Gasgoo, China Automotive News, reports another set of spectacular results from Ganfeng Lithium:

"Shanghai (Gasgoo) - Ganfeng Lithium Group Co., Ltd. (“Ganfeng Lithium”), one of the world's leading producers of battery-grade lithium, scored a 274.68% year-on-year hike in its annual revenue for the year of 2022, which reached around 41.823 billion yuan, according to the financial results the group released on Mar. 30.

During the year of 2022, the group saw its full-year net profit attributable to shareholders zoom up 292.16% from a year earlier to 20.504 billion yuan. After deduction of non-recurring profit and loss, the yearly net profit belonging to shareholders even rocketed 586.34% over the previous year to 19.952 billion yuan." (Gasgoo)

Ganfeng demonstrates its industrial might and staying power. Those who still remember the world before Crypto scams will recognise REE 2.0 price wars unleashed in the Lithium Universe this year. Last time when junior miners all get excited about REE and every company was moving from Gold and Silver to "Rare Earth Elements" Chinese producers applied "The Art of War" principles quite literally. They dropped REE prices dramatically and destroyed any dreams to build commercially feasible REE operations in the West. China still controls 63% of REE mining, 85% of REE processing and 92% of REE magnets production.

Last time Goldman Sachs "was worried" about your investments in the Lithium Universe and called the coming tsunami of the new Battery Grade Lithium Supply they were buying stakes in the Lithium companies at the same time while retail was selling in panic.

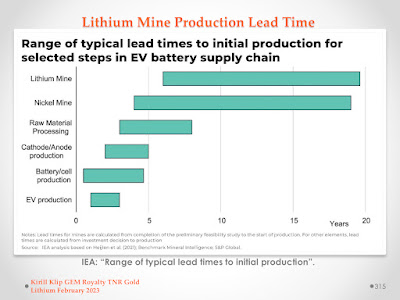

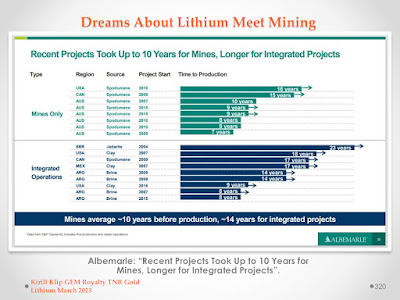

The problem with all estimations for the future supply in mining is the difficulty of the process to put new mining operations in place, particularly in a sustainable way. In the case of Lithium, we are dealing not only with mining operations but with literal "chemical soup", particularly in the case of Lithium Brine Operations. Every single project has a unique chemistry. Only a few companies in the world were able to put online successful Lithium operations.

This is where science meets Wall Street and Bay Street hype. Lithium projects are always delayed, they are never on budget and only a few companies managed to organise operations to reach the previously announced annual capacity production of Battery Grade Lithium.

Investors must remember that a lot of "Lithium companies" have only the word Lithium in their name, but not any real Lithium resources which can be produced economically in the next 10 years. The flood of money following the new Lithium all-time high of over USD$85,000 in China last year was chasing

Bay Street Lithium Dragons all over the junior mining space.

Now, these Dragons flew away with investors' money following

Crypto Dragons. A lot of investors will be burnt again, and retail will start chasing the new wild dreams to become rich overnight. Memories about "One Thousand and One" junior mining Lithium projects will stay as monuments for the happy times.

Dreams about Lithium meet mining realities. Only a few giant companies will be able to withstand Goldman Sachs and Ark Invest manipulations with their worries about Lithium oversupply. They will continue increasing their domination by acquiring the best Lithium projects.

They will decide in the end what and when put into production and who will be allowed to buy at a particular price Battery Grade Lithium. Smart money controls bottlenecks. Disruption of USD$12 Trillion in the Energy and Transportation industries depended on the USD$10 Billion Lithium Market. Price shocks were imminent and new ones will be coming next.

In my personal view,

demand for Battery Grade Lithium will exceed estimations as

The Switch will go into the supercharged EVs Mass Market phase. The new drivers will be electric commercial fleets and Energy Storage following the massive declines in the cost to produce Solar and Wind Energy. Energy Storage available for scaling up is the missing part of Decentralised Energy Generation.

New Lithium discoveries in India and Iran deserve a few observations as well. Wonderful news for Idia. Wonderful news for China. Now sceptics fuelled by the DIEselGate fumes have an answer - there is enough Lithium to make a transition to 100% Electric Cars. Others will start to learn what it takes to put this treasure into your batteries in 15 years...

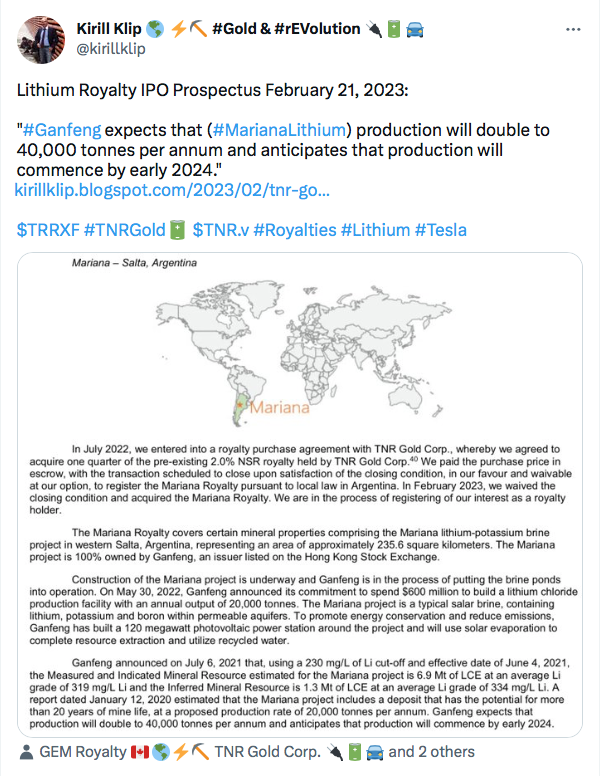

"We have a very important confirmation for all TNR Gold shareholders from Salta, Argentina. According to the publication of Cronica del NOA about the meeting between Ganfeng Lithium and the Governor of Salta Gustavo Saenz: "The Mariana project, which began construction last June, will start producing in 2024 an estimated 20 thousand tons per year of Lithium Chloride".

"We have our first great news delivered from Argentina for all TNR Gold shareholders in 2023. El Pregon Minera reports "The Operational Phase of Mariana Project Began"!

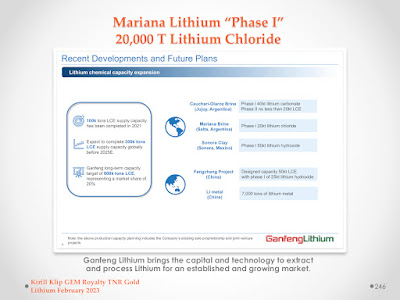

"For all TNR Gold shareholders, the following chart from the Ganfeng Lithium presentation is particularly important. The production facilities of 20,000 T of Lithium Chloride per year are called "Phase 1".

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, and stay safe and prosper. Join rEVolution!

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

Gasgoo:

Ganfeng Lithium boasts 274.68% YoY soar in 2022 full-year revenue"Shanghai (Gasgoo) - Ganfeng Lithium Group Co., Ltd. (“Ganfeng Lithium”), one of the world's leading producers of battery-grade lithium, scored a 274.68% year-on-year hike in its annual revenue for the year of 2022, which reached around 41.823 billion yuan, according to the financial results the group released on Mar. 30.

During the year of 2022, the group saw its full-year net profit attributable to shareholders zoom up 292.16% from a year earlier to 20.504 billion yuan. After deduction of non-recurring profit and loss, the yearly net profit belonging to shareholders even rocketed 586.34% over the previous year to 19.952 billion yuan.

Photo credit: Ganfeng Lithium

By the end of Dec. 2022, the group’s total assets had amounted to 79.16 billion yuan, soaring 102.68% compared with the year-ago period.

The company has already laid out its lithium battery business in various fields including consumer battery, TWS battery, power/energy storage battery, and solid-state battery. It has established lithium battery R&D and production bases in cities such as Xinyu, Dongguan, Ningbo, Suzhou, Huizhou, and Chongqing, with products widely used in such areas as photovoltaic energy storage, passenger vehicle battery, electric bus, airport equipment, electric boat, smart home, 5G communications, Bluetooth earphone, medical equipment, and more.

According to the announcement, Ganfeng LiEnergy, the group’s subsidiary dedicated to lithium battery business, recorded a 6GWh of annual shipment of power & energy storage batteries in 2022.

In terms of production capacity expansion of lithium batteries, Ganfeng LiEnergy’s 20GWh battery industrial park in Chongqing city has already started operation. The company expects to build the Chongqing park into China’s biggest solid-state battery production base.

Besides, Ganfeng LiEnergy is planning further production capacity upgrades for the second phase of its new-type lithium battery project in Xinyu city, which is still under construction, aiming to raising the annual capacity to 12GWh by 2023 from the current designed volume of 10GWh."

No comments:

Post a Comment