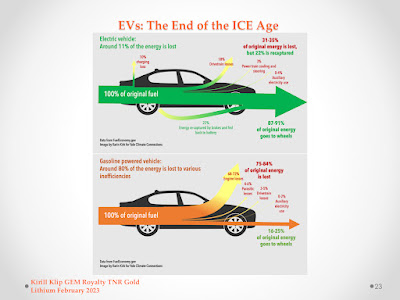

We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

TNR Gold Mariana Lithium NSR Royalty Holding - "The view from China: Exclusive Interview with Ganfeng Lithium"

"We have another enormously important development for TNR Gold's royalty partner on the Marina Lithium Project, Ganfeng Lithium. The giant from China signed a 4-year supply agreement for battery materials with Huyndai. Ganfeng Lithium already supplies battery materials to a numeral of the most significant participants in the electric cars space including Tesla, BMW and VW. Hyundai is a fast-growing automaker with a range of cheaper electric cars and rapidly increasing its market share. They are targeting 30% growth for 2024 and will launch more affordable EV models soon."

"Photovoltaic solar parkThe Mariana project will be exclusively supplied by power provided by an off-grid solar farm, producing 120 MW from solar panels with 288 MWp of battery storage. The plan is to expand capacity to 150 MW in solar panels, and 360 MWp in battery storage, exclusively manufactured by Ganfeng.

The system is designed to respect and comply with international standards in quality, energy-saving and environmental care, and has the capacity to supply both the company’s various operational facilities and the crew camp set up for approximately 500 people." (Ganfeng Lithium)

"We have another very significant confirmation of the positive business environment in Argentina for TNR Gold royalty projects. Today you can go over the main pieces of our analysis and find out why we are talking about re-rating of market valuations of our assets. Mariana Lithium is on track towards production later this year and Ganfeng Lithium is confirming its commitment to Argentina and expanding its portfolio."

"By developing the Vertically Integrated Lithium Business Modelincluding the production of higher-margin Lithium chemicals, battery materials and, particularly, expanding its Lithium Batteries business, Ganfeng can use its own raw material base of the Lithium supply chain to produce the higher margin products in the supply chain for electric cars."

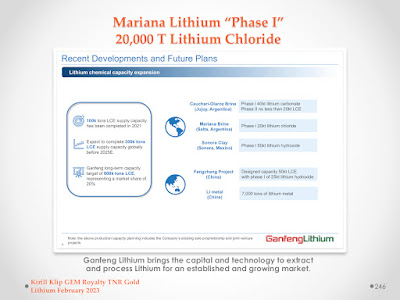

"For all TNR Gold shareholders, the following chart from the Ganfeng Lithium presentation is particularly important. The production facilities of 20,000 T of Lithium Chloride per year are called "Phase 1".

Emily Jarvie: "TNR Gold Has Analysts Bullish on Near-term Royalty Potential from Ganfeng’s Mariana Lithium Project"

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

“Since our initiating report in September 2023, TNR’s royalty projects have made significant progress,” the analysts wrote in a report. “TNR is up 40% since September 2023.” (Emily Jarvie)Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

TNR Gold Reaches Milestone with Ganfeng's Mariana Lithium Project on Track for First Production in 2024

“We are building the green energy metals royalty and gold company”, commented Kirill Klip, Executive Chairman of TNR Gold. “Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

“Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle; the potential of blue-sky discovery at Shotgun Gold Project, and important partnerships with industry leaders Like Ganfeng Lithium, McEwen Mining and Lundin Mining as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for the Company.

“Last year we repaid our investment loan in full, and our Company has no debt. We believe that the recent market prices of our shares do not properly reflect the underlying value of the shares, and the ongoing normal course issuer bid allows us to purchase shares in the market to help increase the share value for the Company.

“We are very pleased that the Mariana Lithium Project is progressing smoothly towards commercial production scheduled for 2024. Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began in June 2022, will start producing, in 2024, an estimated 20,000 tons per year of lithium chloride.

The Government of Salta has stated that Ganfeng Lithium announced that the operational phase of the Mariana Lithium Project began in January 2023. We are looking forward to our first NSR royalty cash flow payments from the Mariana Lithium Project.

“TNR does not have to contribute any capital for the development of the Mariana Lithium Project, the Los Azules Copper Project or the Josemaria Project. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

NEWS RELEASE

TNR Gold NSR Royalty Update – Ganfeng’s Mariana Lithium Project Scheduled to Commence Production in 2024

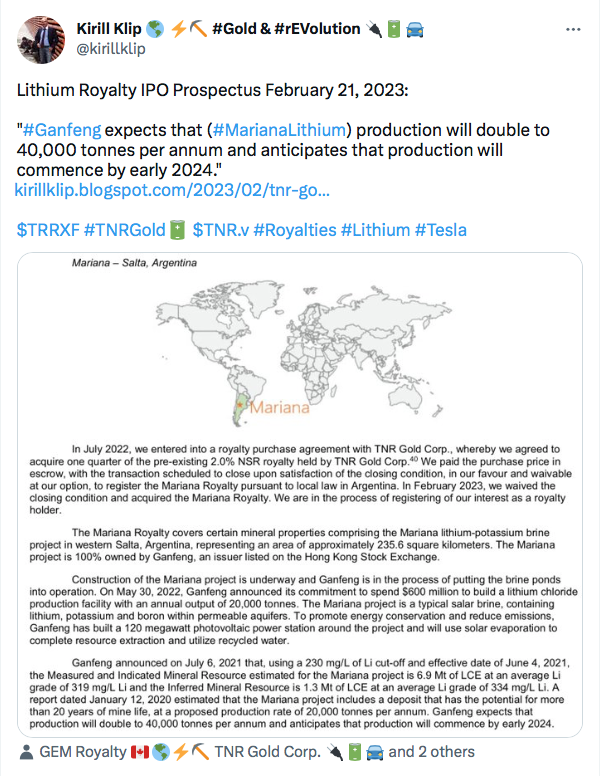

"Vancouver, British Columbia – April 8, 2024: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce that Ganfeng Lithium has provided an update on the Mariana Lithium Project. TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which a 0.15% NSR Royalty is held on behalf of a shareholder.

In its 2023 Annual Report, Ganfeng Lithium reported:

“Mariana is a lithium-potassium salt lake located in Salta Province, Argentina. The construction of the project started in June 2022, and the infusion of brine into the salt fields started at the end of 2022. Currently, the construction of the salt fields, salt wells, chemical plants, photovoltaics, and other infrastructure facilities are progressing smoothly, and it is scheduled to produce the first batch of products at the end of 2024.”

“We are building the green energy metals royalty and gold company”, commented Kirill Klip, Executive Chairman of TNR Gold. “Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

“Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle; the potential of blue-sky discovery at Shotgun Gold Project, and important partnerships with industry leaders Like Ganfeng Lithium, McEwen Mining and Lundin Mining as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for the Company.

“Last year we repaid our investment loan in full, and our Company has no debt. We believe that the recent market prices of our shares do not properly reflect the underlying value of the shares, and the ongoing normal course issuer bid allows us to purchase shares in the market to help increase the share value for the Company.

“We are very pleased that the Mariana Lithium Project is progressing smoothly towards commercial production scheduled for 2024. Representatives of Ganfeng Lithium confirmed to the Governor of Salta Gustavo Sáenz that the Mariana Project, on which construction began in June 2022, will start producing, in 2024, an estimated 20,000 tons per year of lithium chloride. The Government of Salta has stated that Ganfeng Lithium announced that the operational phase of the Mariana Lithium Project began in January 2023. We are looking forward to our first NSR royalty cash flow payments from the Mariana Lithium Project.

“TNR does not have to contribute any capital for the development of the Mariana Lithium Project, the Los Azules Copper Project or the Josemaria Project. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

ABOUT TNR GOLD CORP.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

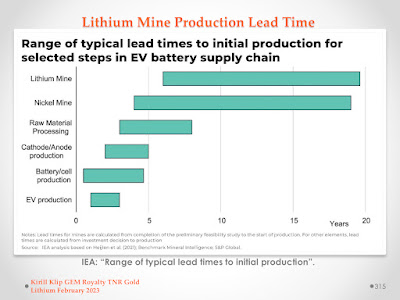

Over the past twenty-eight years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR royalty and its shareholder holding a 0.05% NSR royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

TNR also holds a 7% net profits royalty holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources. The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I & II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

For further information concerning this news release please contact Kirill Klip +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, and future potential transactions being considered by the Special Committee and the Board. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s SEDAR+ profile on www.sedarplus.ca. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will enter into one or more strategic transactions, partnership or a spin-out, or be able to complete any further royalty acquisitions or sales of royalty interests, or portions thereof; debt or equity financings will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties, in future, challenging the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc., Ganfeng Lithium and Lundin Mining will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."