"The Great Crypto Scam". The Circus Left, But Clowns are Still Here. Where is Your Money?

"The simple question to answer is: "Can theoretically some super-smart specially gifted people digitise ENRON's brave advanced accounting, Bernie Madoff's and Lehman Brothers' "Best Investment Practices"; encrypt it all for safely with a lot of BS, put it on a blockchain and give it as a finished product to ReTail to enjoy? In the end, it seems, that this is exactly what they really want to keep them happy while they are FOMO chasing their Day Dreams with LAMBos". A lot of Circus entertainment and some Bread for some, sometimes. All the same, just encrypted with a lot of hard to understand Crypto Tech jargon and other BS spices, so it tastes so good."

"I would say, why not? After all, other "One Thousand and One" known to humans scams are already being tortured by elliptic-curve cryptography in the Dark Crypto Web and put on different blockchains. Needless to say, that Circus has left already, probably, with all treasure troves, only clowns are still here."

"Blessed are the young with their ignorance and they will be forgiven. But those who know, will not escape their own judgement, they know better. When The Great History of Cults is written, this chapter will be one of the best page-turners."

How could so many bright people miss the whole point of another beautiful idea... again? How could dirty hands corrupt so quickly with Greed and Lust FOMOs the commandments of The White Paper? Bitcoin Crypto Bubble, like every other Great Bubble, demands from the Great People to self-sacrifice in order to become The Great Crypto Bubble. "The revolution always eats its own children."

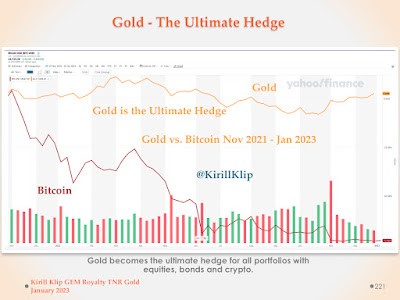

"There is no Gold 2.0 - there are more than 5,000 years of human history with Gold. We have another confirmation of the unique status of Gold - as the ultimate hedge for all portfolios constructed with equities, bonds and Crypto assets."

Masterpiece. Beautifully crafted by James Jani this brilliant video provides a superb detailed presentation of "The Great Crypto Scam". Those who are seeking the truth can find it in this video with a lot of very smart people to follow for your own research. On the link below you can find more information to dive deep into the Crypto MetaVerse. Make your own wise choices after your own due diligence. Now you have a lot of ideas on how to do it. Stay safe.

"Crypto myths are being dismantled one by one: Bitcoin is NOT Gold 2.0, Bitcoin is not an inflation hedge and Bitcoin is not a new asset class. Bitcoin is triggering, following and igniting the burst of all bubbles starting with technology sectors."

"Now it is imperative for us to save as many as we can. The whole generation is being slaughtered at the Crypto Slaughter House. Who will invest in the real future? Will people continue to "farm" after the collapse of this Crypto Tulip Bubble? We reap what we sow. To go ALL UP we need a lot of strategic metals for the Energy rEVolution: Lithium, Copper and Silver."

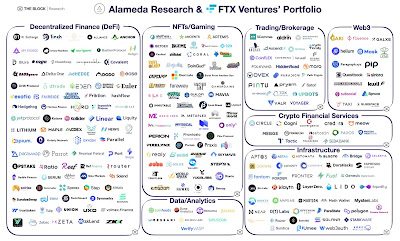

Why Banksters Are "Fighting" the FED with Tether Using Your Money? History Lessons of SEC and DOJ Rug Pulls, Tornado Black Swans and "Liberty Reserve" Black Friday

Specially gifted traders and Cult leaders should not be even bothered. Every single "investor" in any Crypto Dreams must invest 37 min of your time and watch very carefully the history lessons about SEC, IRS and DOJ Rug Pulls from "Liberty Reserve" Black Friday.