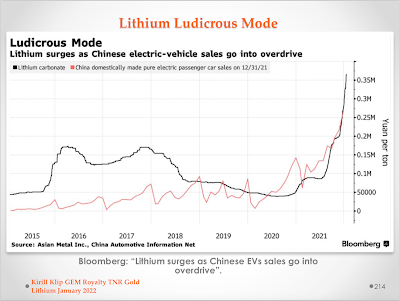

Lithium prices are hitting a new all-time high of over $59,000/T LCE in China and Ganfeng Lithium is moving Mariana Lithium Project fast forward with their US$600 million investment plan for the approved "Phase 1" with 20,000 T of the annual production capacity of Lithium Chloride.

"Environmental monitoring has been carried out satisfactorily at Mariana for more than 10 years and LMA will continue to work so that this process is participatory, involving not only the enforcement authority but also the community, thus demonstrating the commitment and transparency of our company in all its environmental protection activities. (Ganfeng Lithium)

"At the current lithium carbonate equivalent ("LCE") spot price of approx.US$55,000 per tonne, following completion, royalty revenue attributable to Trident..." (Trident Royalties)

"TNR retains a 2.0% NSR Royalty on the entire Mariana Lithium Project in Argentina with Ganfeng Lithium, (TNR holds a 0.2% NSR on behalf of a shareholder). Ganfeng’s subsidiary, Litio Minera Argentina, has a right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% relates to the Company’s NSR Royalty interest. The Company would receive $900,000 on the completion of the repurchase. The project is currently being advanced by Ganfeng Lithium International Co. Ltd.

Mariana Lithium Project** measured and indicated resource: 4,410,000 T of LCE and 49,700,000 T of potash with the additional inferred resource: 786,000 T of LCE and 9,260,000 T of potash.

(Updated Mariana Lithium Project measured and indicated resource: 6,854,000 T of LCE with the additional inferred resource: 1,267,000 T of LCE – Company news release, July 14, 2021)"

Ganfeng Lithium

Participatory Environmental Monitoring at Mariana Project

TNR Gold Mariana Lithium NSR Royalty Holding: "Ganfeng Is About To Start Work On Plants Planned For The Salar Del Llullaillaco And The Gemes Industrial Park. It Will Invest Close To US$600 Million".

TNR Gold Royalty Holding Update: ILC Reports Ganfeng Subsidiary Litio Minera Argentina Assumes All Rights And Obligations In Respect Of Mariana Lithium.

Kirill Klip, Executive Chairman of the Company commented, “We are pleased with the great news regarding Ganfeng Lithium, our NSR Royalty holding and advance of the Mariana Lithium Project to construction. I am also very pleased to see that this deal between ILC and Ganfeng Lithium included confirmation that Ganfeng’s subsidiary, Litio Minera Argentina, assumes all rights and obligations that ILC had in respect of the Mariana Lithium Project, including in respect to TNR Gold NSR Royalty Holding. Ganfeng Lithium has now consolidated 100% of the Mariana Lithium Project and advanced it to the construction stage.

This news comes after a 55% increase in the measured and indicated resource estimate from the previously announced 2020 increase of more than 250% in measured and indicated resources at the Mariana Lithium Project. We extend our congratulations to Ganfeng and salute the people of Argentina on the celebration of ‘Pachamama’ – the ritual that thanks the earth for all that we receive from it. This ritual was performed at Mariana Lithium in September after successful approval of the Environmental Impact Report by the Salta regional government in Argentina and approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

We are very pleased to see that this new plan represents a 100% increase of the previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased. We welcome the news from the Salta regional government, following its discussions with Ganfeng, that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million.

TNR does not have to contribute any capital for the development of the Mariana Project. The 2.0% Mariana NSR Royalty on the Mariana Project with Ganfeng Lithium is a very important part of TNR Gold’s portfolio, (TNR holds a 0.2% NSR on behalf of a shareholder). The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

No comments:

Post a Comment