NEWS RELEASE

TNR Gold Announces Results of Annual General and Special Meeting

Vancouver, British Columbia – June 24, 2025: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that all resolutions proposed at the Company’s annual general and special meeting of shareholders (“AGM”) held on June 24, 2025 were passed. The agenda items outlined in the information circular for the AGM were approved and all directors standing for election were re-elected. The directors elected for the ensuing year were Kirill Klip, John Davies, Tobias Higgins, and Konstantin Klip. Manning Elliott LLP was re-appointed as auditor of the Company and renewal of the Stock Option Plan was also approved by the shareholders.

“I would like to thank all our shareholders for your overwhelming support, and the vote of confidence in the TNR Gold Team and our strategy for maximizing shareholders value,” stated Kirill Klip, Executive Chairman of TNR Gold. “Our Company has repaid our investment loan in full, and we do not have any debt. We believe that the recent market prices of our shares do not fully reflect the underlying value of TNR’s assets. Our transformation from a project-generator junior mining company into a cashflow-generating royalty company may bring the necessary catalyst for improved market valuation of our assets.”

“We are working on building the green energy metals royalty and gold company,” continued Mr. Klip. “Our business model provides a unique entry point for the creation of supply chains for critical materials, such as energy metals, which are powering the Tesla Energy rEVolution, and the gold industry that is providing a hedge during this part of the economic cycle. Our shareholders are participating in the building of a “GEM Royalty and Gold Company”. In our portfolio, we have a unique combination of assets providing exposure to different parts of the mining cycle, starting with the power of blue-sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium, Lundin Mining and BHP as operators on the projects that could potentially generate royalty cashflows to contribute value for our shareholders.”

TNR Gold’s motto remains: “Solid Values in Uncertain Times”.

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.

Over the past twenty-nine years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina, among many others, have been recognized.

TNR holds a 1.5% NSR royalty on the Mariana Lithium Project in Argentina, of which 0.15% of such NSR royalty is held on behalf of a shareholder of the Company. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR royalty interest. The Company would receive CAN$900,000, and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report. Ganfeng officially inaugurated Mariana Lithium’s start of production at a 20,000 tons-per-annum lithium chloride plant on February 12, 2025.

TNR Gold also holds a 0.4% NSR royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder of the Company. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% NPR on the Batidero I and II properties of the Josemaria Project that is being developed by the joint-venture between Lundin Mining and BHP.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives and future potential transactions being considered by the Special Committee and the Board, and the benefit that TNR’s shareholders may derive from same; TNR’s future receipt of cash flows from its royalty holdings and the subsequent contribution of significant value to its shareholders; the possible growth of TNR’s value; future revenue and increased valuations of TNR’s royalty holdings caused by potential strategic alliances with major mining companies and investment institutions; the use of potential future cash flows to fund a normal course issuer bid; the potential spin-out of the Shotgun Gold Project; future investment of substantial capital in the development of the Shotgun Gold Project by a potential partner of TNR; the future potential of the the Kuskokwim Gold Belt in southwestern Alaska; the possible benefits that may accrue to the Los Azules copper project if McEwen Copper’s application for admission to the Regime of Incentives for Investment is successful; the potential acceleration of the Los Azules project’s potential due to Rio Tinto’s involvement in the project; and the potential benefits caused by delivering ‘green copper’ to Argentina and the world. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR, and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."

Vote With the Management "FOR" at TNR Gold AGM to Continue Our Success Story: "TNR Gold Shares Jump as Strategic Review Sparks Investor Interest"

GEM Royalty TNR Gold Corp.

“TNR Gold Corp is your gateway to the green energy rEVolution and gold stability! We're building a leading green energy metals royalty and gold company, offering a unique entry into the supply chains powering the energy transition. With a 1.5% NSR royalty (of which 0.15% is held on behalf of a shareholder) on the Mariana Lithium Project in Argentina, operated by Ganfeng Lithium, and a 0.4% NSR (of which 0.04% is held on behalf of a shareholder) on the massive Los Azules Copper Project with McEwen Mining—backed by giants like Rio Tinto and Stellantis—we’re positioned for significant cash flows without the capital burden. Add to that our 90% stake in the Shotgun Gold Project in Alaska, near the Donlin Gold deposit, with 705,960 ounces of inferred gold resources, and we’re a diversified powerhouse. TNR delivers exposure to lithium, copper, silver and gold, blending blue-sky discovery with partnerships that drive value—perfect for investors seeking growth and a hedge in today’s economic cycle!”

Kirill Klip, Executive Chairman,

TNR Gold Corp.

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman, TNR Gold Corp.

Shares of TNR Gold Corp (TSX-V:TNR, OTC:TRRXF) are set to end the week on a high after the royalty company's stock spiked on Thursday, climbing as much as 33% to an intraday high of $0.08 and continued to add another 13% on Friday.

Trading volume spiked to 3.7 million shares—well above average—as investors responded to growing market interest in the company's strategic review and prized royalty assets.

The renewed investor enthusiasm follows TNR’s May 14 announcement that it is advancing a strategic review aimed at exploring merger and acquisition opportunities. The Vancouver-based company is fielding interest from potential partners and acquirers for its green energy metals and gold royalty portfolio.

“Our company has repaid our investment loan in full, and we believe that the recent market prices of our shares do not properly reflect the underlying value of TNR’s assets,” said executive chairman Kirill Klip. “Our transformation from a project-generation junior mining company into a cashflow-generating royalty company may bring the necessary catalyst for improved market valuation of our assets.”

TNR holds a 1.5% net smelter return (NSR) royalty on the Mariana Lithium Project in Argentina, operated by Ganfeng Lithium, and a 0.4% NSR royalty on McEwen Mining’s Los Azules copper project—backed by major partners including Rio Tinto and Stellantis. It also owns a 90% stake in the Shotgun Gold Project in Alaska, located near the multi-million-ounce Donlin Gold deposit.

With the Mariana project beginning production earlier this year, TNR expects its first royalty payments in 2025, providing potential cash flow with no further capital commitment. The company is also evaluating a spinout of the Shotgun project into a separate vehicle, AmeriGold, to attract a joint venture partner for further development.

“We’re building a leading green energy metals royalty and gold company, offering a unique entry into the supply chains powering the energy transition,” Klip added.

The company said it is also considering a share buyback program as part of its capital strategy, citing strong fundamentals and a diversified portfolio of royalties across lithium, copper, silver, and gold projects.

Thursday’s rally suggests that investors are beginning to take note."

TNR Gold Sees M&A Interest As It Develops Royalty Portfolio and Delivers Above Market Returns

"Hi, I'm Kirill Klip, Chairman and CEO of TNR Gold Corp. We're at the forefront of the green energy metals sector, with royalty interests in world-class projects like the Mariana Lithium Project and the Los Azules Copper Project in Argentina. The demand for lithium, copper, and other critical metals is surging as the world accelerates its shift towards sustainable energy. At TNR Gold, we're strategically positioned to benefit from this trend, offering investors exposure to the future of energy while maintaining a strong foothold in the gold market. With recent advancements in our key projects, such as Ganfeng Lithium's starting production at Mariana Lithium and McEwen Mining securing environmental permits for Los Azules, we're poised to generate significant value through our royalty interests. My extensive experience in mining and my commitment to sustainable practices drive our mission to contribute to a greener future."

Kirill Klip, Executive Chairman,

TNR Gold Corp.

Angela Harmantes from Proactive is writing about the new report on TNR Gold from Fundamental Research Corp:

"TNR Gold’s portfolio spans various mining assets, with a key focus on its Shotgun gold project in Alaska and royalties in two advanced-stage projects in Argentina: the Mariana lithium project, owned by Ganfeng Lithium, and the Los Azules copper-gold project, held by McEwen Copper."

"TNR Gold is on the brink of generating significant royalty revenue from its stake in Ganfeng Lithium's Mariana lithium project in Argentina as it heads toward commercial production, Fundamental Research analysts believe.The analysts have raised their share price target for TNR from $0.24 to $0.28 per share, highlighting the imminent cash flow potential from this strategic investment."

(Angela Harmantes)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

NEWS RELEASE

TNR Gold Corporate Update and Strategic Review of the Developing M&A Opportunities

Vancouver, British Columbia – May 14, 2025: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to provide a corporate update and announce that the Company is continuing its strategic review of developing M&A opportunities.

“TNR Gold Corp is your gateway to the green energy rEVolution and gold stability”, stated Kirill Klip, Executive Chairman of TNR Gold Corp. “We’re building a leading green energy metals royalty and gold company, offering a unique entry into the supply chains powering the energy transition. With a 1.5% net smelter returns (“NSR”) royalty on the Mariana Lithium Project in Argentina, operated by Ganfeng Lithium, and a 0.4% NSR royalty on the Los Azules Copper Project with McEwen Mining – backed by majors like Rio Tinto and Stellantis – TNR is potentially positioned for significant cash flows without the capital burden. Add to that our 90% stake in the Shotgun Gold Project in Alaska, near the Donlin Gold deposit, with 705,960 ounces of inferred gold resources, and the Company is also well diversified. TNR delivers exposure to lithium, copper, silver and gold, blending blue-sky discovery with partnerships that drive value, in turn offering potential growth with a hedge in today’s economic cycle.”

Strategic Priorities

Our priorities remain focused on maximizing value for all our shareholders by preventing unnecessary dilution, reducing general and administrative expenses and delivering above the market returns for our investors. Our strategic action plan includes, but is not limited to, the following initiatives:

Marketing Success and Industry Recognition

- Recent increased M&A interest from numerous parties suggests that TNR’s management (“Management”) has succeeded with its marketing activity by presenting the Company’s GEM Royalty Story to the mining and investment industries.

- In February 2023, Lithium Royalty Corp. valued only a portion of the Company at US$9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project for US $9 million.

- Our team has successfully repaid TNR Gold’s investment loan in full, returning our shareholders all our assets free from encumbrance. The value generated from delivering that strategic transaction has justified Management’s stance on rejecting other opportunistic low-ball offers.

Delivering Value in Uncertain Times

- Management has succeeded in delivering solid values in uncertain times. The Company’s share price has performed above the market average, not only during very challenging market times of the COVID-19 pandemic, but also during the market rout following the U.S. tariff announcements. This has justified the strategy of TNR’s board of directors (the “Board”) of presenting the Company as a structural hedge in an investment portfolio.

- Management has been investing in TNR Gold for over than two decades and continues to support our Company by participating in private placements, even during the darkest hours of COVID-19 pandemic. Management resumed its buying of shares of the Company and increased its stake in TNR Gold.

Strategic Growth and Stability

- TNR Gold’s assets are now well recognized within the mining and investment industries. The Company has received indications of further M&A interest from numerous parties and even successfully defended our Company from the opportunistic low-ball hostile takeover attempts.

- On October 12, 2023, TNR announced that the Board had formed a special committee comprised of independent directors (the “Special Committee”) to consider and evaluate strategies to maximize shareholder value, including pursuing one or more strategic transactions. Management continues to work diligently with the Special Committee in order to capitalize on potential transactions, including potential further royalty acquisitions. We believe the Company is a leader among its industry peers in maintaining integrity and consideration towards our retail shareholders, while prioritizing the discipline in order to unlock the full potential valuations of our assets. TNR’s Shareholder Rights Plan allows us to pursue the most appealing transactions for the benefit of all our shareholders while avoiding predatory tactics like crawling takeover attempts and low-ball opportunistic offers.

- Management is currently working on new avenues to open the new chapter of growth for the Company’s GEM royalty, including trying to facilitate potential strategic alliances with major mining companies and investment institutions. If successful, such alliances would allow us to unlock higher valuations of our royalty holdings and generate new capital without diluting the Company’s current shareholders.

- Management believes that in order to maximize shareholder value and reach the potential valuations reflecting the intrinsic value of the Company’s assets, TNR must preserve capital, reduce its number of outstanding shares, and seek outside investment for the development of the Shotgun Gold Project.

- Management believes that potential cash flow generated from TNR’s royalties and capital management strategy would be well used to implement a normal course issuer bid (subject to regulatory approval) in order to reduce the Company’s float of shares and deliver returns to its shareholders.

- Management is considering the best value-creation strategies for the Shotgun Gold Project and has put in place the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project joint venture operations after the contemplated potential spinout from TNR Gold.

- By maintaining this strategic approach, we aim to continue generating substantial value for our shareholders while ensuring long-term stability and growth.

“We are building the Green Energy Metals Royalty and Gold Company,” continued Kirill Klip, Executive Chairman of TNR Gold Corp. “Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla, the energy rEVolution, and the gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of the mining cycle, starting with the power of blue-sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium, Lundin Mining and BHP as operators on the projects that could potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold’s motto remains: “Solid Values in Uncertain Times”.

Shotgun Gold Project – Alaska

The Shotgun Gold Project is an advanced-stage exploration prospect in southwestern Alaska. The Company’s exploration field program in 2022-2023 at the Shotgun and Winchester prospects, located in the Taylor Mountain Quadrangle, Alaska, investigated the geochemical anomalies generated by the 1998 Novagold Resources soil surveys and the geophysical targets indicated by anomalies from the SJ Geophysics 2011 and 2012 EM surveys.

“The Company’s strategy with the Shotgun Gold Project is to attract a partnership with a major gold mining company. TNR Gold has successfully consolidated and updated its mining claims in Alaska and is actively introducing the project to interested parties,” commented Kirill Klip. “There is a clear path on how to move this prospective project forward using the geological and geophysical research currently available to target drilling to expand the resource. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun Gold Project over time. The latest exploration program allows us to provide additional information on TNR’s Shotgun Gold Project for our potential strategic partners.”

The strategy presented to potential strategic partners involves the creation of a joint venture with a major gold mining company, where TNR’s partner would invest substantial capital in the development of the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders would benefit from the strategic partner’s capital being invested “in the ground”, and industry expertise, including operations in Alaska.

Management is investigating the best value-creation strategies for the Shotgun Gold Project and has put in place the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project joint venture operations after a potential spinout from TNR Gold.

TNR holds a 90% interest in the Shotgun Gold Project that is located 190 kilometres south of the Donlin Gold Project deposits within the Kuskokwim Gold Belt in southwestern Alaska. This area is emerging as a multi-million-ounce gold district. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester. The Donlin Gold Project is an intrusion-associated system and represents one of the largest undeveloped gold deposits in the world. The Company believes that there are several key similarities between prospects on the Shotgun property and those of the Donlin Gold Project deposits, as well as other important intrusion-associated deposits worldwide.

The Company is targeting a large tonnage porphyry system at Shotgun Ridge. Structural repeats, as interpreted from airborne magnetic data and ground geophysical surveys, provide TNR with encouraging targets for future drill testing.

Detailed information about the inferred mineral resource estimate is included in the technical report titled, “Technical Report on the Shotgun Gold Project, Southwest Alaska”, dated May 27, 2013 that can be found on the TNR Gold website at www.tnrgoldcorp.com or on SEDAR+ at www.sedarplus.ca.

Mariana Lithium NSR Royalty Holding

On February 20, 2025, TNR Gold announced that Ganfeng Lithium Group Co., Ltd. (“Ganfeng”) provided an update on the Mariana Lithium Project. TNR holds a 1.5% NSR royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder of TNR.

On February 14, 2025, Ganfeng announced commencement of formal production of the Mariana Lithium salt-lake project in Argentina. Ganfeng stated in its announcement:

“A production ceremony for the first phase of the Mariana lithium salt-lake project in Argentina owned by Litio Minera Argentina S.A. (hereinafter referred to as “LMA”), a wholly-owned subsidiary of Ganfeng Lithium Group Co., Ltd. was held at the project site on 12 February 2025, which means the formal production of the first phase of the Mariana lithium salt-lake project.

Mariana lithium salt-lake project is located in Salta Province, Argentina, with total lithium resources of approximately 8,121,000 tons of LCE currently explored. After the formal production of the first phase of Mariana lithium salt-lake project with an annual production capacity of 20,000 tons of lithium chloride production line, the Company will actively accelerate the ramp-up of the production capacity of the project. With the gradual release of production capacity, the supply and cost structure of the lithium resources of the Company will be further optimized, the Company’s profitability will be enhanced, and the Company’s core competitiveness in the global market will be continuously improved.

The Company will perform the corresponding procedures and obligation of information disclosure according to the subsequent progress of the relevant matters. Investors are advised to invest rationally and pay attention to the investment risks.”

“We are very pleased that Ganfeng officially inaugurated the Mariana Lithium’s start of production at a 20,000 tons-per-annum lithium chloride plant on February 12, 2025”, commented Kirill Klip. “We are looking forward to our first NSR royalty cash flow payments from the Mariana Lithium Project.

TNR does not have to contribute any capital for the development of the Mariana Lithium Project, the Los Azules Copper Project or the Josemaria Project. The essence of our business model is to have industry leaders like Ganfeng as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

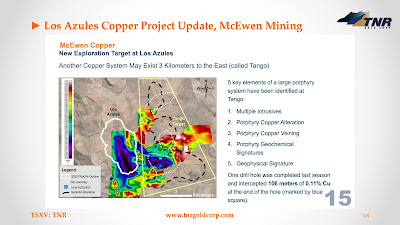

Los Azules Copper, Gold and Silver NSR Royalty Holding

On May 12, 2025, TNR Gold announced that McEwen Mining Inc. provided an update on the Los Azules Copper Project in San Juan, Argentina. TNR holds a 0.4% NSR royalty (of which 0.04% of the 0.4% royalty is held on behalf of a shareholder of TNR) on the Los Azules Copper Project. The Los Azules Copper Project is held by McEwen Copper Inc., a subsidiary of McEwen Mining.

An excerpt from a news release issued by McEwen Mining on May 8, 2025, is below. For additional details, please refer to the McEwen Mining website.

“McEwen Copper (46.4% owned)

McEwen Copper invested $21.3 million (100% basis) in Q1 to advance its feasibility study on Los Azules. Including amounts spent by Minera Andes Inc. prior to 2012, and McEwen Mining prior to 2021, we have invested over $400 million to develop Los Azules as a world-class copper development project.

Los Azules

Located in the province of San Juan, Argentina, the Los Azules project is one of the world’s largest undeveloped copper deposits.

Following the successful conclusion of the 2023-2024 drilling program, the Los Azules team finalized the resource model supporting our planned feasibility study. During 2025, Los Azules spent $21.3 million to support remaining activities required for our feasibility study.

Drilling Program

The 2024-2025 campaign commenced on November 5, 2024, and by March 31, 2025, we have completed 36,000 feet (11,000 meters) of drilling, covering geotechnical, exploration, hydrological, and condemnation work. As of March 31, 2025, the Los Azules drilling database totals approximately 685,600 feet (209,000 meters).

The objectives of the 2024-2025 campaign include conducting hydrogeological testing to assess and model the site’s water resources, carrying out condemnation drilling to evaluate areas designated for future permanent mine infrastructure, and completing geotechnical and geophysical studies.

Additionally, drilling has progressed at targets of interest near our deposit, such as the Tango Area, located east of the future Los Azules open pit. Regional exploration efforts are also ongoing, supported by recent helicopter-assisted magnetotelluric surveys, to identify other areas with mineralization potential across our 100% owned mining property.

Feasibility Study and Construction

With the Environmental Impact Assessment (EIA) approval in place since December 2024, Los Azules is advancing towards the release of a definitive feasibility study, expected in July 2025.

Regime of Incentives for Investment (RIGI)

The Regime of Incentives for Investment aims to attract domestic and foreign investment to a number of sectors in Argentina, including mining, enhancing resource exploration and production while creating job opportunities and increasing energy security. On February 11, 2025, McEwen Copper submitted an application for admission to the Los Azules copper project into the RIGI. If approved, the Los Azules project would become eligible for a range of fiscal and regulatory benefits, including a reduction in the corporate income tax rate from 35% to 25%, acceleration of sales tax recovery, reduced tax of dividends from 7% to 3.5%, elimination of export duties currently 4.5%, and relief from the requirement to repatriate export proceeds. Additionally, the project would benefit from a 30-year stability guarantee and access to international arbitration for dispute resolution.”

The McEwen Mining press release appears to be reviewed and verified by a Qualified Person (as that term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects) and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify McEwen Mining’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

Kirill Klip stated “we are pleased that McEwen Copper has reached this major milestone after it secured the environmental permit for the construction and operation of the Los Azules copper project. Our Company has repaid our investment loan in full, and we believe that the recent market prices of our shares do not properly reflect the underlying value of TNR’s assets. Our transformation from a project generation junior mining company into a cashflow-generating royalty company may bring the necessary catalyst for improved market valuation of our assets. The potential admission to Regime of Incentives for Investment (RIGI) could move the Los Azules copper project development closer to a construction decision.”

Significant developments on the advancement of the Los Azules project towards the feasibility stage have led to increased Rio Tinto and Stellantis holdings in McEwen Copper, strategic partners of this large copper, gold and silver project. In 2023, Stellantis invested an aggregate ARS $72 billion. An additional US $100 million in total was invested by Rio Tinto’s Venture Nuton in McEwen Copper. TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, whose aim is to decarbonize mobility, and mining industry leaders such as Rob McEwen, whose vision is ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of leading environmental performance. The involvement of Rio Tinto, with its innovative technology, may also accelerate realizing the potential of the Los Azules project.

The green energy rEVolution relies on the supply of critical metals like copper. Delivering ‘green copper’ to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

The new president of Argentina has introduced important government policies aimed at supporting business and unlocking the country’s economic potential. Mining in Argentina is being recognized by the government as an integral part of its economic development plan, providing jobs and enriching local communities.

The strong team performance of McEwen Copper is advancing the Los Azules Project towards a feasibility study. The Los Azules Project preliminary economic assessment (PEA) results highlight the potential to create a robust leach project while reducing the environmental footprint, and greater environmental and social stewardship sets the project apart from other potential mine developments.

It’s also encouraging to see an updated independent mineral resource estimate that has increased the resource significantly. Infill drilling during the 2023-24 season upgraded the resource categories, validated the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules feasibility study is now complete, and the study appears to be on track for delivery in 2025.

Los Azules was ranked in the top ten largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Batidero I and II NPR Royalty Holding

On April 28, 2022, TNR Gold announced that Lundin Mining Corporation (“Lundin Mining”) completed a plan of arrangement pursuant to which Lundin acquired all of the issued and outstanding shares of Josemaria Resources Inc. (“Josemaria Resources”) and Josemaria Resources became a subsidiary of Lundin. TNR holds a 7% net profit interest royalty (“NPR”) on the Batidero I and II properties of the Josemaria copper-gold project located in San Juan, Argentina that is owned by Josemaria Resources.

On January 15, 2025, Lunding Mining announced the completion of the joint acquisition of Filo Corp. with BHP Investments Canada Inc. (“BHP”). An excerpt from a news release issued by Lundin Mining is below. For additional details, please refer to the Lundin Mining website.

“Concurrently, Lundin Mining and BHP have formed a 50/50 joint arrangement, Vicuña Corp. (the “Joint Arrangement” or “Vicuña”), holding the Filo del Sol project (“FDS”) and the Josemaria project. On completion, BHP paid Lundin Mining a cash consideration of US$690 million for a 50% interest in the Josemaria project.

Vicuña will create a long-term strategic alliance between Lundin Mining and BHP to jointly develop an emerging copper district with the potential to support a globally ranked mining complex. The proximity of the FDS and Josemaria projects allows for greater economies of scale and increased optionality for staged expansions, as well as the incorporation of future exploration as the district matures.”

On May 4, 2025, Lunding Mining announced that Vicuña Corp. has completed an initial mineral resource estimate for the Filo del Sol sulphide deposit, an update to the mineral resource estimate for the Filo del Sol oxide deposit and an update to the mineral resource estimate for the Josemaria deposit (collectively referred to as the “Vicuña Mineral Resource”). An excerpt from a news release issued by Lundin Mining is below. For additional details, please refer to the Lundin Mining website.

“The Josemaria project, is an advanced stage copper project, located approximately 10 km from Filo del Sol in San Juan Province, Argentina. A feasibility study for the Josemaria project with an effective date of September 28, 2020 was completed in November 2020 (the “2020 Josemaria Feasibility Study”) and an Environmental Social Impact Assessment was approved by the Mining Authority of San Juan, Argentina in April 2022. The Josemaria project features favourable topography for the placement of infrastructure for the district, with expansion potential. The Vicuña Mineral Resource estimate and the corresponding Vicuña Technical Report (defined below) supersede the 2020 Josemaria Feasibility Study (including declassifying the Mineral Reserves previously declared therein).”

“A technical report in support of the Vicuña Mineral Resource estimate (the “Vicuña Technical Report”) will be filed within 45 days under Lundin Mining’s profile on SEDAR+ at www.sedarplus.ca. The Vicuña Mineral Resource estimate, effective April 15, 2025, and the corresponding Vicuña Technical Report supersede the 2020 Josemaria Feasibility Study (including declassifying the Mineral Reserves previously declared in the 2020 Josemaria Feasibility Study) and the Filo del Sol updated pre-feasibility study dated March 17, 2023 with an effective date of February 28, 2023.”

TNR’s 7% NPR on the Batidero I and II properties of the Josemaria Project held by Lundin Mining and BHP represents future growth potential for the Company’s royalty portfolio.

ABOUT TNR GOLD CORP.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.

Over the past twenty-nine years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina, among many others, have been recognized.

TNR holds a 1.5% NSR royalty on the Mariana Lithium Project in Argentina, of which 0.15% of such NSR royalty is held on behalf of a shareholder of the Company. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR royalty interest. The Company would receive CAN$900,000, and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report. Ganfeng officially inaugurated Mariana Lithium’s start of production at a 20,000 tons-per-annum lithium chloride plant on February 12, 2025.

TNR Gold also holds a 0.4% NSR royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder of the Company. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% NPR on the Batidero I and II properties of the Josemaria Project that is being developed by the joint-venture between Lundin Mining and BHP.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

www.tnrgoldcorp.com

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives and future potential transactions being considered by the Special Committee and the Board, and the benefit that TNR’s shareholders may derive from same; TNR’s future receipt of cash flows from its royalty holdings and the subsequent contribution of significant value to its shareholders; the possible growth of TNR’s value; future revenue and increased valuations of TNR’s royalty holdings caused by potential strategic alliances with major mining companies and investment institutions; the use of potential future cash flows to fund a normal course issuer bid; the potential spin-out of the Shotgun Gold Project; future investment of substantial capital in the development of the Shotgun Gold Project by a potential partner of TNR; the future potential of the the Kuskokwim Gold Belt in southwestern Alaska; the possible benefits that may accrue to the Los Azules copper project if McEwen Copper’s application for admission to the Regime of Incentives for Investment is successful; the potential acceleration of the Los Azules project’s potential due to Rio Tinto’s involvement in the project; and the potential benefits caused by delivering ‘green copper’ to Argentina and the world. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR, and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."