TNR Gold is moving quickly on its path to transitioning from a project-generating junior mining company into a cash-flow-generating royalty company. We believe that the recent market prices of our shares do not properly reflect the underlying value of the shares and that this transformation will bring the necessary catalyst to crystallise the potential valuation of our assets for investors in the marketplace. Let's explore our company's rising value proposition.

All three of TNR Gold's royalty projects are featured in the Argentina Secretariat of Mining investment feature. Our Company holds 1.5% NSR royalty (of which 0.15% is held on behalf of a shareholder) on Mariana Lithium with Ganfeng, 0.4% NSR royalty (of which 0.04% is held on behalf of a shareholder) on Los Azules Copper with McEwen Mining and 7% net profits royalty on Batidero I and II properties of Josemaria with Lundin Mining.

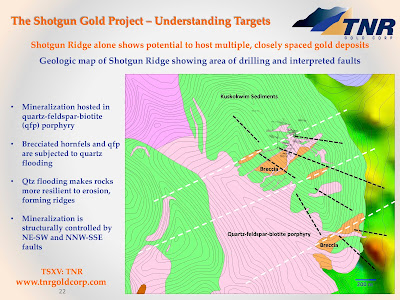

"TNR Gold’s portfolio spans various mining assets, with a key focus on its Shotgun gold project in Alaska and royalties in two advanced-stage projects in Argentina: the Mariana lithium project, owned by Ganfeng Lithium, and the Los Azules copper-gold project, held by McEwen Copper.""TNR Gold is about to make a strategic shift in its business model and position itself as a revenue-generating royalty firm, according to analysts at Fundamental Research Corp.Production began earlier this year at the Mariana lithium project, owned by China’s Ganfeng Lithium, with TNR set to begin receiving royalty payments as early as the fourth quarter of 2025.

Based on current spot lithium prices, Fundamental Research estimates annual royalty revenue from Mariana could reach C$1 million." (Angela Harmantas)"The company's other flagship royalty asset is on the Los Azules copper-gold project in Argentina, controlled by privately held McEwen Copper Inc, a division of McEwen Mining Inc (TSX:MUX, NYSE:MUX). The large-scale, open-pittable deposit holds an estimated 38 billion pounds of copper, 4.7 million ounces of gold, and 159 million ounces of silver. McEwen plans to complete a resource update and feasibility study this quarter, with construction targeted for 2026 and production slated to start by 2029.FRC projects that TNR’s royalty from Los Azules could generate annual revenues of up to C$10 million at current copper prices.The firm reiterated its Buy rating and increased a fair value estimate from C$0.28 to C$0.30 per share, compared with a current trading price of C$0.09." (Angela Harmantas)Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

"Marketing Success and Industry Recognition

- Recent increased M&A interest from numerous parties suggests that TNR’s management (“Management”) has succeeded with its marketing activity by presenting the Company’s GEM Royalty Story to the mining and investment industries.

- In February 2023, Lithium Royalty Corp. valued only a portion of the Company at US$9 million, based on its purchase of the 0.5% NSR royalty involving the Mariana Lithium project for US $9 million.

- Our team has successfully repaid TNR Gold’s investment loan in full, returning our shareholders all our assets free from encumbrance. The value generated from delivering that strategic transaction has justified Management’s stance on rejecting other opportunistic low-ball offers."

"Mariana is a lithium-potassium salt lake located in Salta Province, Argentina. According to a technical report issued by Golder Associates Consulting Ltd., the total lithium resources at the Mariana lithium salt lake project amounted to approximately 8,120,000 tons of LCE. The construction of the project has been completed. In February 2025, the production line for phase I of the Mariana lithium salt-lake project with a planned annual production capacity of 20,000 tons of lithium chloride was officially put into operation. The Company will accelerate the progress of the production capacity ramp-up of the project, and it is expected that the Mariana project will gradually supply lithium chloride products in a stable manner from the second half of 2025 onwards." (Ganfeng Lithium, 2024 Annual Report, April 30, 2025)"

"But is the Mariana royalty even the best asset inside TNR?"

"Arguably not, since the Los Azules royalty, according to some calculations, may be worth as much as US$30mln. Rob McEwen himself holds a 1.25% NSR royalty over Los Azules, and he’s been putting some pretty punchy numbers around his own interest in his recent video presentations. (Alatair Ford)

"The company's other flagship royalty asset is on the Los Azules copper-gold project in Argentina, controlled by privately held McEwen Copper Inc, a division of McEwen Mining Inc (TSX:MUX, NYSE:MUX). The large-scale, open-pittable deposit holds an estimated 38 billion pounds of copper, 4.7 million ounces of gold, and 159 million ounces of silver. McEwen plans to complete a resource update and feasibility study this quarter, with construction targeted for 2026 and production slated to start by 2029.FRC projects that TNR’s royalty from Los Azules could generate annual revenues of up to C$10 million at current copper prices." (Angela Harmantas)