Guest Post:

A New Year Special: Copper, Gold and Silver FOMO Electrified by Lithium Rush

Let's open up the interesting year that 2022 is due to be by passing congratulations to where congratulations are due.

Kirill has spent many a post writing about ‘the divine match made in Heaven’. As we scroll through and through, parsing signal from noise, could it be that this message was prophesied more than a century ago? Could we look back and realise that well, it really seemed quite obvious when viewed in the grand scheme of things?

But where do we find this match? Where do we find this wonderful wedding of state and resource? For the matter of this article, we’ll be looking at the world’s cradle of "white gold'; the ‘lithium triangle’, the peak of the world’s (exceptionally flat) plains of lithium.

And while a certain nation (rhymes with Chilli) is perhaps a little confused and takes my metaphor too literally; coming dangerously close to nationalising its resource under the state, our focus is on the nation that has managed to demonstrate the fine balance between helicopter nurture and healthy hands-off parenting.

Even though multiple projects and geographies share similar attributes (lithium brine in the case of South America), only when time passes do we see the great divide in risk.

With recent events, it's easy to choose when comparing Argentina to neighbouring Chile, where our sectors’ worst nighttime bogeyman of resource nationalisation is heralded by a far-left socialist & communist coalition prevailing in political elections.

Some time back I wrote about the importance of jurisdiction when picking your favoured projects. How to see through homogeneity? How to pick the best location for your money when all look similar?

Of the ~50 salars located within Antofallos-Pocitos volcanic rift valley, even fewer of them contain lithium brine with economically viable resources, and even fewer are in hands of those able to implement efficient production of battery-grade lithium.

Kirill has spent many hours writing how ‘Argentina has everything to become the Power House of the Tesla Energy rEVolution.’ And we have seen that money, sense and Mandarin are flooding into Argentina as step after step it positions itself on the politically strategic tightrope to supply the copper and lithium commodity deficit devoured by the green electric transportation.

Companies like Ganfeng Lithium and McEwen Mining are investing many millions of dollars to bring giant projects like Mariana Lithium and Los Azules Copper, Gold and Silver into the next stage of development. Now Argentina receives one more vote of confidence in its future. Rio Tinto joins the lithium race with the lithium giants like Ganfeng and buys Rincon Brine Project for US$825 million.

If TNR Gold can do one thing well, it's identify underappreciated assets and squat on them until pop hype and fanfare wake up the hatchling within. But there’s a certain poetry to this business model; TNR must be warmed in turn by those looking for underappreciated assets, so participating in this type of venture requires a certain kind of paternal patience, no matter the blizzard coming.

We see the same again in TNR’s choice of investments. Take Argentina many years back, for instance, where the nation was criticised for an unconducive investment climate that prevented a timely transformation of lithium resources into commercially viable reserves.

Now, however, Argentina provides the most promising case for expansion of the lithium industry as it seeks opportunities to expedite its economic recovery. It possesses the world’s second-largest identified lithium resources (behind only Bolivia), and the third-largest quantity of commercially viable lithium reserves behind only Chile and Australia.

'Argentina is the most promising case for the expansion of the lithium industry, as it is looking for opportunities to accelerate the recovery of its economy,' said Ryan C. Berg, a fellow at the Washington-based Center for Strategic and International Studies, in an August 2021 report.

"Argentina plans to triple its mining exports

According to official sources, mining could increase export revenue 3.4 times to US$10.76 billion.

RIO DE JANEIRO, BRAZIL - The Argentine government will launch a mining plan to triple export revenue to more than US$10 billion. The mining sector's contribution to GDP is barely 0.6%, while it reaches 10% in Peru, 11% in Brazil, and 12% in Chile.

The program is called the Strategic Plan for the Development of Argentine Mining (PEDMA) and will be launched after the November elections, as the election embargo period does not allow any government announcements."

Talk is abound as lithium, that 'white gold', has now become pop for the mainstream.

‘In February 2021, the Council of the Americas, a U.S. organization that seeks to promote democracy and free trade in the region, predicted that the global lithium market will increase fivefold in the next 35 years. This will have consequences in Argentina, Bolivia, and Chile — the so-called lithium triangle — where, according to the U.S. Geological Survey, 58 per cent of the world’s lithium reserves are located.’

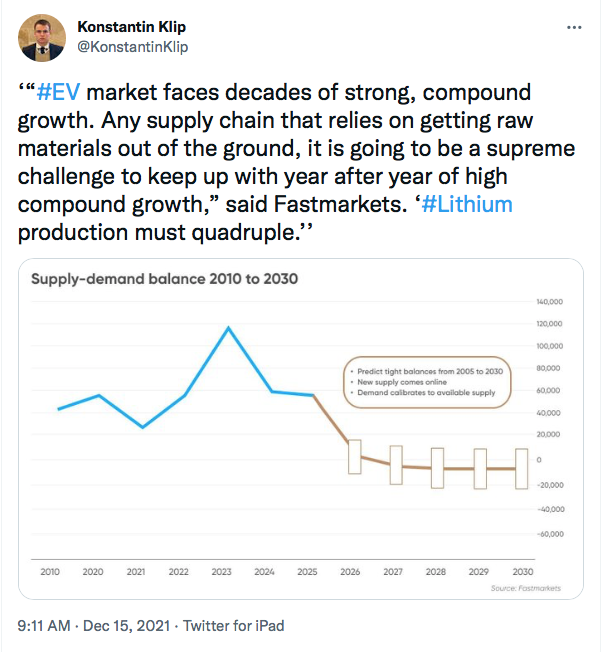

‘EV market faces decades of strong, compound growth. Any supply chain that relies on getting raw materials out of the ground, it is going to be a supreme challenge to keep up with year after year of high compound growth,' said Fastmarkets. ‘Lithium production must quadruple.'

There is a greater understanding of the lithium market from the ‘investment community’ regarding how to identify a good prospect. Opportunities for value investment; that very definition of underappreciation, are closing rapidly in the sector. Nowadays many a napkin is left unattended with lithium royalty evaluations.

I wrote that TNR Gold is close to enjoying a pincer move many years in planning as the company picks up not one but two cashflow generating royalties on the essential minerals electrifying the gears of change within the electric and renewable global market.

Now a third column marches into view for TNR Gold, as we highlight a little-known position of ours in Josemaria resources.

‘The Josemaria project is among the top-ten open-pit copper projects in the Americas in term of total mineral reserves, according to Rockandel. Once in production, it is expected to churn out over 130,000 tonnes of copper, nearly 225,000 oz. of gold and 1 million oz. of silver a year over a 19-year mine life, based on a November 2020 feasibility study. The project is expected to start commercial production in 2026.

The feasibility study estimated the project would generate a post-tax net present value of $1.53 billion and a post-tax internal rate of return of 15%.’

Josemaría is going to generate enormous opportunities; the managing minister assured this project will lead to another larger project, Filo del Sol. That would be spectacular, a new era of copper would open in Argentina.'

Our business model provides an exceptionally valued entry point into the creation of a critical material supply chain like copper and lithium energy metals which are powering the EV revolution and the gold and silver industry which is providing the ultimate hedge during this part of the economic cycle.

TNR Gold’s purpose is quite simple in intent; a solid value launchpad of green royalties for the gold in the USA rocketship in fueling 2022 is set to be an interesting year, one that is due to go by in pop celebration, national flag waving fanfare and certain marching bands.

“I am very pleased that the TNR Gold team finds the full support of our major shareholders as well as the Company’s investment loan capital provider who continues to approve our business plan and long-term strategic initiatives,” commented Kirill Klip, Executive Chairman of TNR. “It is clear that this decision of our investment loan capital provider is a resounding show of confidence in TNR Gold’s long-term business strategy, our management team and all recent positive developments in our portfolio of assets.

“We can now concentrate our efforts on building this green energy metals royalty and gold company by maximizing the value of our royalty portfolio of lithium, copper, gold and silver projects that are instrumental in the electric vehicle and green energy sectors. We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in Company’s share price. TNR Gold has industry interest in our assets and the Company is working on potential new strategic partnerships to provide benchmarks for the market valuations of our royalty holdings."

“Our Net Profits Royalty (”NPR”) holding on the Batidero I and II properties with Josemaria Resources represents future growth potential for our royalty portfolio. We are also investigating new potential acquisitions while our main focus remains on the development of the Shotgun Gold Project in Alaska. The essence of our business model is to have industry leaders like Ganfeng Lithium, McEwen Mining and Lundin Group as operators on the projects that will potentially generate royalty cash flows to contribute and develop a significant long-term value for our shareholders."

“I would like to thank all our shareholders for your support and on your behalf to thank our very talented team at TNR Gold who have achieved all these remarkable milestones for our Company.”

Lundin Mining (TSX: LUN) is acquiring Josemaria Resources (TSX: JOSE) for about C$625 million ($483.5m) for its namesake copper-gold project in San Juan, Argentina.

The Canadian miner is acquiring the company for C$1.60 a share in cash and stock, a 29% premium to Josemaria’s 10-day volume weighted average price on the TSX. Josemaria shareholders will be able to choose to receive payment in cash or 0.1487 Lundin shares for each existing share they own in the company.

“In our view this project is a unique and scarce opportunity,” Lundin Mining CEO Peter Rockandel said during a conference call with analysts and investors on December 20.

“Lundin Mining has been following Josemaria’s advancements into a world-class ore body for a considerable period of time.”

The acquisition would increase Lundin Mining’s copper and gold production by 50% and 140% respectively, compared to its 2022 production guidance of 258,000 to 282,000 tonnes of copper and 153,000 to 163,000 oz. of gold.

The Josemaria project is among the top-ten open-pit copper projects in the Americas, in terms of total mineral reserves, according to Rockandel. Once in production, it is expected to churn out over 130,000 tonnes of copper, nearly 225,000 oz. of gold and 1 million oz. of silver a year over a 19-year mine life, based on a November 2020 feasibility study. The project is expected to start commercial production in 2026.

The feasibility study estimated the project would generate a post-tax net present value of $1.53 billion and a post-tax internal rate of return of 15%.

The project has proven and probable mineral reserves of 1.01 billion tonnes grading 0.22 gram gold per tonne, 0.94 gram silver per tonne and 0.30% copper, for 7.02 million oz. of contained gold, 30.72 million oz. of contained silver and 6.71 billion lb. of copper.

Josemaria Resources submitted its Environmental and Social Impact Assessment (ESIA) earlier this year and expects it will be approved in 2022.

Adam Lundin, Josemaria’s CEO, said he expects the deal will deliver an “immediate uplift” to all of the company’s shareholders.

“We have been exploring different financing options for the advancement and development of the Josemaria project and we believe this is the best opportunity to develop the project without direct dilution or financing risk for Josemaria shareholders,” he said in a press release.

In response to a query about the risks of making such a big investment in Argentina, Rockandel said that it was the “perfect time” to invest in the country, before the landscape turned “competitive.”

“If you are trying to find a world class ore body, you have to step out in areas unexplored,” Rockandel said.” I think Argentina is a place that’s going to start to see a lot more mining investment as we move forward.”

On December 16, Argentina’s Chubut province approved a legislative bill that modified a 19-year-old law against open pit mining. The move was met with protests by environmentalists in the province’s capital.

(This article first appeared in The Northern Miner)"

No comments:

Post a Comment