Something's broken, something unspoken... The chatter about something very serious which is happening in the financial markets is intensifying in Europe. Gold is pushed down today below $1,400 again on the "very solid" NFP numbers, but the resilience of this new Gold Bull is making people talk. Even G20 manipulation was not able to bring gold down and it snapped back above $1,400 almost immediately. Today there will be a lot of talk about the double top in gold, but do not miss the Big Picture with all market noise these days.

In our quest for the answers, maybe, we should go no further than the numerous headlines about "restructuring" of Deutsche Bank today. We should revisit first the blog post from 2016 and the $60 Trillion "derivatives nuclear bomb" on the Deutsche Bank's books. All good things take time, people are getting old and some of us are getting wiser, but here as it looks now - it is not the case.

As Pam Martens and Russ Martens wrote in their article in April: "After a $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion in Derivatives". Even after all efforts "to trim the derivatives exposure" and bailouts Deutsche Bank was still holding ... $49 Trillion in Derivatives in 2018 - the largest derivatives book on the Wall Street.

That Derivatives WMD Bomb has never been really defused. We can only speculate now how this "new restructuring" is affecting Deutsche Bank derivatives portfolio and, hopefully, this "reorganisation" will be happening orderly. Otherwise, as we all know, the financial system can be tested to its core with the systemic shock in case if this largest derivatives counterparty goes dark. It is great to discuss the Net Exposure to derivatives in the financial system when there is somebody to deliver that Hedge. In the case when the major counterparty in all these financial games with derivatives will be gone missing, gold has a very long way to go up recalibrating what will be left of the financial systems.

It is important to note that the record amount of debt with negatives rates and the planed FED rates cut in July are happening with the gold price still at the record low if we will adjust it properly for the real consumer inflation. And yes, a blast from the past, which is now officially confirmed:

In our quest for the answers, maybe, we should go no further than the numerous headlines about "restructuring" of Deutsche Bank today. We should revisit first the blog post from 2016 and the $60 Trillion "derivatives nuclear bomb" on the Deutsche Bank's books. All good things take time, people are getting old and some of us are getting wiser, but here as it looks now - it is not the case.

As Pam Martens and Russ Martens wrote in their article in April: "After a $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion in Derivatives". Even after all efforts "to trim the derivatives exposure" and bailouts Deutsche Bank was still holding ... $49 Trillion in Derivatives in 2018 - the largest derivatives book on the Wall Street.

That Derivatives WMD Bomb has never been really defused. We can only speculate now how this "new restructuring" is affecting Deutsche Bank derivatives portfolio and, hopefully, this "reorganisation" will be happening orderly. Otherwise, as we all know, the financial system can be tested to its core with the systemic shock in case if this largest derivatives counterparty goes dark. It is great to discuss the Net Exposure to derivatives in the financial system when there is somebody to deliver that Hedge. In the case when the major counterparty in all these financial games with derivatives will be gone missing, gold has a very long way to go up recalibrating what will be left of the financial systems.

It is important to note that the record amount of debt with negatives rates and the planed FED rates cut in July are happening with the gold price still at the record low if we will adjust it properly for the real consumer inflation. And yes, a blast from the past, which is now officially confirmed:

"FED has never had a chance to reload "Efficient Central Bankers Economy" gun this time."

Why Gold? Deutsche Bank And $60 Trillion Derivatives - Is It The Last Snowflake Before The Avalanche?

"Dan Stringer wrote a great article covering Deutsche Bank's exposure to derivatives, why it doesn't matter you can read in the official reports. Why it does matter the market is telling us today: DB is at all time low, Credit Swiss is at all time low and Barclays is down another 5% today. As you know, I have a very unconventional theory: that actual state of the financial system is so bad that they will save it by all means now. By the way, if they fail - it will not matter any more anyway. Tomorrow just watch Janet Yellen turning this market around and US Dollar will be the victim. Gold is shining bright now. We will have a very interesting situation with the majority of market participants reversing the trades this year from being Short Gold and other Commodities and Long Us Dollar, once the message from the FED will be clear - we have just made a policy mistake. FED has never had a chance to reload "Efficient Central Bankers Economy" gun this time."

We have discussed in depth the McKinsey's Gold Reserves crisis and you can find this analysis on my blog. According to McKinsey: "Reserves by major Gold companies have declined 26% from 2012 and now below 2007 levels." M&A will be only part of the solution for some companies as it only redistributes the same Gold reserves, we need new discoveries and new elephant projects coming online just to address the gap between growing demand and available supply.

Barrick Gold is developing together with NovaGold 40MOZ giant Donlin Gold in Alaska - "arguably the most important Gold project in the world." So where will you be looking for the new elephants? Maybe in the Alaskan Elephant Country.

Barrick Gold received crucial permits to advance Donlin Gold now and this new developing mining district in the US can make the promise of "Gold In the USA" providing stable supply feasible again and it can become that solution to "The Gold Mining Reserve Crisis" McKinsey is talking about:

"The Company's strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR Gold ("TNR") is actively introducing the project to interested parties," commented Kirill Klip, Executive Chairman of TNR. "We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner that shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time."

Gold In The USA: Kirill Klip GEM Royalty TNR Gold Presentation May 2019 - Gold In The Alaskan Elephant Country.

Wall Street on Parade:

By Pam Martens and Russ Martens: April 17, 2019

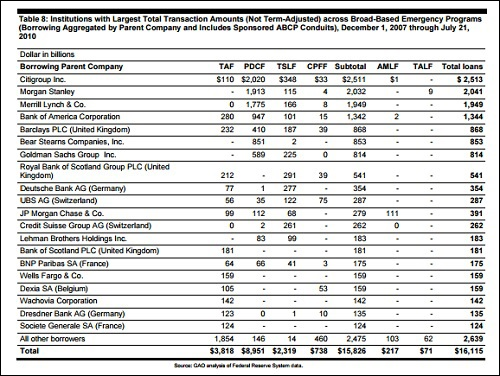

On July 21, 2011, when the GAO released its audit of the Federal Reserve’s secret $16.1 trillion in bank loans during the financial crisis, a foreign bank ranked number 9 on the list of the largest borrowers. The loans went not just to the largest banks on Wall Street but to foreign derivative counterparties to the Wall Street banks. The foreign bank that ranked 9 on the list of the largest borrowers was Germany’s largest bank, Deutsche Bank, which took $354 billion in revolving loans from the U.S. Federal Reserve.

According to an article in the Financial Times last week “Germany’s federal and state governments have spent €70bn on bailing out banks since the financial crisis, according to an estimate by Gerhard Schick, head of lobby group Finance Watch.” The figure of €70bn is about 79 billion U.S. dollars. Why did the U.S. Fed throw $364 billion at one German bank when its country of origin has only reached in its pocket to the tune of $79 billion for all of its troubled banks? (Read on for the answer.)

During 2018, the serially troubled Deutsche Bank – which still has a vast derivatives footprint in the U.S. as counterparty to some of the largest banks on Wall Street – trimmed its exposure to derivatives from a notional €48.266 trillion to a notional €43.459 trillion (49 trillion U.S. dollars) according to its 2018 annual report. A derivatives book of $49 trillion notional puts Deutsche Bank in the same league as the bank holding companies of U.S. juggernauts JPMorgan Chase, Citigroup and Goldman Sachs, which logged in at $48 trillion, $47 trillion and $42 trillion, respectively, at the end of December 2018 according to the Office of the Comptroller of the Currency (OCC). (See Table 2 in the Appendix at this link.)

Deutsche Bank’s feeble 10 percent reduction in mind-numbing derivatives stands in stark contrast to the reduction in Deutsche Bank’s share price last year. On the first trading day of 2018, Deutsche Bank opened at $19.27. On the last trading day of the year, December 31, 2018, Deutsche Bank closed at $8.15 – a reduction in shareholder value of 58 percent.

What that did to Deutsche Bank’s market capitalization was this: with 2,066,773,131 shares outstanding at both the start of the year and at the end of the year, shareholders lost an enormous $23 billion in market cap.

In 2011 when the GAO released the list of the banks that had received the $16.1 trillion in secret loans from the Fed during the financial crisis, two other foreign banks ranked in the top ten of those receiving this strange largesse from the U.S. central bank: the U.K. mega bank, Barclays, ranked number 5 with $868 billion in cumulative borrowings and the Royal Bank of Scotland Group PLC, also of the U.K., ranked number 8 with $541 billion in revolving loans from the Fed. (See chart below.)

With those numbers in mind, now study this chart provided by the Financial Crisis Inquiry Commission, which issued subpoenas and took testimony from more than 700 witnesses. The chart lists Goldman Sachs’ derivatives counterparties as of June 2008 and the dollar amount of exposure. Between Deutsche Bank, Barclays, and the Royal Bank of Scotland, Goldman had a cumulative derivatives exposure to just those three foreign banks of $7.2 trillion notional (face amount).

Goldman is just one investment bank. Add in the derivatives exposure to these foreign banks by Citigroup, JPMorgan Chase, Morgan Stanley, Merrill Lynch and one can begin to understand why the Federal Reserve wanted to keep its $16.1 trillion in revolving loans to both domestic and foreign banks a big secret from the American people. That’s because the Federal Reserve is not just the U.S. central bank but it is also a regulator of bank holding companies, which includes the largest banks on Wall Street. It had allowed this stockpile of financial weapons of mass destruction to grow exponentially in the years leading up to the 2008 Wall Street collapse. According to Phil Angelides, the Chair of the Financial Crisis Inquiry Commission, the “notional value of over the-counter derivatives grew from $88 trillion in 1999 to $684 trillion in 2008.” And it grew in a dark and mostly unregulated market.

Rather than stripping away the regulatory powers of such an incompetent regulator as the Fed, Congress succumbed to the demands of Wall Street lobbyists and gave the crony Fed broadened supervisory powers over the Wall Street banks in the 2010 financial reform legislation known as Dodd-Frank. (Those expanded powers continue to this day despite one of its own bank examiners, Carmen Segarra, blowing the whistle on how she was fired because she wouldn’t bow to pressure to change her examination of Goldman Sachs.)

One of the Fed’s enhanced regulatory powers was to conduct stress tests of the big banks – effectively to convince the American people that the banks were safe and sound again. But in 2016 when researchers at the Office of Financial Research looked at how the Fed was conducting these stress tests, they concluded that the Fed was doing it all wrong. (We think this wasn’t a bug but a feature of how the Fed was pretending to oversee the Wall Street banks while allowing the dangerous derivative markets to continue.)

The OFR researchers who conducted the study, Jill Cetina, Mark Paddrik, and Sriram Rajan, determined that the Fed’s stress tests are measuring counterparty risk for the trillions of dollars in derivatives held by the largest banks on a bank by bank basis. The real problem, according to the researchers, is the contagion that could spread rapidly if one big bank’s counterparty was also a key counterparty to other systemically important Wall Street banks. The researchers wrote:

“A BHC [bank holding company] may be able to manage the failure of its largest counterpartythe system’s largest counterparty. Thus, the impact of a material counterparty’s failure could affect the core banking system in a manner that CCAR [one of the Fed’s stress tests] may not fully capture.” [Italic emphasis added.]

The black hole surrounding derivatives is just as dark today as it was in 2008 – and just as dangerous. The Financial Crisis Inquiry Commission had this to say about the crash: “the existence of millions of derivatives contracts of all types between systemically important financial institutions—unseen and unknown in this unregulated market—added to uncertainty and escalated panic, helping to precipitate government assistance to those institutions.” There is not one Federal or state regulator today who could tell you which counterparty has the most concentrated risk to derivatives. Nor is there one Wall Street bank who has clarity on this issue — because the majority of the over-the-counter derivative contracts are secret contracts between one party and another.

We know that Deutsche Bank’s derivative tentacles extend into most of the major Wall Street banks. According to a 2016 report from the International Monetary Fund (IMF), Deutsche Bank is heavily interconnected financially to JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as other mega banks in Europe. The IMF concluded that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections – and that was when its market capitalization was tens of billions of dollars larger than it is today.

Until these mega banks are broken up, until the Fed is replaced by a competent and serious regulator of bank holding companies, and until derivatives are restricted to those that trade on a transparent exchange, the next epic financial crash is just one counterparty blowup away.

No comments:

Post a Comment