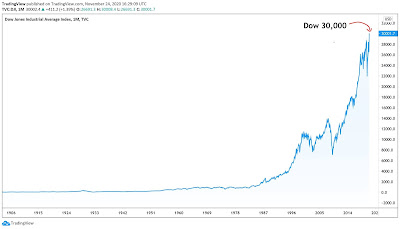

Charts are wonderful. Charts are very powerful. One picture can tell more than a thousand words. And it is very convenient to mascarade your own stupidity in silence. I have been declined this simple luxury here. All my super-smart, brave and equally stupid thoughts are put here on record. Even worse -

I am putting my own money where my mouth is. Today we will briefly address the major philosophical topic of human stupidity and investment paradox of the low prices.

We never really judge a seller when we can buy a flat-screen TV at a deep discount. In the investment realm, the same physical manifestation of a lower price can bring the investors unbearable pain of inability to make a clear decision whether it is an opportunity or a curse. And by all means, it can be both. Your ability to make this distinction and your discipline to follow your own decision will define your success.

Chart by @Schuldensuehner

Now I do not have to explain to you a lot about

the rEVolution and the future for electric cars. We have EVs bubble in the making already. When Gold was crossing $2,000, all Robinhood crowd was more than happy to chase it higher. But then

Joe Rogan talked about aliens and Gold during his mushroom trips, we had our new Gold all-time high at $2,078 in August and the same people were selling Gold in horror the last couple of days.

Chart by ZeroHedge

As usual, only you can make the right decision for you. Is it the value trap and this particular company will experience its "Kodak moment"? Or if all fundamentals are better, the investment thesis is the same, maybe ruthless Mr Market is just busy separating the brave Robinhood crowd and their money in other places? Maybe Mr Market provides his

Time Machine opportunity for us here again?

Chart by

@Schuldensuehner

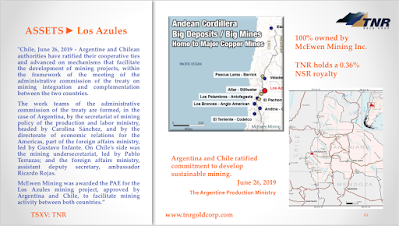

Last spring some people joined our Gold Geniuses Club. Now Mr Market’s Time Machine provides some tickets on Black Friday sale for our appropriately socially distanced Rock concert celebrating the opening of the Copper Genuises Club. AC/DC and Metallica are on the menu all the way up to "50 cents".

One very smart person put it brilliantly: “I have been waiting for this buying opportunity for a long time and now I am wondering whether this low will hold”. As always do your own research and stay safe. You know where to get the tickets, please do not hesitate to ask. I am buying the whole front row again and links below can help to explain to you why. Best and stay safe.

"TNR Gold receives a very good valuation benchmark for our Royalty Holding on the entire giant Los Azules Copper Project which is being developed by the legendary Rob McEwen. All our long-term followers remember that McEwen Mining was stating in their news releases that "Taca Taca serves as a good proxy for the value of Los Azules".

McEwen Mining Chairman, Chief Owner and CEO Rob McEwen said: "With First Quantum acquiring Lumina Copper and their Taca Taca project, Los Azules moves to the forefront in terms of world-class, undeveloped, high-grade copper assets not owned by a major mining company. As we have said in the past, Taca Taca serves as a good proxy for the value of Los Azules and we believe this transaction demonstrates value in projects located in Argentina."

Now deal by Nova Royalty provides all our devoted followers with more information to crunch the numbers and arrive at their own conclusions about the potential valuations for TNR Gold. Below you can find more information for your own research.

Nova Royalty pays for 0.24% of NSR Royalty on Taca Taca USD$12.75 million, TNR Gold holds 0.36% NSR Royalty on the entire giant Los Azules Copper project.

"Nova Royalty Corp. said on Thursday that it has struck royalty purchase agreements with private parties to acquire an existing 0.24% net smelter return (NSR) royalty on First Quantum Minerals Ltd’s Taca Taca copper-gold-molybdenum project, in Argentina for around US$12.75 million in a cash-and-stock deal."

Please always read legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blog. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

No comments:

Post a Comment