Equal Ocean, an investment research firm from China, reports about the latest "investment relations activities" disclosed by Ganfeng Lithium. TNR Gold's Mariana Lithium NSR Royalty partner sets the new industry standards and very high benchmarks for this global vertically integrated lithium business.

According to Equal Ocean, Ganfeng Lithium "has planned to form a supply capacity of no less than 300,000 tons of LCE by 2025". "About 200,000 tons of LCE will come from the supply of its own resources".

Now you can better understand why this slide from the Ganfeng Lithium presentation is so important for all investors of TNR Gold. The planned 20,000 T of Lithium Chloride annual production capacity at Mariana Lithium is called "Phase 1"!

"We are very pleased to see that this new plan represents a design capacity of 20,000 tonnes lithium chloride (LiCl) over the previously planned annual lithium production rate of 10,000 tonne-per-year lithium carbonate equivalent (LCE) presented in the Mariana Project preliminary economic assessment ("PEA"), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR royalty from Mariana's life of mine cashflow, which has now been significantly increased. We welcome the news from the Salta regional government, following its discussions with Ganfeng, that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million."

We can expect now that the "Phase 2" may potentially increase the annual production of Mariana Lithium even more in the future. After all, Ganfeng Lithium's Chairman is talking about 3 million tons LCE of lithium annual demand by 2030.

"Due to the technical complexity, only the strongest Lithium companies will be able to develop new projects and achieve a significant production increase of Battery Grade Lithium. The whole industry produced only 369,000 T LCE of Lithium in 2020 and now we have to jump first to over 1 million T LCE by 2025. Ganfeng's Chairman is talking about 3 million T LCE annual demand by 2030 and Canaccord Genuity estimated that only Tesla will consume 2.7 million T LCE annually by 2030."

Operations at Mariana Lithium will be powered by a 150 MW Solar Park - Ganfeng is setting up another ESG level for lithium production operations on the global scale.

"And now Ganfeng's plan to power all operations at Mariana Lithium Project with renewable energy is taking shape as well. Runrun Electrico reports about the latest developments and Ganfeng Lithium plan for a 150 MW Solar Park at the Salar de Llullaillaco."

TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on Mariana Lithium Project with Ganfeng Lithium, Los Azules Copper, Gold and Silver Project with McEwen Mining and Batidero I and II Properties of Josemaria Copper-Gold Project with Lundin mining.

I consider my personal investment in TNR Gold, as a unique entry point into the state of the art vertically integrated lithium business being built by Ganfeng Lithium for the 21st century. We are building The Green Energy Royalty and Gold Company and participating in the creation of secure supply lines feeding The Switch and Tesla Energy rEVolution.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, stay safe and prosper. Join rEVolution!

Equal Ocean:

Ganfeng lithium industry: it is expected that the planned capacity of 2GWh first-generation solid-state battery will be gradually released this year"Ganfeng lithium disclosed the record of investor relations activities and announced that the company has planned to form a supply capacity of no less than 300000 tons of lithium carbonate equivalent by 2025 to meet the vigorous development of the lithium market. It is estimated that the supply of the company's own resources will account for about 70% in the future, that is, in the production scale of 300000 tons of lithium carbonate equivalent in 2025, about 200000 tons of lithium carbonate equivalent will come from the supply of its own resources. In terms of power and energy storage batteries, the company has built a capacity of 7gwh, of which the 3gwh production line put into operation in 2021 can be fully produced, and the newly built 4gwh production line is still under commissioning. In terms of solid-state batteries, the planned capacity of 2gwh first generation solid-state batteries is expected to be gradually released this year. In terms of consumer batteries, the company's recent TWS battery capacity has been further improved, the automation capacity has been strengthened, and the cost has been reduced. (This text is a result of machine translation)"

Elon Musk And Lithium: "Salt On A Salad"? - It Looks More Like Water In The Desert Needed For Tesla To Continue To Grow To The Sky.

Elon Musk is talking about lithium again. This time around even the laziest investors are already chasing everything with lithium in their name. Lithium prices have separated themselves from any ideas about the dirt and dust which is lying around in Nevada "full of Battery Grade Lithium" and just waiting to jump straight into the battery packs.

Lithium prices jumped first through the roofs of the empty warehouses in China and after that went Space X vertical to the new all-time high of USD$78,300 per T of LCE spot price in the Chinese domestic market.

"Supply chains are not ready. All stability of the US$12 Trillion dollars of the inverted Pyramid of Energy and Transportation Sectors depends on the security of supply provided by the Lithium market with a size of less than US$4 Billion dollars by sales in 2020."

"The tsunami wave after the Tesla earthquake has shattered all ICE legacy automakers is hitting the very small market of specialised lithium chemicals products. Price shocks for Battery Grade Lithium were imminent."

"Lithium price goes up first and a new stable secure supply of Battery Grade Lithium will be coming much later after many years of development. The industry might and investments of Billions of dollars are only the start, each lithium project is a unique "chemical soup" and only a few companies in the world have a "Know-How" to unlock the potential of new projects and reach the "Number Plate" - Battery Grade Lithium quality and announced capacity of annual production. "Skyrocketing lithium prices unlikely stabilise soon", says Ganfeng Chairman and now you can understand why."

Now you can better understand, why I am congratulating all our TNR Gold Team and expressing my gratitude to all our shareholders for their support of our Company, particularly today.

Elon Musk talks about the lithium business and we have just announced our best news about TNR Gold NSR Royalty Holding on Mariana Lithium with Ganfeng. And we have not even started to talk about Robots...

"Kirill Klip, TNR's Chief Executive Officer commented, "We have seen Ganfeng Lithium consolidate 100% of the Mariana Lithium Project and both TNR Gold and Ganfeng Lithium's subsidiary Litio Minera Argentina Corp. ("LMA") have acknowledged LMA's responsibility to pay the 2% NSR royalty on the commencement of Commercial Production at the Mariana Lithium Project, and LMA has assumed the right to the repurchase of 50% of the NSR royalty (that is 1%)."

We have had a validation point of our Lithium business strategy for the last 14 years. Now we are moving into the crystallisation point for our assets and their potential market valuations.

"We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in the Company's share price. We have received significant industry interest in our assets and the Company is working on potential new strategic partnerships to provide benchmarks for the market valuations of our royalty holdings. Such strategic transactions may potentially allow us to substantially improve our working capital position."

These potential transactions may allow everybody in the marketplace to see our lithium, copper, gold and silver assets' values more clearly. And even more, very naughty and ruthless Mr Market may start to recognise these real values as well.

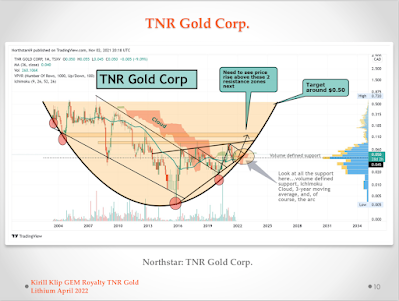

There is a long journey between dreams about lithium, copper, gold and silver and the share price of the company reflecting the real valuations and going steadily up on the screen of your iPhone. This is what I call "Mr Market Time Machine". You are buying when nobody wants it. When there is still a unique opportunity and you can buy a much better business at a very reasonable price before the FOMO crowd will be driving the share price up.

You are buying the Dream before it became reality. Then after very hard work and if you get lucky you can go "Back Into The Future". In the future for me personally, I can see the UniVerse where only TNR Gold Royalty Holdings in Mariana Lithium with Ganfeng and in Los Azules Copper, Gold and Silver with McEwen Mining can each potentially justify valuations representing multiples of our recent market cap.

"Using my previous articles presented below, we can check and review the main driving market forces behind this phenomenal price performance for Lithium. This is the reflection of the exponentially growing demand and the very limited ability of the established producing facilities to increase the supply of Battery Grade Lithium. "Skyrocketing Lithium prices unlikely to stabilize soon", says Ganfeng Lithium Chairman: "Overall global demand for the material could reach 3 million tons by 2030".

"With these kinds of numbers, some analysts in our industry may start calculating potential future NSR Royalty cash flows for TNR Gold from the Mariana Lithium Project closer to US$15 million per year rather than US$5 million, even after Ganfeng will execute its buyback right for 1% of NSR."

This is why I constantly invest in TNR Gold and other insiders joined me. Nobody knows the future, we can only do our best to make it.

"There is magic, but you have to be a Magician to make this magic happen". Sidney Sheldon.

We have found Mariana Lithium Project many years ago in 2009. Now after more than a decade this beautiful project has grown into one of the largest Lithium Brine projects in the world.

"Ganfeng has successfully advanced Mariana Lithium to the construction stage. This is after a 55% increase in the measured and indicated resource estimate from the previously announced 2020 resource estimate at Mariana. We extend our congratulations to Ganfeng and salute the people of Argentina on the successful approval of the Environmental Impact Report by the Salta regional government in Argentina and approvals for the construction of a plant with a designed annualized capacity of 20,000 tonnes per annum of lithium chloride."

"We are very pleased to see that this new plan represents a design capacity of 20,000 tonnes lithium chloride (LiCl) over the previously planned annual lithium production rate of 10,000 tonne-per-year lithium carbonate equivalent (LCE) presented in the Mariana Project preliminary economic assessment ("PEA"), announced in our news release of January 28, 2019. It was the first PEA on the project and provided a potential value for the total NSR royalty from Mariana's life of mine cashflow, which has now been significantly increased. We welcome the news from the Salta regional government, following its discussions with Ganfeng, that the likely project expenditure to bring the Mariana Project to full production is approximately US$600 million."

"We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in the Company's share price. We have received significant industry interest in our assets and the Company is working on potential new strategic partnerships to provide benchmarks for the market valuations of our royalty holdings. Such strategic transactions may potentially allow us to substantially improve our working capital position."

"TNR does not have to contribute any capital for the development of the Mariana Project. The 2.0% NSR royalty on the entire Mariana Project with Ganfeng Lithium is an important part of TNR's portfolio, (TNR holds a 0.2% NSR on behalf of a shareholder). Lithium Minera Argentina retains the buyback right on 1.0% of the NSR royalty as described herein. The essence of our business model is to have industry leaders like Ganfeng Lithium as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders."

Now the largest integrated lithium producer from China Ganfeng Lithium is developing this massive Mariana Lithium brine salar in Salta, Argentina. We are not even talking yet about any potash values at this stage, Mariana Salar brine contains one of the highest potash grades in Argentina.

And today the most important message for the future of the Mariana Lithium Project development will be a slide from the Ganfeng Lithium presentation, where they are calling this plan for 20,000 T Lithium Chloride annual production "Phase 1".

No comments:

Post a Comment