We have another very significant confirmation of the positive business environment in Argentina for TNR Gold royalty projects. Today you can go over the main pieces of our analysis and find out why we are talking about re-rating of market valuations of our assets. Mariana Lithium is on track towards production later this year and Ganfeng Lithium is confirming its commitment to Argentina and expanding its portfolio:

"China’s Ganfeng Lithium will acquire a 15% stake in the Pastos Grandes lithium project in Argentina’s Salta province from Canada’s Lithium Americas for US$70mn, the Vancouver-based company said in a statement.In the same area, Ganfeng has interests in the Sal de la Puna, Pozuelos-Pastos Grandes and Caucharí-Olaroz lithium projects.The Pasto Grandes deal is due to be completed in Q2 and Ganfeng will be able to acquire up to 50% in total under certain conditions.The agreement includes a commitment from both parties to undertake a development plan for the Pastos Grandes basin and test Ganfeng's direct lithium extraction technology to add to conventional evaporation methods that they plan to use at Pastos Grandes.Ganfeng's Sal de la Puna project is being explored by its partner Arena Minerals, and is adjacent to Pozuelos-Pastos Grandes which is due to start production this year and ramp up to capacity of 25,000t/y lithium carbonate equivalent (LCE) within three years.Pozuelos-Pastos Grandes will have a useful life of 25 years and is in the engineering development stage to begin construction this quarter.Just 100km away in Jujuy province is Caucharí-Olaroz, which began production last year with a plan to reach 40,000t/y of LCE. It is operated by Minera Exar, jointly owned by Ganfeng Lithium, Lithium Argentina and provincial company JEMSE.Also in Salta province, Ganfeng is involved in the Mariana project operated by Litio Minera Argentina in the Llullaillaco salt flat, which targets production of 20,000t/y of lithium chloride, and the Incahuasi exploration project in the likewise named salt flat.Argentina is the fourth largest producer of lithium in the world. With the announced and injected investments, the so-called Argentine lithium triangle, which also includes Catamarca province, could export more than US$7bn starting in 2025, according to a report published by the Rosario Stock Exchange." (Bnamericas)

“The new president of Argentina introduced important government policies aimed at supporting business and unlocking the country’s economic potential. Mining is being recognized as an integral part of this economic development plan providing jobs and enriching local communities."

"Stability has always been a mantra for our Company - Solid Values in Uncertain Times. Be it fluctuating or stabilised lithium prices, these are royalty projects for keypoint critical metals under industry majors with no input needed; a simple fundamental win maker for shareholders: 1.35% NSR royalty on a major Mariana Lithium project that’s currently being developed by Chinese champion Ganfeng, 0.36% NSR royalty on the giant Los Azules copper project being worked up by McEwen Mining and 7% net profits royalty on Batidero I and II Properties of Josemaria copper project in Argentina under Lundin Mining."

(Konstantin Klip)

"In my opinion, Argentina’s new president Javier Milei represents a low risk to domestic mining projects; the state’s provincial jurisdictional buffer will buffet any radical policies regarding Sino-affiliated projects, plus a goal of boosting national mineral exports keeps lithium and copper projects guarded." (Konstantin Klip)

"During the ongoing REE 2.0 Lithium price war Ganfeng is following its main strategy by using the crash in the Lithium market as an opportunity to consolidate the supply chains. The main efforts of all major players are focused on securing new production capacity for the raw materials and increasing the market share through long-term supply contracts for OEMs, automakers and, increasingly, providers of Energy Storage Solutions among other Lithium battery makers."

TNR Gold Royalty Holding: Ganfeng's Mariana Lithium is on Track to Production in 2024

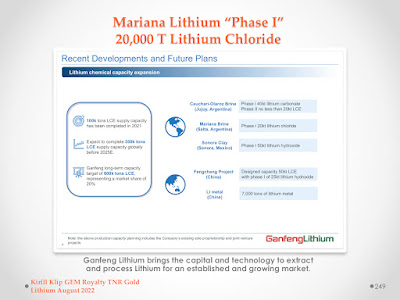

"For all TNR Gold shareholders, the following chart from the Ganfeng Lithium presentation is particularly important. The production facilities of 20,000 T of Lithium Chloride per year are called "Phase 1".

"TNR retains a 1.35% NSR royalty on the Mariana Lithium projectthat is being developed by Ganfeng Lithium in Argentina. We also hold a 0.36% NSR royalty on the Los Azules copper project that is being developed by McEwen Mining in Argentina. In addition, TNR holds a 7% net profits royalty on the Batidero I and II properties of the Josemaria project that is being developed by Lundin Mining in Argentina. TNR also provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska.

In February 2023, LRC valued only a portion of the Company at US $9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project in Argentina for US $9 million. LRC’s recent offer of CAD $15 million (approximately US $11 million) for the entire Company was opportunistic and financially inadequate. The duty of the board is to maximize the potential value of our assets and our Company’s valuation for all of our shareholders, and the fair treatment of all shareholders. The special committee will help the board achieve these aims by evaluating opportunities in the most streamlined, efficient manner possible. We are engaging with multiple parties proposing much higher potential valuations for our assets than LRC’s recent proposal, and these are the opportunities that the special committee will focus on first."

"How to spot the next M&A target? What if you learn that insiders of major Royalty companies have bought personal stakes in a small but very promising company holding royalties in lithium, copper, gold and silver projects under development by industry leaders like Ganfeng Lithium, Rio Tinto, McEwen Mining and Lundin Mining?"

My Vision for TNR Gold and Strategy: Share Buyback, Potential Valuations, and Shotgun Gold Project Spinout

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

Kirill Klip, Executive Chairman TNR Gold Corp.

"A lot of our investors have been asking me recently, what is my personal Vision for TNR Gold, what is the future of our Company and what are my personal goals to achieve for TNR Gold."

"Our Company has reached major milestones this year after the full repayment of the investment loan and all recent developments in the marketplace."

"I would like to share with you my personal Vision for TNR Gold’s future.

The Company is of the view that the recent market prices of its Shares do not properly reflect the underlying value of the Shares. I personally believe that the current market price is grossly undervaluing the intrinsic value of TNR Gold’s assets."

"The Governor of Salta, Gustavo Sáenz and directors of the Ganfeng mining company, evaluated the economic and social impact of the Mariana lithium project, which will generate more than 3 thousand jobs." (Google Translate)

"Representatives of the company Litio Minera Argentina, local exploitation subsidiary of the “Mariana” project of the Chinese company Ganfeng Lithium, told Radio Salta about their work experience.

The firm with three projects in development participated in the cycle “Let's talk about what's coming” organized by the newspaper El Tribuno, last few days.

They have the Mariana project, -the largest of the three-, in second place is a project located in the Llullaillaco salt flat, in the Los Andes department and in last place is another project in Incahuasi, near Tolar Grande.

“Extracting lithium from brine is the friendliest to the planet,” explained Sergio Mastnak, Senior Manager of Human Development and Finance at Litio Minera Argentina SA.

Mastnak announced that when the three lithium extraction projects are underway, direct employees will reach a thousand people.

“We are having a hard time finding geologists and engineers, who we must look for in other provinces,” he said.

He commented that obtaining lithium production from the “Mariana” project will begin to be seen in the second half of 2024." (Google Translate)

No comments:

Post a Comment