Dan Stringer wrote a great article covering Deutsche Bank's exposure to derivatives, why it doesn't matter you can read in the official reports. Why it does matter market is telling us today: DB is at all time low, Credit Swiss is at all time low and Barclays is down another 5% today. As you know, I have a very unconventional theory: that actual state of financial system is so bad that they will save it by all means now. By the way, if they fail - it will not matter any more anyway. Tomorrow just watch Janet Yellen turning this market around and US Dollar will be the victim. Gold is shining bright now. We will have a very interesting situation with the majority of market participants reversing the trades this year from being Short Gold and other Commodities and Long Us Dollar, once the message from the FED will be clear - we have just made a policy mistake. FED has never had a chance to reload "Efficient Central Bankers Economy" gun this time.

Why Gold? Debt Is An Elephant In The Room And It’s Going To Rampage.

We have very interesting market action today and Gold is knocking now on $1,200 with Barclays bank halted in London due to the market volatility and Deutsche Bank crashed over 11% to 7 year lows. Gold is breaking out from the down trend now. FED will save the market, but we can forget now about 4 FED rates hikes for sure. Gold must retake $1,224 this week to ignite the short squeeze and if we can jump above $1,300 the Gold Bull will be back. Now we are entering the stage with banks when Bubble TV will be discussing "not a return on the capital, but the return of the capital." Samuel Bryan provides very interesting analysis of the Debt "crashing American economy", I can only add that it is not only U.S.

"Expect to learn the words Shale Oil Credit Bust and Derivatives related to it by heart in the next few weeks now from the headlines. I guess, that FED was too late to reload the "Efficient Central Bankers Economy Gun" in the end and now we all will face the music. This time the real panic will start among Central Banks even before the Retail: everybody became totally complacent these days - but "saved" World Financial System does not mean that everybody will have the Return of The Capital. We can expect coordinated actions now starting with China, Japan, Europe and FED dialling down any further expectations about the Rate Hikes. Gold must be finally coming to life now." Read more.

The Last Chance To Prevent The Crash: Stock Market's Worst January Ever.

"We have now the last chance to prevent the real Crash. If market slides below August 2015 Low the floodgates will be open and waterfall will bring us not only the worst January for markets on record so far, but the real Crash. I think that it will be averted by the coordinated action by all Central Banks now killing the US Dollar rally. It is an election year in the U.S. and nobody will be taking any chances. Realisation that not only FED rate hikes are not coming, but another QE is in order will drive Gold prices back into the Bull market. Read more."

"Expect to learn the words Shale Oil Credit Bust and Derivatives related to it by heart in the next few weeks now from the headlines. I guess, that FED was too late to reload the "Efficient Central Bankers Economy Gun" in the end and now we all will face the music. This time the real panic will start among Central Banks even before the Retail: everybody became totally complacent these days - but "saved" World Financial System does not mean that everybody will have the Return of The Capital. We can expect coordinated actions now starting with China, Japan, Europe and FED dialling down any further expectations about the Rate Hikes. Gold must be finally coming to life now."

Gold And FED: Tom McClellan Predicted Major Market Peak In August 2015, Bear Market Into 2016.

This original post was made in June 2015: Tom McClellan deserves a very good attention - majority of the commentators are just going with the flow, while his analysis is based on liquidity and forward looking indicators. He is a must to study. I am very impressed and following him closely now. Jim Rickards and Peter Schiff were talking about this coming outcome of the FED decision for many, many months as well. Finally the Black Swan created by FED is coming to all the markets. I do not expect Crash, as it will be impossible to recover after it with FED without any bullets left and 4 Trillion Dollars balance sheet. But when you look at FCX falling down today 17% below 5 dollars and Copper below $2/lb, you start to think who will blow up this time. Arch Coal - America's second biggest coal company has just announced the bankruptcy and Oil is sliding today towards $31 per barrel with both WTI and Brent. Expect to learn the words Shale Oil Credit Bust and Derivatives related to it by heart in the next few weeks now from the headlines. I guess, that FED was too late to reload the "Efficient Central Bankers Economy Gun" in the end and now we all will face the music. This time the real panic will start among Central banks even before the Retail: everybody became totally complacent these days - but "saved" World Financial System does not mean that everybody will have the Return of The Capital. We can expect coordinated actions now starting with China, Japan, Europe and FED dialling down any further expectations about the Rate Hikes. Gold must be finally coming to life now.

Energy Metals Royalty Company TNR Gold Corp. Announces Restructure of Loan.

TNR Gold holds:

1. Royalty in giant Los Azules copper project with McEwen Mining and 1% on Sale of this project;

3. 25.5% in International Lithium, which develops J/V Mariana Lithium project in Argentina being financed by giant from China - Ganfeng Lithium.

Please carefully read my legal disclaimer and you can find all latest financial information about TNR Gold and International Lithium on SEDAR. Please never make any investment decisions without consulting with your preferred qualified financial adviser. Read more.

Dan Stringer:

Deutsche Bank: Just A Snowflake Away

Summary

Deutsche Bank has accumulated a substantial derivatives book, worth over 52 trillion Euros in notional value, over 50% higher than Lehman Bros. was at the time of its bankruptcy.

This large derivatives book makes DB vulnerable to potential Black Swan events.

The company's management oversight is in question as it is being investigated or litigated against by numerous parties.

This lack of oversight, combined with the sheer size and complexity of its derivatives, make DB a risky proposition in this increasingly volatile world.

In Nassim Nicholas Taleb's seminal book Antifragile, he outlines the concept of fragility. Fragility is an indication of vulnerability or being easily broken or damaged. It is a key component of complex systems. Today, we may not have a more complicated, man-made, complex system than the international financial system.

A financial system's basic tenant is to enable lenders and borrowers to exchange funds. However, as you increase the scope from a regional basis to a global basis, the complexities begin to abound with different currencies, different financial instruments and country-specific issues, such as the relative strength of each country's economy.

Financial instruments are tradeable assets of any kind, such as cash, equities, and bonds. They represent either an asset, a claim on an asset or a contractual right to an asset.

Derivatives, as their name would imply, derive their value from the performance of an underlying asset. They can fluctuate based on the price of the underlying asset and time. As these types of contracts can act as levered investments, they can potentially vary in value substantially, producing outsized gains and losses.

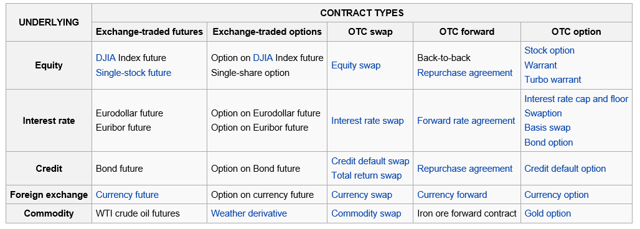

Derivatives were originally used mostly for hedging risk (for example, farmers could guarantee prices for corn, wheat etc. for the price of the derivative), but they are now mostly used as another type of financial instrument. The potential of outsized returns has caused them to proliferate extensively as speculators have adopted them as a way to increase their return on capital. Below are some common examples of derivative contracts:

Source: Wikipedia

Derivatives have added an extra layer to the financial system, making a complex system even more complex as now you can have significant fluctuations in not just the underlying assets, but in the derivatives of those assets, multiplying the effect. With the wider variety of counterparties available through the global system, these fluctuations are also spread globally as well. This magnification of risk is why Warren Buffett termed derivatives as financial "Weapons of Mass Destruction". Derivatives gone wrong were at the heart of the Long Term Capital Meltdown in 1998 and the Lehman bankruptcy in 2008 that triggered the Financial Crisis.

When we look specifically at where Lehman was at the time of its filing for bankruptcy, it had a derivative book of over $35 trillion in notional value over 900,000 contracts. Notably, its leverage ratio (capital to assets) peaked at an astronomically high 31x. The actual time to process the largest bankruptcy in history was over three-and-a-half years, with Lehman emerging as a liquidating company that still needed to settle its affairs.

It is widely assumed that the Financial Crisis of 2008 had made the banks learn their lesson with respect to risk. However, we will see that Deutsche Bank (NYSE:DB) has clearly not learned this lesson, making it extremely vulnerable to the many catalysts that could shock the global financial system.

Not Learning Its Lesson

Deutsche Bank AG is a German banking and financial services company headquartered in Frankfurt, Germany with operations around the world. Founded in 1870, the bank's operations range from private wealth management to corporate banking and securities to global transaction banking.

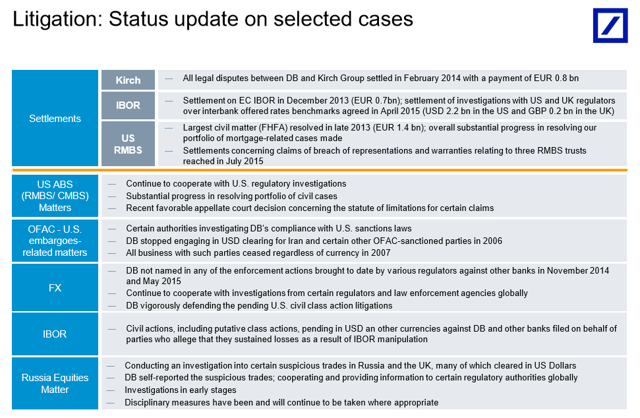

However, with size comes complexity. DB has operations in 71 different countries, so coordinating its businesses takes a high degree of management. My concern is that its operations have become too unwieldy. This is revealing itself in the number and range of legal matters and investigations that the bank is currently facing. DB actually had these investigations on a management slide in its most recent earnings call:

Since this earnings call, it has had several more actions initiated against it, including one by the Department of Justice. With this level of, at a minimum, alleged malfeasance, it appears management control has been severely lacking, making me question if appropriate risk controls are in place.

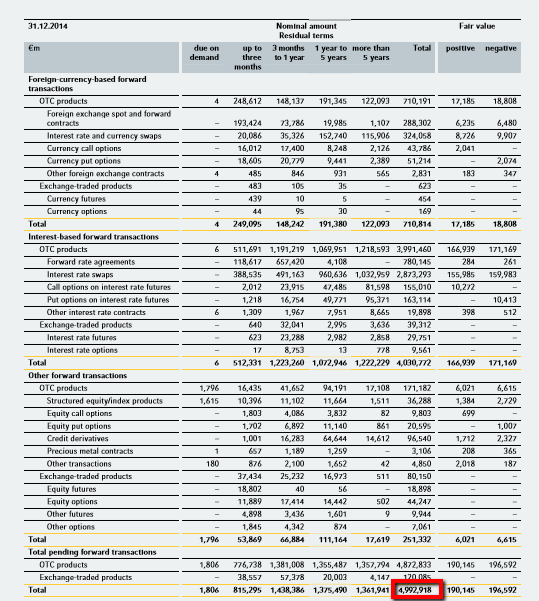

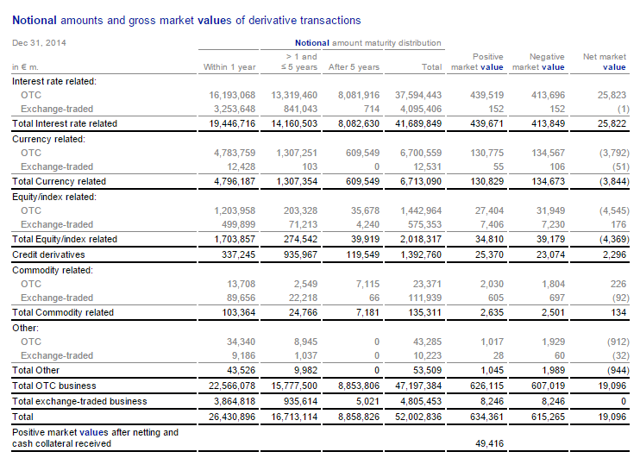

However, I believe this lack of risk control is even more apparent in the size of its derivative book. If we look at the notional value of its derivative book, the pure size of it is incredible:

Source: Annual Report 2014

This gives DB a notional value of its derivative book of 52 trillion Euros or $58.2 trillion, a full 66% higher than Lehman was at the time of its failure. DB's derivative book was 47.2 trillion Euros on December 31, 2007, prior to the financial collapse, so it is now at an even higher level than it was during the height of financial institution risk taking prior to the Financial Crisis.

Although this data is from 2013, this ZeroHedge graph illustrates the absolute magnitude of its derivative book:

As a comparison, I wanted to look at Commerzbank (OTCPK:CRZBF) (OTCPK:CRZBY), the second largest bank in Germany. It has a 3.6% CRD4 (capital requirements directive) fully loaded ratio, the same as DB. Commerzbank's market cap is only about a third of DB's, though. However, its notional derivative book is significantly smaller:

Source: Commerzbank Annual Report 2014

DB's level of risk is clearly not a symptom of the German banks, as Commerzbank's derivative book value is just 9.5% the size of DB's. It has been able to create an enterprise one third the size of DB (by market cap) with about 1/10th the risk level. This holds up in assets as well as CRZBF has $660 billion in assets, roughly 1/3 of DB's $1.8 trillion in assets.

However, DB trades at a TTM simple P/E ratio of 24.1 while CRZBF trades at 18.7x, a significant discount despite its less risky derivative book. For an American comparative, JPMorgan Chase (NYSE:JPM) trades at a P/E of just 11x. However, its derivative book is just as large as DB's. DB is clearly not being penalized for its risk taking and lack of management control based on its earnings multiple.

Where we start to see a risk discount reflected is in the price to book value of DB, which sits at just 0.46 (by comparison, CRZBF is even lower at 0.42 while JPM is at 1.0). DB's price to book has been in this range largely since 2009, not reflecting its continued increase in derivatives leveraging.

Jim Rickards described a potential economic collapse in the context of snowflakes landing on a ridge. You won't know which snowflake sets off the avalanche, only that one will. I believe that DB is at great risk to potential Black Swan risks due to the size of its derivative book. In the event that these types of transactions are impacted by an unanticipated shock (for example, the Swiss de-pegging of its currency to the Euro in January 2015), this could put severe liquidity risk in play. As we saw with Lehman, there is the potential that no one will be there to help them survive a liquidity squeeze.

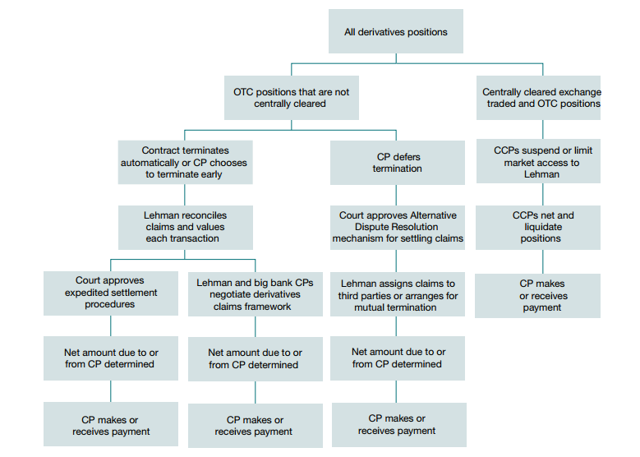

If there is an attempt to try to unwind its book of contracts, this will not be an easy task. I include below the steps taken to unwind each derivative contract during the Lehman bankruptcy process:

Source: The Failure Resolution of Lehman Brothers, Michael J. Fleming & Asani Sarkar, December 2014

This will not be accomplished quickly and during a liquidity crisis, time is at a premium.

I believe that taking a short position in DB is a prudent position to take, especially as a hedge in a largely long portfolio. While I certainly cannot see the future, this is a bet against the fragility of the complex global financial system, of which DB is one of its most fragile entities.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in DB over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I will use long dated put options as a portfolio hedge.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks."

No comments:

Post a Comment