Central Banks and China go FOMO, Gold hits $2,050 - just 1% away from the all-time high of $2,70 made in 2020.

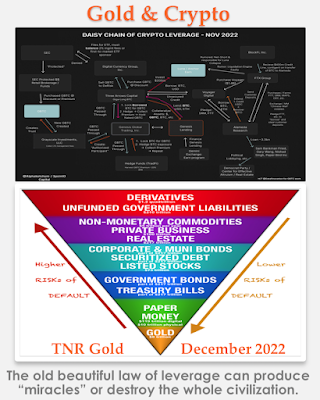

My $10,000 aspiration target for Gold will not look so naive, considering all the ongoing manipulation in order to keep it down, if you consider the amount of the derivatives held by the banks and the new proposed Stablecoins legislation.

"Kirill Klip, CEO TNR Gold Corp: Gold prices could reach $10,000 an ounce. Everyone is going away from crypto back to Gold. Central Banks have ought the largest amount of gold over the past 50 years."

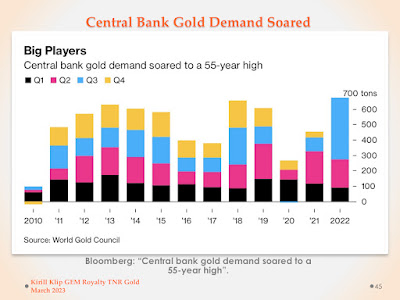

People are getting hypnotised by "Line Goes Up". Even Central Banks and China are going FOMO, but they do not chase Crypto Gragons, they are buying a record amount of Gold.

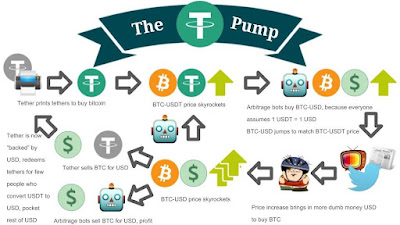

The fearless operators of Tether may let some people still think, that "institutions" are sending billions of dollars after the collapse of the FTX to buy bags of Tethers somewhere on the beaches of the tropical islands following numerous investigations, settlements and new investigations.

Maybe this new draft bill for Stablecoins can help "Freedom Fighters Against the FED" to realise that there is a non-zero chance that they have been scammed again.

What if a simple trick has allowed manipulating all Crypto markets to all-time highs? What if "institutions" are not sending all those "billions of dollars" to Tether with headquarters on that tropical beach to buy bags of Tethers?

What if Tether just simply first prints Tethers out of thin air and then buys Bitcoin and other Cryptos making "Line Goes Up"?

And only after that, they are selling Bitcoin and other Cryptos to create "reserves" supporting the outstanding float of Tethers.

The rising market cap of Tether kept this circus of magic internet money going for a while. The circus left but the clowns are still here. Where is your money?

Now you know who is buying Gold and who is buying Crypto. This recent pump in Crypto despite all investigations and announced CFTC charges against Binance, SEC Wells Notice issued to Coinbase and brave Tether PR on Twitter, could be your last opportunity to cash out dirty Tether chips into that "Ugly FIAT" and leave the Crypto Casino before Zero Day.

After all Central Banks and China are not taking any chances and buying Gold like there is no tomorrow.

"Now we know why Central Banks were buying all Gold they can like there is no tomorrow. Because there is no tomorrow as we know it. The dam holding The Global Derivatives Avalanche is showing cracks with every headline about Deutsche Bank."

"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

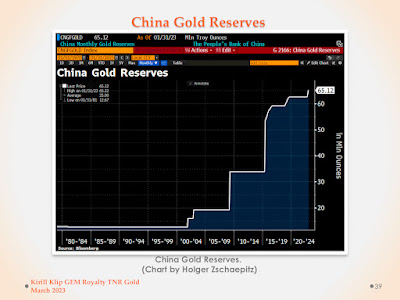

Central banks are buying a record amount of Gold and China is increasing dramatically its officially announced Gold reserves. According to Statista, worldwide Gold demand amounted to 4,740.8 metric tons in 2022, an increase of 18.1% from 4,012.8 metric tons in the previous year. Total Gold demand was just below $300 Billion in 2022.

In 2022, worldwide Gold production stood at 3,100 metric tons. Central Banks bought a record 1,136 metric tons of Gold and their demand soared to a 55-year high. The amount of above-ground reserves for Gold is estimated to be around 205,238 metric tons by the end of 2021, according to the World Gold Council. The total "Market Cap" of Gold can be estimated at roughly $13 Trillion.

Now we can compare it with the derivatives books of the major systemic banks in the USA. Just 3 of them are holding over $150 Trillion in derivatives, with Goldman Sachs standing at $53 Trillion, JP Morgan - at $50 Trillion and Citibank - at $47 Trillion respectively.

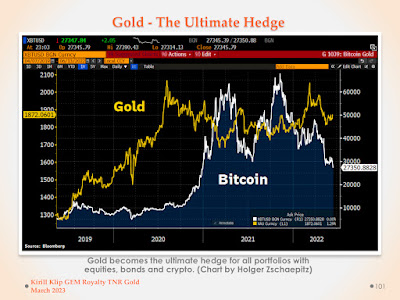

We have The Catalyst for Gold in place after the Crypto bloodbath massacre. As we discussed before, even when you are playing Crypto Video Games your losses will be real. Retail chasing Crypto Dragons in the MetaVerse had a rude awakening after Dragons have flown away with their money and "Crypto friendly" banks are collapsing one after another.

Gold becomes The Ultimate Hedge for all portfolios constructed with stocks, bonds and crypto assets. Solid values in uncertain times.

Gold miners are printing money again with expanding margins and they will have to start looking more aggressively for new major Gold projects. They must replenish their reserves in time just to keep their production levels during the higher Gold prices. We have The Peak Gold Supply in place which will be driving the new M&A cycle for the Gold industry.

"There is no Gold 2.0, there are over 5,000 years of humankind's history with Gold. Investors are tired of loosing money by chasing Crypto Dragons and Bitcoin Dreams in the Tether Metaverse."

The extreme volatility and the recent crash in the crypto markets have evaporated more than 2 trillion dollars of "crypto capital" and have wiped out millions of "investors", some of them with all their life savings.

"Crypto myths are being dismantled one by one: Bitcoin is NOT Gold 2.0, Bitcoin is not an inflation hedge and Bitcoin is not a new asset class that will take the place of bonds in the "deworsified" model portfolios. Bitcoin is triggering, following and igniting the burst of all bubbles starting with technology sectors."

Kirill Klip GEM Royalty TNR Gold Presentation from Kirill Klip

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

TNR Gold started the new exploration program last year and is actively introducing Shotgun Gold to potential partners to decisively drill the entirety of these prospects. The objective of such a partnership would be to expand the known area of mineralisation, define new mineralised areas and conclusively assess the Project’s potential top-end valuation.

No comments:

Post a Comment