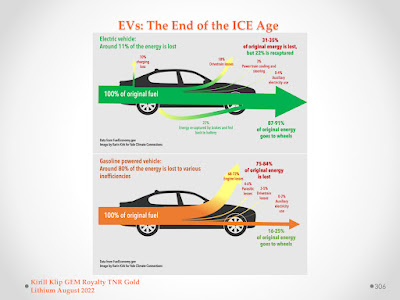

Despite the very challenging markets, sales of electric cars are going up exponentially and taking over our streets one by one. Electric cars are better on "the first level of physics": they are more energy efficient, cleaner than ICE during the full life cycle and much cheaper in their maintenance.

Now the question is not "If?", but only "When?" all cars will be electric. After the Tesla earthquake for the ICE automakers, the tsunami is taking all autos by storm. Consumers are demanding the best electric cars.

Gigafactories are mushrooming all over the world ramping up the production of Lithium batteries. Lithium prices hit new all-time highs in China. The End of the ICE Age is here and this energy transition depends on the secure supply of critical green energy metals like Lithium and Copper.

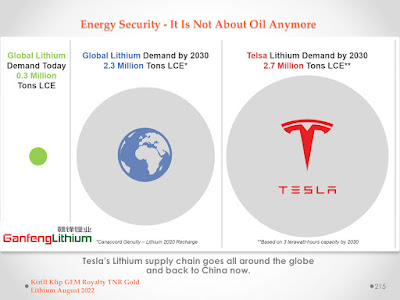

"Ganfeng's Chairman is talking about 3M T LCE of Lithium annual demand by 2030. Canaccord Genuity estimated that only Tesla will consume 2.7M T LCE annually by 2030."

"Very soon many investors will realise the danger of the digital divide between them and their money during the electrification of our transportation and energy sectors. The dreams about Lithium are driven by the real desire of automakers to have it yesterday.

They wish that they can rely on a secure stable supply of critical metals to feed Tesla Energy rEVolution. But this crucial ability to produce Battery Grade Lithium and the word lithium in the names of many companies are not the same."

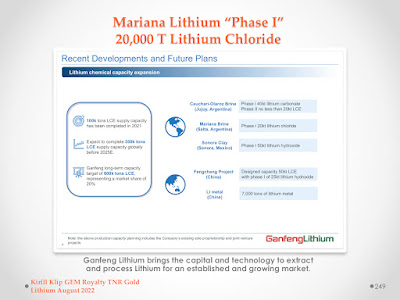

TNR Gold is plugged into Tesla Energy rEVolution with our Royalty Holdings on the Mariana Lithium Project with Ganfeng Lithium, Los Azules Copper, Gold and Silver Project with McEwen Mining and Batidero I and II Properties of Josemaria Copper-Gold Project with Lundin mining.

On my blog following the links below, you can find more information about TNR Gold Corp. and our Royalty Holdings. Do your own research, read all disclaimers, as usual, and stay safe and prosper. Join rEVolution!

Lithium Will Power Us For The Next 50 Years And Then Robots: Kirill Klip GEM Royalty TNR Gold Lithium Presentation

Kirill Klip, TNR’s Chief Executive Officer commented, “We are very pleased that after many months of deliberate negotiations we have achieved this major milestone for our Company and a further validation of TNR Gold’s business model. By monetizing part of our royalty holdings, we are providing a very important benchmark for valuations of assets in our royalty portfolio and generating very significant capital, while selling to LRC only a portion of our royalty holding on the Mariana Lithium Project.

This strategic transaction with LRC allows us to significantly improve our working capital position and strengthen our balance sheet. The parties expect the transaction to close within 60 days. The Company has received an initial advance of USD$350,000 from LRC under the terms of the royalty purchase agreement.

We believe that our royalty holdings are undervalued, and their appropriate values are not reflected in the Company’s share price. This transaction clearly demonstrates it. We have generated a total amount of cash for TNR Gold that is well above the Company’s recent market capitalization. We have received significant industry interest in our assets and the Company is working on potential new strategic partnerships to provide further benchmarks for the market valuations of our royalty holdings.”

No comments:

Post a Comment