Frank Holmes gives a very good observations of the driving forces in the gold market and point our attention to Swiss Gold Referendum again.

Swiss Gold Initiative Referendum to Acquire 1500 tons of Gold.

On November 30th, the 8 million citizens of Switzerland will vote either YES or NO in an opportunity to determine the fate of their own financial system. On the ballot will be three matters which would effectively make Switzerland the first country in the world with an official partial gold-backing of their currency. Citizens will vote on:

1) Returning their national gold which is held abroad back to Switzerland

2) Requiring the Swiss National Bank to hold 20% of their assets in physical gold

3) Prohibiting further gold sales

What will a “YES” vote mean for Switzerland and gold? Read more."

Kitco:

SWOT Analysis: Gold Appears to Have Reached a Bottom

Strengths

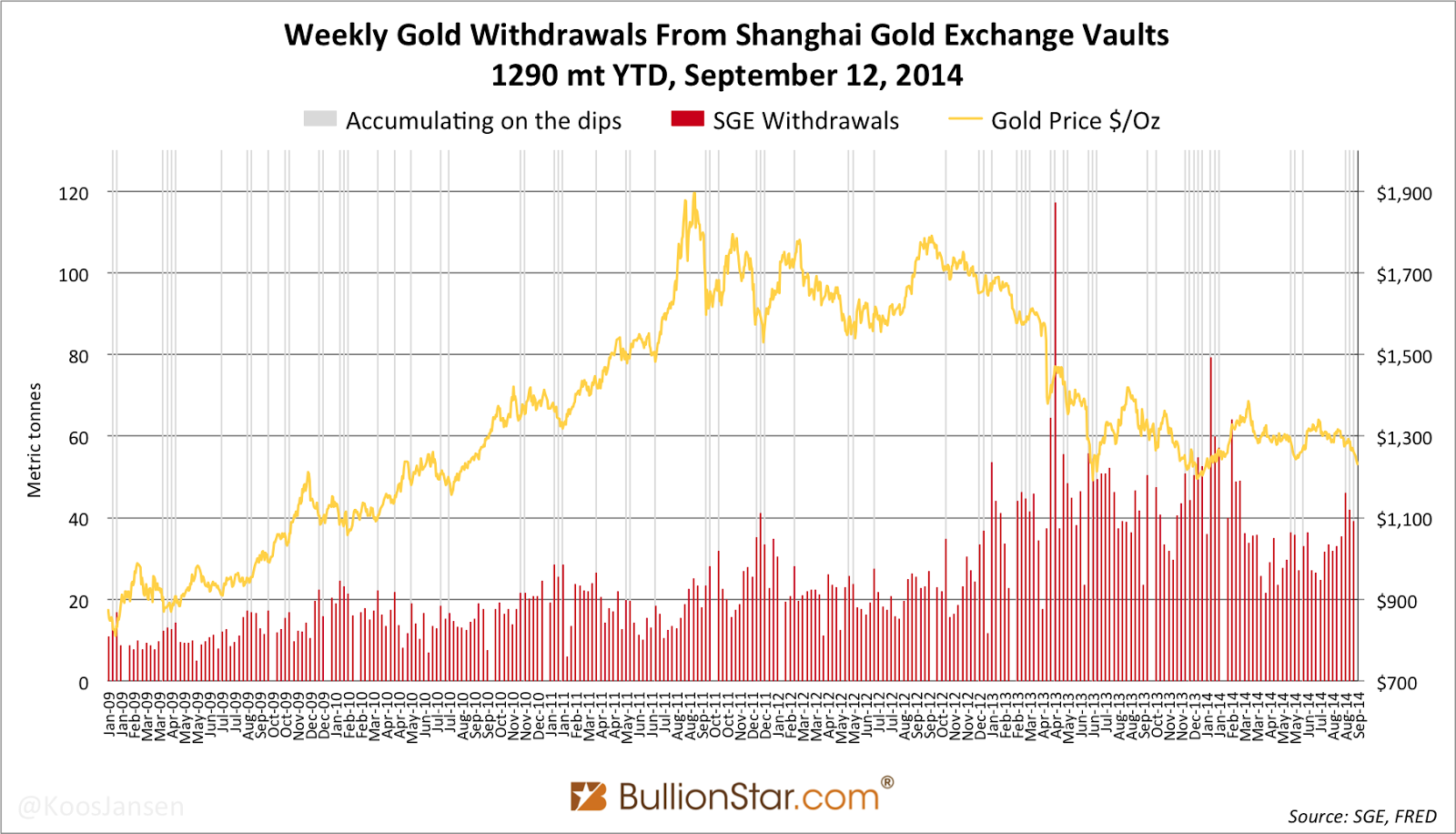

- After the one-week holiday, Chinese consumers returned to the gold markets. Gold futures rose this week as many anticipate the Chinese will take advantage of lower gold prices. Indeed, gold seemed to withstand recent decreases in oil prices as well as increases in the dollar, implying that many investors are taking advantage of the bargain prices. On Friday, the Bank Credit Analyst highlighted that gold prices are unlikely to break down after successfully bouncing off support at $1,200 and are poised to stage a relief rally into the end of the year.

- Franco-Nevada Corp. has entered into an agreement with Lundin Mining Corp. to acquire a gold-silver stream. Lundin recently purchased an 80-percent interest in Freeport-McMoRan’s Candelario/Ojos del Salado mining complex in Chile.

- There was a significant amount of positive news from many companies this week. Balmoral Resources Ltd. reported that its drill results revealed a higher-grade potential at its Martiniere property. Romarco Minerals, Inc. received its awaited 401 Water Quality Certification for its Haile project. Lastly, Richmont Mines raised its gold output view to 85,000-90,000 ounces, claiming strong performance from Island Gold mine.

Weaknesses

- This week, Deutsche Bank recommended shorting gold due to the strong dollar environment.

- A continuation of the prevailing socialist model in South America, Chile’s Supreme Court granted a petition by the Diaguita communities to overturn a resolution to develop the El Morro gold-copper project joint venture (JV) in Chile. This is the third time Goldcorp’s El Morro project has been suspended in three years.

- This week Luna Gold established a special committee of independent board members to look into strategic alternatives. The stock tumbled as much as 30 percent on the news.

Opportunities

Multiple opportunities relating to the Swiss National Bank Gold Initiative:

- Switzerland has decided to hold a vote on the initiative, which would force the central bank to hold at least 20 percent of its assets in gold. The initiative, scheduled for a November 30 vote, would forbid the sale of any holdings and require them to be held in Switzerland.

- If passed, the Swiss National Bank would have to buy roughly 1,500 tonnes of gold over five years to meet the 20-percent requirement. Since 1993, the Bank has reduced its gold holdings by 1,550 tonnes, the largest liquidation by any central bank. Changing from the largest seller to a rapid buyer should create serious tailwinds for gold.

- The initiative put forth in Switzerland is part of a larger theme relating to increased gold purchases by central banks. Global central bank reserve holdings had been declining without interruption since 1989 until the financial crisis. Since 2008, there has been a steady rise in central bank gold holdings. With the possibility of substantial purchases from the Swiss National Bank, this rise should continue.

Threats

- This week, BMO Capital Markets, Morgan Stanley and ANZ all reinforced their negative outlook for gold prices. While this consensus is negative, such wide consensus agreement usually coincides with a reversal in the going trend.

- The World Gold Council is calling on India to mobilize and monetize its household savings imbedded in physical gold stocks. If the Indian government decides to use the idle gold from households and temples, it would reduce the need for future imports, which would be negative for global gold demand.

- Uncertainty from residents of the Mokopane area in the northern Limpopo province of South Africa is threatening to hold up Robert Friedland’s platinum project. The billionaire promised the residents a 20-percent stake in the project, but the residents remain unsure of the exact method of repayment for the project.

No comments:

Post a Comment