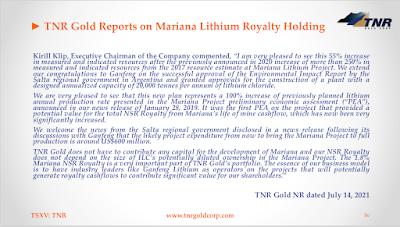

Kirill Klip, Executive Chairman of the Company commented, “We are pleased with the great news when it comes to Ganfeng Lithium and the Mariana Lithium Project. I am also very pleased to see that Ganfeng Lithium has consolidated 100% of the Mariana Lithium Project and advanced it to the construction stage. This news comes after a 55% increase in measured and indicated resources following the previously announced 2020 increase of more than 250% in measured and indicated resources from the 2017 resource estimate at Mariana Lithium Project. We extend our congratulations to Ganfeng and salute to people of Argentina on the celebration of ‘Pachamama’ – the ritual that thanks the earth for all that we receive from it. This ritual was performed at Mariana Lithium in September after successful approval of the Environmental Impact Report by the Salta regional government in Argentina and granted approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

We are very pleased to see that this new plan represents a 100% increase of previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased.

We welcome the news from the Salta regional government following its discussions with Ganfeng that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million.

TNR does not have to contribute any capital for the development of Mariana and our NSR Royalty does not depend on the size of ILC’s diluted ownership in the Mariana Lithium Project. The 1.8% Mariana NSR Royalty on the entire Mariana Lithium Project is a very important part of TNR Gold’s portfolio. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

TNR Gold:

TNR Gold Announces Advancement of Mariana Lithium Project to Construction by Ganfeng Lithium

"Vancouver, British Columbia – September 27, 2021: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that, further to the Company’s news release dated July 14, 2021, International Lithium Corp. (“ILC”) announced the purchase by Ganfeng Lithium of ILC’s remaining 8.58% stake in Litio Minera Argentina S.A., the owner of the Mariana Lithium Project in Salta Province, Argentina. TNR Gold holds a 1.8% net smelter returns (“NSR”) royalty on the Mariana Lithium Project.

The news release issued on September 21, 2021 by ILC stated:

“The board of International Lithium Corp. (the “Company” or “ILC”) is pleased to announce that it has agreed to the sale of its remaining 8.58% stake in Litio Miñera Argentina S.A. “LMA”, the company owning the Mariana lithium salar project in Argentina, and also to sell its other rights in the project, including the right to acquire a further 10% in the Mariana project. The legal entity acquiring is Ganfeng Lithium Netherlands Co., B.V., a subsidiary of the Company’s partner Ganfeng Lithium Co. Ltd.”

The news release issued by ILC on July 8, 2021 stated:

“The Company has now received a 300-page report (the “Report”) from strategic partner Ganfeng Lithium Co. Ltd., (“GFL”) that contains an updated mineral resource estimate for the Mariana lithium brine project (the “Project”) located in Salta, Argentina. This Report was not prepared for public NI43-101 reporting standards, and therefore the Company is unable to disclose it fully. However, in the interests of investor transparency and to avoid selective disclosure, we are disclosing the following details from the Report which have already been disclosed in a news release issued by Ganfeng Lithium on July 6, 2021, and/or in a news release by the Salta Government in Argentina on June 16, 2021.

Highlights from the Report which are already in the public domain are as follows:

- The resource estimate contained in the Report, detailed in the table below, includes:

- 6,854,000 tonnes of lithium carbonate (“Li2CO3“) equivalent (LCE) in the Measured and Indicated Resource categories, an increase of 55% over the 2019 estimate of 4,410,000 tonnes of Measured and Indicated Resource (Company news release, February 6, 2020)

- an additional 1,267,000 tonnes of Li2CO3 in the Inferred Resource category

- these amounts are also now stated as 7,863,000 tonnes of lithium chloride equivalent in the Measured and Indicated Resource categories, and an additional 1,454,000 tonnes of lithium chloride equivalent in the Inferred Resource category

- Ganfeng have reported that an Environmental Impact Report approval has been received from the Salta regional government in Argentina for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

- The Salta regional government has disclosed in a news release following its discussions with Ganfeng that the likely project expenditure from now to bring the Mariana Project to full production is around US$600 million.

Report – Mariana Lithium Brine Project, Argentina

Further to previous Company news releases dated March 8, 2017, April 20, 2017, and February 6, 2020, ILC has received the Report for the Mariana lithium brine project containing an update to the resource estimate for the Project. Golder Associates Consulting Ltd. (“Golder”) prepared the Report based on an independent lithium brine resource estimate by Geos Mining Minerals Consultants (“Geos”) based in Sydney, Australia.

| Resource Category | Aquifer Volume (Mm3) | Brine Volume* (GL) | Brine Density (g/mL) | Li (mg/L) | K (mg/L) | Li (kt) | LCE# (kt) | LiCl# (kt) |

| Measured | 17,653 | 2,648 | 1.217 | 315 | 9,598 | 833 | 4,436 | 5,089 |

| Indicated | 9,286 | 1,393 | 1.213 | 326 | 10,044 | 454 | 2,418 | 2,774 |

| Inferred | 4,747 | 712 | 1.211 | 334 | 10,121 | 238 | 1,267 | 1,454 |

| Measured + Indicated | 26,939 | 4,041 | 1.215 | 319 | 9,752 | 1,287 | 6,854 | 7,863 |

Kirill Klip, Executive Chairman of the Company commented, “We are pleased with the great news when it comes to Ganfeng Lithium and the Mariana Lithium Project. I am also very pleased to see that Ganfeng Lithium has consolidated 100% of the Mariana Lithium Project and advanced it to the construction stage. This news comes after a 55% increase in measured and indicated resources following the previously announced 2020 increase of more than 250% in measured and indicated resources from the 2017 resource estimate at Mariana Lithium Project. We extend our congratulations to Ganfeng and salute to people of Argentina on the celebration of ‘Pachamama’ – the ritual that thanks the earth for all that we receive from it. This ritual was performed at Mariana Lithium in September after successful approval of the Environmental Impact Report by the Salta regional government in Argentina and granted approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

We are very pleased to see that this new plan represents a 100% increase of previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased.

We welcome the news from the Salta regional government following its discussions with Ganfeng that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million.

TNR does not have to contribute any capital for the development of Mariana and our NSR Royalty does not depend on the size of ILC’s diluted ownership in the Mariana Lithium Project. The 1.8% Mariana NSR Royalty on the entire Mariana Lithium Project is a very important part of TNR Gold’s portfolio. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

The ILC press releases and website material appear to be prepared by Qualified Persons and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR has done sufficient work to analyze, interpret, classify or verify ILC’s information to determine the current mineral resource or other information referred to in its press releases. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Over the past twenty-five years, TNR, through its lead generator business model, has been successful in generating high-quality exploration projects around the globe. With the Company’s expertise, resources and industry network, it identified the potential of the Los Azules Copper Project in Argentina and now holds a 0.36% NSR Royalty on the entire project, which is being developed by McEwen Mining Inc.

In 2009, TNR founded International Lithium Corp. (“ILC”), a green energy metals company that was made public through the spin-out of TNR’s energy metals portfolio in 2011. ILC holds interests in lithium projects in Argentina, Ireland and Canada.

TNR retains a 1.8% NSR Royalty on the Mariana Lithium Project in Argentina. ILC has a right to repurchase 1.0% of the NSR Royalty on the Mariana Lithium Project, of which 0.9% relates to the Company’s NSR Royalty interest. The Company would receive $900,000 on the completion of the repurchase. The project is currently being advanced in a joint venture between ILC and Ganfeng Lithium International Co. Ltd.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources Inc.

The Company’s strategy with Shotgun Gold Project is to attract a joint venture partnership with one of the gold major mining companies. The Company is actively introducing the project to interested parties.

At its core, TNR provides significant exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and Argentina (the Los Azules Copper and the Mariana Lithium projects) and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the results of McEwen Mining’s and ILC’s PEAs, and improvements in the financial performance of the Company. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financing will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc. and International Lithium Corp. will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."