"All this flood of money that is seeking the best investment returns during the Energy Transition and Electrification of our Energy and Transportation sectors will be creating a tsunami of shock waves across Lithium supply lines that are not ready and still being built to feed Tesla Energy rEVolution."

"All Lithium market was less than US$4 Billion in size just a year ago. Now Lithium price has tripled. Choose very wisely among the best lithium companies to participate in this generational investment trend."

Caixin Global:

Skyrocketing Lithium Prices Unlikely to Stabilize Soon, Says Ganfeng ChairmanTNR Gold Mariana Lithium Royalty Holding Partner: "China's Ganfeng Lithium Inks 3-year Supply Contract With Tesla."

We extend our congratulations today to our Mariana Lithium Royalty Holding Partner - Ganfeng Lithium. Reuters reports: "China's Ganfeng Lithium inks 3-year supply contract with Tesla".

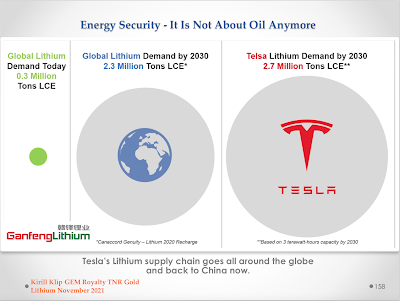

We have discussed in depth here that Tesla Lithium supply lines are going all around the globe and back to China. Today we have another confirmation for the Ganfeng Lithium's status as a major leader in the technology of the reliable and sustainable production of battery-grade Lithium.

Ganfeng is already supplying Lithium to Tesla, Volkswagen and BMW among many other battery producers and automakers. Reuters reports today that a new deal will be in place for Ganfeng and Tesla for another 3 years starting from 2022.

Now Ganfeng's "Phase 1" plan for 20,000 T of LCE annual production at Mariana Lithium can be seen via the new perspective. The whole Lithium industry will be put to a major test of its ability to ramp up the supply of battery-grade Lithium just in a few years.

"We are very pleased to see that this new plan represents a 100% increase of the previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased."

Hopefully, "Phase 2" will be following after "Phase 1" at Mariana Lithium and it will potentially increase TNR Gold NSR Royalty Holding valuation and the potential future cash flow even more.

TNR Gold Royalty Holding Update: ILC Reports Ganfeng Subsidiary Litio Minera Argentina Assumes All Rights And Obligations In Respect Of Mariana Lithium.

Kirill Klip, Executive Chairman of the Company commented, “We are pleased with the great news regarding Ganfeng Lithium, our NSR Royalty holding and advance of the Mariana Lithium Project to construction. I am also very pleased to see that this deal between ILC and Ganfeng Lithium included confirmation that Ganfeng’s subsidiary, Litio Minera Argentina, assumes all rights and obligations that ILC had in respect of the Mariana Lithium Project, including in respect to TNR Gold NSR Royalty Holding. Ganfeng Lithium has now consolidated 100% of the Mariana Lithium Project and advanced it to the construction stage.

This news comes after a 55% increase in the measured and indicated resource estimate from the previously announced 2020 increase of more than 250% in measured and indicated resources at the Mariana Lithium Project. We extend our congratulations to Ganfeng and salute the people of Argentina on the celebration of ‘Pachamama’ – the ritual that thanks the earth for all that we receive from it. This ritual was performed at Mariana Lithium in September after successful approval of the Environmental Impact Report by the Salta regional government in Argentina and approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride.

We are very pleased to see that this new plan represents a 100% increase of the previously planned lithium annual production rate presented in the Mariana Project preliminary economic assessment (“PEA”), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR Royalty from Mariana’s life of mine cashflow, which has now been very significantly increased. We welcome the news from the Salta regional government, following its discussions with Ganfeng, that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million.

TNR does not have to contribute any capital for the development of the Mariana Project. The 2.0% Mariana NSR Royalty on the Mariana Project with Ganfeng Lithium is a very important part of TNR Gold’s portfolio, (TNR holds a 0.2% NSR on behalf of a shareholder). The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

No comments:

Post a Comment