CNN reports that Tesla is selling twice as many electric cars as it was a year ago! The sales in Q3 are up 111% to the record of 24,500 EVs compared with 11,603 sold last year in the same quarter. It looks like the famous now motivational email by Elon Musk is making its magic at Tesla as more than 5,000 Teslas reported to be in a transition already. Tesla is on track to sell 50,000 electric cars in the second half of 2016 and meet its target of 80,000 to 90,000 new Teslas cruising on the roads for the whole year.

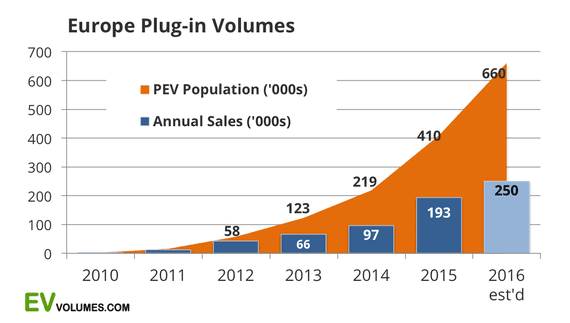

This new achievement by Elon Musk and his Team at Tesla will contribute nicely to my expected 1,000,000 of electric cars being sold in 2016. China will claim at least 500,000 EVS in sales in 2016 and Europe will be racing for the 2nd place against the U.S. with roughly 250,000 in sales each hopefully. In another important news, Elon Musk has confirmed that Tesla is on track to meet its very ambitious goal of 500,000 electric cars made annually by 2018. Now a lot of people will have to change their estimations for lithium demand. China is acting already and driving the new round of consolidation in "The New Lithium Top 5" where security of lithium supply is a major concern now.

This new achievement by Elon Musk and his Team at Tesla will contribute nicely to my expected 1,000,000 of electric cars being sold in 2016. China will claim at least 500,000 EVS in sales in 2016 and Europe will be racing for the 2nd place against the U.S. with roughly 250,000 in sales each hopefully. In another important news, Elon Musk has confirmed that Tesla is on track to meet its very ambitious goal of 500,000 electric cars made annually by 2018. Now a lot of people will have to change their estimations for lithium demand. China is acting already and driving the new round of consolidation in "The New Lithium Top 5" where security of lithium supply is a major concern now.

Lithium 2.0: "New Lithium Top 5" Consolidation And Security Of Supply: FT "China's Tianqi Moves On Chile's SQM."

"FT reports that further round of competition for the security of lithium supply is driving the new wave of consolidation among our "New Lithium Top 5". With all political troubles in Chile Argentina is rising to the top lithium destination in the world now. Chinese Tianqi and Ganfeng were competing for the stake in SQM. Now we can see that Tianqi will pay 51% premium to get 2.6% for more than $200 million dollars in SQM. This move opens the doors to acquire more than 20% stake in SQM. I will be following on more details of this deal.

"Now you can better understand why the security for lithium supply becomes crucial for the industry leaders. Ganfeng Lithium and Tianqi have made it to the "New Lithium Top 5" this year and even pushed FMC down in the 5th place, according to Joe Lowry. Tianqi controls with Albemarle Talison Lithium - a source of lithium raw material from hard rock mining in Australia. Now with Tianqi front running for the 23% stake at SQM - a source of lithium raw material from brine in Chile, we will have a new round of competition for the security of lithium supply. Reflecting on its political problems in Chile SQM moves to Argentina in J/V with Lithium Americas and Albemarle has just announced plans for the lithium exploration in Argentina.International Lithium is building the vertically integrated lithium business with $4.5 Billion market cap giant from China Ganfeng Lithium, which is financing J/V operations in Argentina and Ireland. Below you can find more links on the Lithium Battery and raw materials space to make your own conclusions." Read more.

Energy rEVolution: Finding Value In The Booming Lithium Sector.

"International Lithium is getting noticed in the industry with our strategic partnership with Ganfeng Lithium from China. Ganfeng has made it into the "New Lithium Top 5" this year and now we have a new round of competition for the security of lithium supply with a further consolidation in the industry. Argentina becomes the top destination for the Lithium Supply development and our projects in Europe and Canada are moving fast forward now with our strategic partners. We are drilling in Ireland after recent discoveries with Ganfeng and Pioneer Resources from Australia is advancing Mavis Lake and Raleigh Lake projects this year. ILC is one of the most active lithium exploration and development companies with CAD$17 million budgeted for the advance of our projects on the 3 continents.

Please read carefully my legal disclaimer and never invest without consulting with your qualified financial adviser. I cannot comment or provide any information on the other companies as International Lithium's qualified person as it is defined by NI 43-101 was not able to verify and confirm the provided information. You can find below more information on Ganfeng Lithium and ILC including for our followers from Germany. Read more."

Lithium Market Small But Complex. Canadian Junior And Chinese Partner Taking Long View.

“This brings the total amount budgeted for exploration to CAD$17 million across the Company’s projects in Canada, Argentina and Ireland, making International Lithium Corp. one of the most active exploration companies in the lithium sector. This speaks volumes for the quality as well as the potential of the Company’s projects,” states Kirill Klip, President, International Lithium Corp.”

International Lithium At Wentworth 2016 Presentation.

Lithium Race: We Can Get 1,000,000 Electric Cars Sold Worldwide In 2016.

EVObsession

"EV Obsession reports that now we have 500,000 electric cars in Europe. As you remember, I expect China to sell only this year 500,000 EVs with 207,000 already sold by August. Europe has 91,300 EVs sold by July and is taking the second place after China and before the U.S. with 93,197 EVs sold by September, which is now falling into the 3rd place. Europe will reach its 100,000 EVs sold faster than the U.S. this year. What is really interesting to note is that Renault Zoe is leading sales in Europe now with 14.2% market share. It is a nice car, but not the best electric cars can offer. Tesla Model S is at 8.7% of EU sales. It is the best electric car, but not affordable for the mass market by ant stretch of the imagination.

Now you can better realise why I am calling that the tide is coming after the release of GM Bolt and Tesla Model 3 following after that. For the first time, we will have two electric cars with more than 200 miles range and below $40k. Another very interesting point in this article that 250,000 EVs are estimated to be sold this year only in Europe! We are reaching the pivotal point on our way towards the mass market for electric cars and the total electrification of our transportation. We have now only over 1 million electric cars sold in all of our history. This year alone China can sell 500,000, now we can start talking that the U.S. will match Europe at least and we can have 1,000,000 electric cars sold just in 2016! China will see EVs sales accelerated after cleaning up its incentives scheme for the EVs makers earlier this year and Tesla will be ramping up its production with GM selling Electric Chevy Bolts now as well.

Markets will be up and down, companies will come and go, but we are witnessing the historic moment of coming out of ICE-age in our transportation. We are talking here about the disruption of $4 trillion transportation industry based on Lithium Technology. Now it is time to check out where all this lithium will be coming from.And the answer: "From Panasonic" - will be better than: "From the underneath of Tesla Gigafactory in Nevada", but still the same like if electricity is coming just from the socket in your wall. Read more."

CNN:

Tesla is selling twice as many cars as it was a year ago

"That's according to new performance numbers released by the company Sunday. The electric luxury car company said it delivered about 24,500 vehicles last quarter, compared to 11,603 during the same period last year.

Virtually all of Tesla's deliveries at that time last year were of its flagship Model S vehicle. And that's still a big ticket for the company -- Tesla sold 15,800 Model S cars in Q3 2016.

This quarter's totals were largely aided by the new Model X SUV, which launched in September 2015. Tesla made 8,700 Model X deliveries in its latest sales quarter.

Both the Model S and Model X, however, are still pricey propositions for would-be electric car buyers. The Model S starts at $66,000, while the Model X starts at $83,000.

Tesla (TSLA) remains an upstart in the industry. CEO Elon Musk is betting he can win big next year, when the company's first mass-market car, the Model 3, goes on sale. It starts at $35,000.

Musk's next car could face stiff competition. GM's new all-electric car, the Chevrolet Bolt, goes on sale later this year for $37,495.

Volkswagen is also looking to edge in on the electric car market. The automaker's I.D. is expected to cost less than $30,000. But it won't go on sale until 2020."

No comments:

Post a Comment