I would like to share with you today two most important news in the business world for me this week. The first one is that TNR Gold Team avoided casualties during this very tragic time for all of us and have raised successfully very fast CAD$280,000 out of announced CAD$300,000. All our Crew is ready to get our Ship out of the safe harbour and into the open see in line with all health, safety and financial regulations implemented during this very unprecedented period. We still have a few tickets left for our welcoming party of the new Shareholders, please contact me at your convenience, amps are warming up already.

The second news is that joining us new Shareholders and Investors who are increasing their positions appear to be very smart using this particular timing and the unique opportunity and will raise our operational Energy frequency on the spectrum, considering their own DD and research of our Story. I would like to welcome all our new Shareholders and thank all our Investors for your support of our Company. On your behalf, I would like to thank all our TNR Gold Team working tirelessly during this very difficult time.

Very brave discussions about the nature of the US Debt, make our very difficult job of building a successful business which will be generating wealth for years to come a little bit easier this week. We have always had this very strange feeling that some debt is different from the other. Before GFC some credit agencies have been rating different types of debt based on a lot of scientific financial metrics and ... the amount of money paid by those who would like their debt to be rated. This system was not very well designed for Creditors to survive 2008 bust and this year we will see the second half of that play. Basically, now all relatively sophisticated people understand that there are two major types of debt: the one which will be honoured and repaid and the one which will be not. Quite sudden revelations that US Debt can be cancelled for some brave holders of such financial instruments will have very far-reaching implications.

Larry Kudlow was making his best trying to explain what POTUS actually means. Apparently, all US Debt will still be honoured and the US Dollar will remain the Reserve Currency which is fully backed by the military power of the US who will decide: whom, how and when this Debt will be repaid. After very many years of our shy discussions in the local Gold Books Club that Global Reserve Currency status for the US Dollar may be over one day, we are entering this shocking for the remaining globalists part of the history of our species.

Now the world will never be the same. We saw the virus outbreak, pandemic, our governments readiness and reaction; and now we live in the lockdown. There can be circumstances when anything can be done for the common good. Now it is not a mental scientific experiment anymore, this is our brutal sobering reality. The US can kill the last goose laying golden eggs in the land of the free and the best export "Made in the USA" - US Dollar. Tesla was going to compete with it, but after last week we shall see, whether even geniuses can resist and keep under control their demons. Now even the most advanced believers of the human ingenuity which was applied to the creation of the banking system and the FED will realise that to have all your eggs in one basket can be wrong. In the end "The Federal Reserve System" is as "Federal" as "Federal Express.

It is important to remember, that when banks are going down, your deposits are going down with them, but your shares, bonds and Treasury holdings are in the name of the owner and can be recovered during the bankruptcy of the bank. If the same Treasury holdings can be cancelled for the particular names, Gold becomes much more than loving "Pet Rock". It reminds its status of the Real Money, not backed by any credit, anyone or anyone's desire to accept it back.

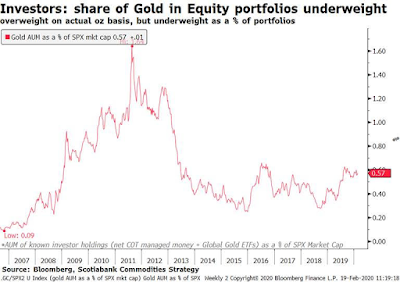

Now Bank of America dreams about Gold price handle of USD $3,000 in the next 18 months can be seen in a completely different light. UBS, Goldman Sachs placing their wealthy clients into Gold and 0.57% holdings for Gold in global equity portfolios make all this macro situation ready to produce the real fireworks. As you already know, TNR Gold is ready for this party, we are very well positioned with our assets portfolio for this macro play starting from our micro-level:

"I have started personally below $300. To put it in the right perspective, I call it: "I used to be smart." Now is the simple thing left, make it "Tenke Mining" for TNR Gold. Sweet memories, I have started buying Tenke Mining below 50 cents in Canada following Lukas Lundin."

Please always read legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blog. Always consult a qualified financial adviser before any investment decisions.

TNR Gold:

TNR Gold Announces Non-Brokered Private Placement First Tranche Close.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

"Vancouver, British Columbia – April 29, 2020: TNR Gold Corp. (TSX-V: TNR) (“TNR”, “TNR Gold” or the “Company”) is pleased to announce the close of the first tranche of the non-brokered private placement (the “Private Placement”) of up to 10,000,000 units (each a “Unit”) announced on April 14, 2020. On closing of the first tranche, the Company issued 9,333,333 Units at $0.03 per Unit for proceeds of $280,000. Each Unit consists of one common share of the Company and one non-transferable common share purchase warrant (each a “Warrant”) exercisable into one common share of the Company at an exercise price of $0.05 per share for five years from the date of issue.

The proceeds of the Private Placement will be used for exploration and maintenance of the Company’s projects in Alaska and Argentina, management consulting fees, office administration, regulatory fees, audit, legal and IT. A cash commission will be paid to Nicholas Winton. The commission consists of 5% of the gross proceeds sourced by him.

All Private Placement securities will be restricted from trading for a period of four months plus one day from the date of closing.

Kirill Klip, Executive Chairman of the Company and a non-arms’ length party, participated in this Private Placement. The issuance of private placement securities to non-arms’ length parties constitutes related-party transactions under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Because the Company’s shares trade only on the TSX Venture Exchange, the issuance of securities is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(b) of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101 pursuant to Section 5.7(b). The Company did not file a material change report 21 days prior to the closing of the private placement as the details of the participation of insiders of the Company had not been confirmed at that time.

The Private Placement is subject to final approval of the TSX Venture Exchange.

ABOUT TNR GOLD Corp.

TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Over the past twenty-four years, TNR, through its lead generator business model, has been successful in generating high-quality exploration projects around the globe. With the Company’s expertise, resources and industry network, it identified the potential of the Los Azules Copper Project in Argentina and now holds a 0.36% NSR Royalty on the entire project, which is being developed by McEwen Mining Inc.

In 2009, TNR founded International Lithium Corp. (“ILC”), a green energy metals company that was made public through the spin-out of TNR’s energy metals portfolio in 2011. ILC holds interests in lithium projects in Argentina, Ireland and Canada.

TNR retains a 1.8% NSR Royalty on the Mariana Lithium Project in Argentina. ILC has a right to repurchase 1.0% of the NSR Royalty on the Mariana Lithium Project, of which 0.9% relates to the Company’s NSR Royalty interest. The Company would receive $900,000 on the completion of the repurchase. The project is currently being advanced in a joint venture between ILC and Ganfeng Lithium International Co. Ltd.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources Inc.

The Company’s strategy with Shotgun Gold Project is to attract a joint venture partnership with one of the gold major mining companies. The Company is actively introducing the project to interested parties.

At its core, TNR provides significant exposure to gold, copper and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and Argentina (the Los Azules Copper and the Mariana Lithium projects) and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the Board of Directors,

Kirill Klip

Executive Chairman

For further information concerning this news release please contact +1 604-229-8129

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “will”, “could” and other similar words, or statements that certain events or conditions “may” or “could” occur, although not all forward-looking statements contain these identifying words. Specifically, forward-looking statements in this news release include, but are not limited to, statements made in relation to: TNR’s corporate objectives, changes in share capital, market conditions for energy commodities, the results of McEwen Mining’s and ILC’s PEAs, and improvements in the financial performance of the Company. Such forward-looking information is based on a number of assumptions and subject to a variety of risks and uncertainties, including but not limited to those discussed in the sections entitled “Risks” and “Forward-Looking Statements” in the Company’s interim and annual Management’s Discussion and Analysis which are available under the Company’s profile on www.sedar.com. While management believes that the assumptions made and reflected in this news release are reasonable, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. In particular, there can be no assurance that: TNR will be able to repay its loans or complete any further royalty acquisitions or sales; debt or other financing will be available to TNR; or that TNR will be able to achieve any of its corporate objectives. TNR relies on the confirmation of its ownership for mining claims from the appropriate government agencies when paying rental payments for such mining claims requested by these agencies. There could be a risk in the future of the changing internal policies of such government agencies or risk related to the third parties challenging in the future the ownership of such mining claims. Given these uncertainties, readers are cautioned that forward-looking statements included herein are not guarantees of future performance, and such forward-looking statements should not be unduly relied on.

In formulating the forward-looking statements contained herein, management has assumed that business and economic conditions affecting TNR and its royalty partners, McEwen Mining Inc. and International Lithium Corp. will continue substantially in the ordinary course, including without limitation with respect to general industry conditions, general levels of economic activity and regulations. These assumptions, although considered reasonable by management at the time of preparation, may prove to be incorrect.

Forward-looking information herein and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and are expressly qualified in their entirety by this cautionary statement. Except as required by law, the Company assumes no obligation to update forward-looking information should circumstances or management’s estimates or opinions change."

No comments:

Post a Comment