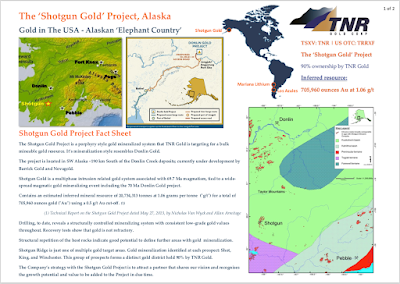

My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

Kirill Klip, Executive Chairman

TNR Gold Corp.

Today we extend our congratulations to TNR Gold shareholder NovaGold and their Donlin Gold JV partner Barrick Gold on the excellent results and new outstanding gold intercepts at Donlin. We have just discussed with you Barrick Gold's CEO Mark Bristow view about "the tremendous potential of Donlin Gold" and now we have another confirmation about this potential from the latest drilling campaign.

"Barrick President and Chief Executive Mark Bristow said, “The 2021 drill program is validating our geologic modeling concepts; in particular with regards to demonstrating the controls over mineralization in the different parts of the deposits. This improved understanding is a necessary step towards optimizing the mine design and progressing the project up the value chain.”

Greg Lang, NOVAGOLD’s President and CEO, said, “The 2021 drill program has been enormously rewarding -- allowing us to improve our knowledge of the geology and mineralization in the ACMA and Lewis deposits which in turn will provide the information required to proceed with a new feasibility study. Indeed, we have decided to expand the drill program by approximately 15 holes and 4,000 meters from the original 2021 plan to test the mineralization continuity in a targeted area of the ACMA deposit. As with last year’s program, drilling has delivered multiple examples of outstanding gold intercepts. Excellent results, such as those reported today, reinforce our belief in the uniqueness of an asset like Donlin Gold, whose combination of outstanding size, quality, and exploration upside are clearly among the only answers to an industry defined by an era of declining reserves, lackluster gold grades and ever-increasing jurisdictional risk.”

Dan Graham, General Manager of Donlin Gold added, “We are proud of the work accomplished by our site crew. We have operated a clean camp for the second season in a row amidst the COVID pandemic, exceeded our productivity rates, while maintaining an excellent safety and environmental record. During the 2021 drill program, 70% of our direct hires were shareholders from Calista Corporation (Calista), which included the new camp catering contract with a Calista subsidiary. Worker safety, environmental stewardship, and benefits to the region remain top priorities for Donlin Gold.” NovaGold NR September 2, 2021.

Resource World provides a great summary of the spectacular results, including 92.02m of 7.8 g/t. Now you can better understand my own thoughts about the potential for the Donlin Gold Mining Camp on US soil:

"On the back of this news, it is time for us to discuss our own relationship with developing Donlin Gold Mining Camp and my own personal vision of how the Donlin Gold project can potentially grow into a 50 million-plus oz Au resource project and become a major Gold Mining Camp in the world based on the U.S. soil."

It is important to note that QP of TNR Gold, as it is defined by NI 43-101, has not verified independently any results reported by NovaGold - you should study all results in their entirety including technical disclaimers on the NovaGold website and consult your qualified financial advisor before any investment decision. But what we can discuss here are the grades reported by Barrick Gold and NovaGold and the depth of those intersections:

"Hole DC21-1970 that intersected 92.02 metres grading 7.8 g/t gold, starting at 69.70 metres drilled depth.

Hole DC21-1963A intersected 40.97 metres grading 10.5 g/t gold, starting at 114.30 metres drilled depth.

Hole DC21-1969 intersected 47.78 metres grading 9.0 g/t gold, starting at 400.51 metres drilled depth

Hole DC21-1959 intersected 24.44 metres grading 14.6 g/t gold, starting at 378.85 metres drilled depth" (NovaGold NR September 2, 2021).

As you can see, these very impressive gold intersections at Donlin Gold are coming from much deeper depth than all inferred gold resources of 705,960 ounces of Au defined at Shotgun Gold so far - where the all defined mineral resource which was included in the resource estimation model is located from the surface of the ridge to a depth of only 150m.

Now you can better understand my personal excitement finding these additional confirmations to my belief that the Shotgun Ridge system has all geological indications pointing to the potential to grow further. It is important to mention here that TNR' Shotgun Gold Project is a Porphyry Gold system as well, with a similar geo signature as Donlin Gold.

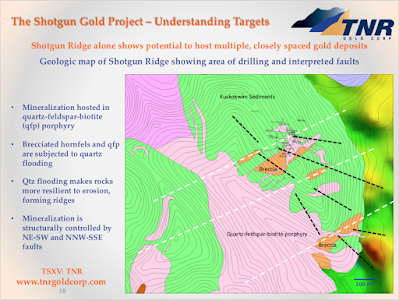

All Shotgun Gold inferred resource of 705,960 oz Au was defined at the Shotgun Ridge. "Mineralisation appears to be open at depth and along strike. Mineralisation from some drill holes was not included in the resource model. It can add additional resources with future drilling."

The next slide demonstrates very well the concept of an "Elephant and its trunk" which may be leading to "a hiding in the ground Elephant" when you study "Depth-fluids Models For IRGS" presented by Dr Tim Baker and TNR's Shotgun Gold exploration studies combining drilling results and 3D chargebility model.

All Shotgun Gold resource was defined just in one target at Shotgun Ridge. "Shotgun Ridge has untested structural intersections that may host significant Gold deposits. If the IP method is showing mineralization as interpreted, then the potential exists to expand the near-surface mineral resource in close proximity to the existing resource."

"Geology supports the target model. Only one of 5 targets is tested to date. 705,960 oz Au defined in one target with less than 5,000m drilling. Deposit is open at depth and along strike."

"Today we have Peak Gold Supply in the spotlight again. Majors have to buy new Gold projects in order to replenish their resources in the pipeline for development. Kinross Gold is acquiring 70% of the Peak Gold project and putting all our Shotgun Gold development Story into the new light of potential developments now:

"CALGARY - Kinross Gold Corp. is moving to secure additional supply for its Alaska gold operations by buying a controlling interest in the Peak Gold project from Royal Gold, Inc., and Contango Ore, Inc., for $125 million.

Toronto-based Kinross has agreed to pay Royal Gold about $66 million for its entire 40 per cent stake and $59.6 million for half of Contango's 60 per cent share, leaving Contango with a minority 30 per cent holding.

The miner says it plans to process ore from the open-pit Peak Gold mine at its existing Fort Knox mine, 400 kilometres to the northwest, to reduce costs and extend the life of the existing mill and infrastructure." BNN Bloomberg.

Shotgun Gold Project is located 190 km south from Donlin Gold, where our shareholder NovaGold is developing this giant project together with Barrick Gold."

Higher Gold prices and rising demand are pushing all industry insiders to adjust their strategy, the whole mining districts can be built around the central, for particular mining camps facilities, like Kinross is doing now. M&A and consolidation of the resources in the satellite deposits around such existing and developing mining infrastructure centres have already started.

Developing Donlin Gold Mining Camp provides a unique opportunity for TNR's Shotgun Gold Project to grow with further exploration and potentially become a part of one of the largest Gold Mining Camps on U.S. soil. Now it is time for you to make your own research and make your own conclusions, stay safe.

TNR Gold In The Alaskan Elephant Country: "Barrick Gold CEO Mark Bristow On Unlocking The Tremendous Potential Of Donlin Gold".

My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

Kirill Klip, Executive Chairman

TNR Gold Corp.

Gold In The USA, The Alaskan Elephant Country: TNR Gold Shotgun Gold Project Presentation.

My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.

Kirill Klip, Executive Chairman

TNR Gold Corp.

"Donlin Gold LLC, owned 50/50 by Barrick Gold Corp. [ABX-TSX; GOLD-NYSE] and NovaGold Resources Inc. [NG-TSX, NYSE American], released initial assay results for 18 completed drill holes, plus additional partial results for 11 holes from the 2021 drill program at the Donlin gold project located 450 northwest of Anchorage, Alaska.

Assay results have been received from approximately 7,500 metres of drilling. Significant new high-grade drill hole intercepts in ACMA and in areas between the ACMA and Lewis deposits (divide) point toward the potential feeder zones of this large system.

The drill program, expanded by approximately 15 holes and 4,000 metres from the original 2021 plan, should provide important information on mineralization continuity that will support feasibility work.

The primary objective of the 2021 drill program is to complete the work necessary to validate and increase the confidence in recent geologic modelling concepts. Initial results indicate variable controls on mineralization in different deposit areas, with more continuous mineralization hosted in ACMA intrusives and more discrete intervals occurring in the sediments and intrusives in Lewis.

The additional confirmation and extension drilling focus on further testing of orebody continuity and structural control as well as data collection for geotechnical and geometallurgical analysis. The drilling program was recently expanded to test an area of ACMA for mineralization continuity. The 2021 drill program is expected to encompass approximately 80 holes for a total of 24,000 metres drilled and should wrap up in the fall. The logging and assay results will then be incorporated into a geologic model update, followed by a shift in focus to feasibility study work, subject to a formal decision by the Donlin Gold board.

Top intervals received in the program to date include hole DC21-1970 that intersected 92.02 metres grading 7.8 g/t gold, starting at 69.70 metres drilled depth, including subintervals of 3.20 metres grading 29.2 g/t gold, starting at 70.70 metres drilled depth; 3.01 metres grading 14.0 g/t gold, starting at 81.90 metres drilled depth; 3.65 metres grading 12.5 g/t gold, starting at 104.85 metres drilled depth; and 5.18 metres grading 33.7 g/t gold, starting at 146.03 metres drilled depth.

Hole DC21-1963A intersected 40.97 metres grading 10.5 g/t gold, starting at 114.30 metres drilled depth, including a subinterval of 14.96 metres grading 22.2 g/t gold, starting at 117.24 metres drilled depth.

Hole DC21-1969 intersected 47.78 metres grading 9.0 g/t gold, starting at 400.51 metres drilled depth, including subintervals of 5.98 metres grading 18.1 g/t gold, starting at 401.43 metres drilled depth; 11.98 metres grading 13.9 g/t gold, starting at 414.41 metres drilled depth; and 5.66 metres grading 11.3 g/t gold, starting at 442.63 metres drilled depth.

Hole DC21-1959 intersected 24.44 metres grading 14.6 g/t gold, starting at 378.85 metres drilled depth, including a subinterval of 6.50 metres grading 33.5 g/t gold, starting at 386.79 metres drilled depth.

NovaGold Shares gained $0.25 to $9.13 in early trading on a volume of 1,445,000 shares traded. Barrick shares gained $0.55 to $25.438 on a volume of 3,713,200 in early trading."

No comments:

Post a Comment