“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Kirill Klip, Executive Chairman TNR Gold Corp.

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"The report from Fundamental Research underscores the company's near-term royalty potential, particularly from Ganfeng Lithium's Mariana project, and reaffirms a Buy rating with an adjusted fair value estimate of C$0.24 per share." (Angela Harmantas)

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

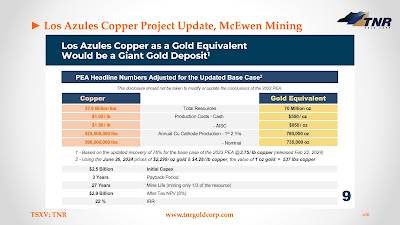

TNR Gold Los Azules NSR Royalty: McEwen Copper Is Planning The World's First Regenerative Green Copper Mine in Argentina

Today you can better understand the idea of Green Copper and why I believe that Argentina has everything to become the Power House of the Tesla Energy rEVolution. Rob McEwen presents his truly extraordinary vision for the world's first regenerative Green Copper mine at Los Azules in Argentina.

"Goldman Sachs is talking about Copper price reaching $6.8 per lb driven by the deficit in the market. "If Copper goes to $6 per lb it will put a few smiles on the faces of people around here", Rob explains. "There is a large gap between supply and demand is developing according to Goldman Sachs. And if China comes back on stream, they are the big buyer of Copper... so we could see that number. I will be very happy as Los Azules is projected to be producing copper at $1.7 per lb."

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)

"TNR Gold's 0.36% NSR Royalty could be valued at USD $30 million, based on Rob McEwen's estimations analysing the recent Osisko Gold Royalties deal with SolGold in Ecuador. In the Alastair Ford article, you can find more information about TNR Gold and benchmarks for our GEM Royalty portfolio."

"As I wrote before, if TNR Gold can do one thing well, it's to identify underappreciated assets and squat on them until pop hype and fanfare wake up the hatchling within. But there’s a certain poetry to this business model; TNR must be warmed in turn by those looking for underappreciated assets, so participating in this type of venture requires a certain kind of paternal patience, no matter the blizzard coming." (Konstantin Klip)

No comments:

Post a Comment