Gold hit $2,010 - just 3% below an all-time high of 2,070 in 2020. Will Central Bank's FOMO push it up to $10,000 after the imminent breakout to a new all-time high?

The Collapse of Crypto "One Thousand and One" scams escalated quickly. A bank run is spilling out from the "Crypto Friendly" banks to the whole EcoSystem of "Decentralised Crypto & Tech Freedom Fighters Against the FED" who are running on their own "VC Friendly" Banks.

The following circus in all caps on Twitter begging the same FED, Treasury and FDIC (the Big Government they were fighting against all their conscious life) about the Silicon Valley Bank bailout tells you everything you need to know about those sad and very angry clowns. The circus left, but the clowns are still here. Where is your money?

FED used the lightning strike of the unprecedented pace of tightening on the wethered aeroplane of the US financial system trying to tame inflation and to make a "soft landing". I do hope that they can make it for the sake of all of us, but the engines are already on fire.

Credit Suisse is gone with all their brave financial experiments in risk management shaming even super smart braindead Crypto entrepreneurs. UBS is holding its nose and picking up the best pieces.

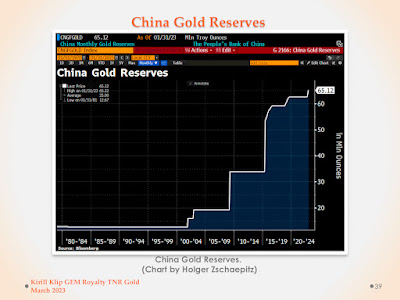

Now we know why Central Banks were buying all Gold they can like there is no tomorrow. Because there is no tomorrow as we know it. The dam holding The Global Derivatives Avalanche is showing cracks with every headline about Deutsche Bank.

JP Morgan, who is in competition with Goldman Sachs about the champion nomination with the largest derivatives book in history, tries to hide behind Jamie Dimon's smile, but people are reading these days even my own very old articles.

Why Gold? Deutsche Bank and $60 Trillion Derivatives - Is it the Last Snowflake Before the Avalanche? Have they fixed it? And how?

Jan Nieuwenhuijs writes in his brilliant article "The Hierarchy of Money And The Case for $8,000 Gold":

"Should we extend this trend and assume gold to make up a conservative 51% of global international reserves, the price of gold would need to be $10,000 per troy ounce. Naturally, in the process of raising the gold price central banks increase the weight of their gold and sell foreign exchange, resulting in a lower price of gold required to make up the majority of total reserves. On the other hand, over time central bank balance sheets grow and so does their demand for international reserves, possibly revaluing gold in urgency."

Now the question for Big Brothers and their FED will be to decide what is worse to have in order to keep the status quo - Gold at $5,000 or a breakdown of the US Treasury market during record deficits and the US National Debt pushing over $31.5 Trillion?

What Central Banks have started for this Gold rush with their FOMO will be magnified by the ReTail once they realise that Gold is going up to the $5,000 mark and not to $500. YOLO will make sure that my target of $10,000 is not so outrageous after all.

"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

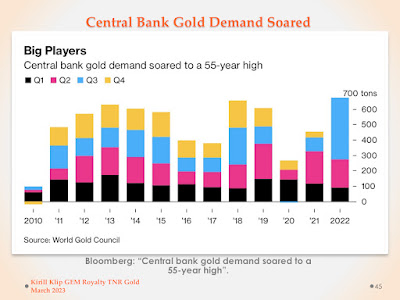

Central banks are buying a record amount of Gold and China is increasing dramatically its officially announced Gold reserves. According to Statista, worldwide Gold demand amounted to 4,740.8 metric tons in 2022, an increase of 18.1% from 4,012.8 metric tons in the previous year. Total Gold demand was just below $300 Billion dollars in 2022.

In 2022, worldwide Gold production stood at 3,100 metric tons. Central Banks bought a record 1,136 metric tons of Gold and their demand soared to a 55-year high. The amount of above-ground reserves for Gold is estimated to be around 205,238 metric tons by the end of 2021, according to the World Gold Council. The total "Market Cap" of Gold can be estimated at roughly $13 Trillion.

Now we can compare it with the derivatives books of the major systemic banks in the USA. Just 3 of them are holding over $150 Trillion in derivatives, with Goldman Sachs standing at $53 Trillion, JP Morgan - at $50 Trillion and Citibank - at $47 Trillion respectively.

We have The Catalyst for Gold in place after the Crypto bloodbath massacre. As we discussed before, even when you are playing Crypto Video Games your losses will be real. Retail chasing Crypto Dragons in the MetaVerse had a rude awakening after Dragons have flown away with their money and "Crypto friendly" banks are collapsing one after another.

Gold becomes The Ultimate Hedge for all portfolios constructed with stocks, bonds and crypto assets. Solid values in uncertain times.

Gold miners are printing money again with expanding margins and they will have to start looking more aggressively for new major Gold projects. They must replenish their reserves in time just to keep their production levels during the higher Gold prices. We have The Peak Gold Supply in place which will be driving the new M&A cycle for the Gold industry.

"There is no Gold 2.0, there are over 5,000 years of humankind's history with Gold. Investors are tired of loosing money by chasing Crypto Dragons and Bitcoin Dreams in the Tether Metaverse."

The extreme volatility and the recent crash in the crypto markets have evaporated more than 2 trillion dollars of "crypto capital" and have wiped out millions of "investors", some of them with all their life savings.

"Crypto myths are being dismantled one by one: Bitcoin is NOT Gold 2.0, Bitcoin is not an inflation hedge and Bitcoin is not a new asset class that will take the place of bonds in the "deworsified" model portfolios. Bitcoin is triggering, following and igniting the burst of all bubbles starting with technology sectors."

Kirill Klip GEM Royalty TNR Gold Presentation from Kirill Klip

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blogs. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.

TNR Gold started the new exploration program last year and is actively introducing Shotgun Gold to potential partners to decisively drill the entirety of these prospects. The objective of such a partnership would be to expand the known area of mineralisation, define new mineralised areas and conclusively assess the Project’s potential top-end valuation.

No comments:

Post a Comment