization from the drilling performed so far.

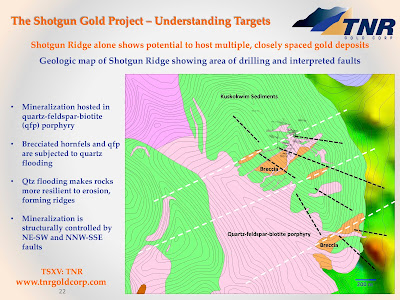

For the Shotgun Gold Project, Shotgun Ridge is just one of the multiple gold target areas controlled by TNR Gold. "Shot", "King" and "Winchester" add to the collection to form a distinct district with five (5) separate gold exploration targets identified so far.

The Company is actively introducing Shotgun Gold to potential partners to decisively drill the entirety of these prospects. The objective of such a partnership would be to expand the known area of mineralisation, define new mineralised areas and conclusively assess the Project’s potential top-end valuation.

“We need to bring US$10mln in to drill the project very strongly,” says TNR Gold Executive Chairman Kirill Klip. “The first US$5mln to take the project from the current 700,000-ounce resource up to the two million ounce mark, the rest to drill out five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”

The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path to moving this project forward using current geological and geophysical research to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognises the growth potential and value to be added to the Shotgun project over time.

I believe that in order to maximise shareholder value and reach the potential valuations presented above, we must preserve capital, reduce the number of outstanding shares and not invest in Alaska with our own capital.

Our strategy, which we presented to potential strategic partners, involves creating a JV with one of the major gold mining companies. Our partner will invest substantial capital in developing the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders will benefit from the strategic partner’s capital being invested “in the ground” and industry expertise, including operations in Alaska.

Management is investigating the best value-creation strategies for the Shotgun Gold Project. It has established the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project JV operations after the contemplated potential spinout from TNR Gold.

Please read my legal disclaimer. There is NO investment advice on any of Kirill Klip's feeds and blogs. Always consult a qualified financial adviser before making any investment decisions.

Do Your Own Research.

No comments:

Post a Comment