Gold continues to shine incredibly brightly during this magnificent historical rally, and we continue our Chronicles of the Gold Bull Market and TNR Gold's Shotgun Gold Project. Without any further hesitation, Gold rushed to the new highest daily closing in history, printed at $2,928 on February 13, smashing before its ATH at $2,908 on February 10, 2025.

Gold demonstrates its incredible performance in the 21st century, as it provides The Ultimate Hedge for all portfolios constructed with stocks, bonds and crypto assets. Asian societies understand very well the unique qualities of Gold.

"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

Angela Harmantas from Proactive is writing about the new report on TNR Gold from Fundamental Research Corp:

"TNR Gold’s portfolio spans various mining assets, with a key focus on its Shotgun gold project in Alaska and royalties in two advanced-stage projects in Argentina: the Mariana lithium project, owned by Ganfeng Lithium, and the Los Azules copper-gold project, held by McEwen Copper."

"TNR Gold is on the brink of generating significant royalty revenue from its stake in Ganfeng Lithium's Mariana lithium project in Argentina as it heads toward commercial production, Fundamental Research analysts believe.The analysts have raised their share price target for TNR from $0.24 to $0.28 per share, highlighting the imminent cash flow potential from this strategic investment."

(Angela Harmantas)

TNR Gold – AmeriGold – Shotgun Gold

The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path to moving this project forward using current geological and geophysical research to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time.

Our strategy presented to potential strategic partners involves the creation of a JV with one of the major gold mining companies. Our partner be investing very substantial capital in the development of the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders will benefit from the strategic partner’s capital being invested “in the ground” and industry expertise, including operations in Alaska.

Management is investigating the best value creation strategies for the Shotgun Gold Project and has established the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project JV operations after the contemplated potential spinout from TNR Gold.

Alastair Ford: TNR Gold’s Recent Rejection of a Takeover Bid From Lithium Royalty Has Shone a Spotlight on the Value of Its Royalty and Exploration Portfolio

Previously, Gold struck 3 ATHs in a row and marched to the ATH at $2,867 on February 5, striking ATHs at $2,815 on February 3 and at $2,842 on February 4, 2025.

Gold demand hits new record in 2024

"Central banks and investors drive market strengthTotal gold demand (including OTC investment) rose 1% y/y in Q4 to reach a new quarterly high and contribute to a record annual total of 4,974t.Central banks continued to hoover up gold at an eye-watering pace: buying exceeded 1,000t for the third year in a row, accelerating sharply in Q4 to 333t.

Annual investment reached a four-year high of 1,180t (+25%). Gold ETFs had a sizable impact: 2024 marked the first year since 2020 in which holdings were essentially unchanged, in contrast to the heavy outflows of the prior three years.Full-year bar and coin demand was in line with 2023 at 1,186t. The composition shifted as bar investment grew and coin buying reduced.Annual technology demand was also additive to the global total: it grew by 21t (+7%) in 2024, largely driven by continued growth in AI adoption.Gold jewellery was the clear outlier: annual consumption dropped 11% to 1,877t as consumers could only afford to buy in lower quantities. Nonetheless, spend on gold jewellery jumped 9% to US$144bn." (World Gold Council)

It happened just the next day after Gold struck the previous ATH daily closing at $2,793 on January 30, 2025. This very brief consolidation phase lasted only a couple of months. The previous ATH daily closing was made by Gold at $2,788 on October 30, 2024.

Gold finished 2024 in style, surging 27% and striking a strong note with a new highest yearly closing in history at $2,624. Now we are in the much-needed consolidation phase of this Gold Bull Market following the parabolic breakout from the powerful bullish "Cup and Handle" technical formation.

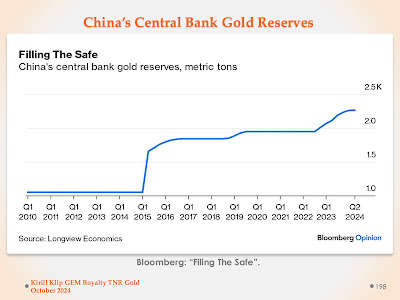

Gold contained its slide that started after the new ATH hit at $2,788 in October and continued consolidating and tracking an uptrend in December following the news from China that its central bank resumed buying Gold in November for the first time in seven months.

Next for Gold is a climb to $5,000 and over $10,000 after this healthy consolidation stage to digest the incredible gains of the last year. You can review the updated charts and my thoughts following the major stages of this unfolding generational investment opportunity for intelligent investors.

On October 30, Gold made a new highest daily close in history at $2,788 and finished that month on a very strong note, making a new monthly ATH at $2,742 on October 31, 2024.

Gold made previous ATHs at $2,775 on October 29 and at $2,748 on October 25, 2024. Gold has been celebrating breaking out above $2,700 for just a few days and decisively made a previous ATH at $2,746 on October 22, 2024. Healthy consolidation will be welcomed at this stage so that this magnificent Gold Bull Market can digest the gains after the amazing parabolic breakout move this year. Still, we are not in Gold Bubble territory yet.

Gold hits a record high above $2,700! Gold made a new highest daily closing in history at $2,721 on October 18, 2024. The previous ATH at $2,694 was hit just a day before, on October 17, 2024.

After a brief consolidation, Gold surged to another highest daily closing in history at $2,674 on October 16, 2024. This time, it took Gold just a few weeks to digest its explosive parabolic move to strike a new ATH, the previous all-time high was made at $2,673 on September 26, 2024.

Gold finished the third quarter of 2024 in style, showing its might and striking the new highest monthly and quarterly closings in history at $2,635 on September 30. Nothing grows straight into the sky, and this very powerful Gold Bull Market will continue its ascent to $5,000 and over $10,000 following the healthy consolidation stage.

Gold continued its parabolic move last week, making the new highest daily close in history at $2,673 on September 26, 2024. In its relentless ascent to new highs, Gold was striking one all-time high daily closing after another again: $2,629 on September 23, 2024; $2,658 on September 24, 2024; and $2,659 on September 25, 2024. The much-needed consolidation phase will be welcomed now for the health of this powerful Gold Bull Market after the amazing break-out phase.

Gold surged to $2,450 and made the previous highest daily close in history at $2,426 on May 20, 2024. Before it, Gold hit ATH at $2,414 on May 17, 2024. That jump followed a brief consolidation following the previous verticle climb of back-to-back all-time highs.

The history of Gold Cycles provided by Tavi Costa illustrates very well the main drivers of this new mighty Gold Bull Market. This is only the beginning of the new leg up after the breakout from the giant Cup and Handle technical formation.

Every consolidation phase will provide new opportunities and allow new investors to shift towards true solid values. New fortunes will be created by this powerful, dramatic rebalancing of the geopolitical and financial systems based on debt and its common denominator, the US Dollar.

Gold surged to the previous ATH at $2,391 on April 19, 2024. During that week, Gold again rushed from one ATH to another at $2,382 on April 15, 2024, and $2,383 on April 16.

Gold smashed a new intraday all-time high at $2,430 on April 12, 2024, after it made a previous ATH at $2,377 on April 11, 2024. During that week, Gold surged from one ATH to another at $2,339 on April 8, 2024, and $2,355 on April 9, 2024.

"The simple question to answer is: "Can theoretically some super-smart specially gifted people digitise ENRON's brave advanced accounting, Bernie Madoff's and Lehman Brothers' "Best Investment Practices"; encrypt it all for safely with a lot of BS, put it on a blockchain and give it as a finished product to ReTail to enjoy? In the end, it seems, that this is exactly what they really want to keep them happy while they are FOMO chasing their Day Dreams with LAMBos". A lot of Circus entertainment and some Bread for some, sometimes. All the same, just encrypted with a lot of hard to understand Crypto Tech jargon and other BS spices, so it tastes so good."

"I would say, why not? After all, other "One Thousand and One" known to humans scams are already being tortured by elliptic-curve cryptography in the Dark Crypto Web and put on different blockchains. Needless to say, that Circus has left already, probably, with all treasure troves, only clowns are still here."

"Gold is coiling into the very powerful spring and knocking on the new all-time high "Heaven's Door". As with all generational Bull Markets, any price suppression and market manipulation can lead only to one thing: another opportunity to accumulate the best stories in the Gold mining junior space where new fortunes will be created in the next few years to come.

Nobody knows the future, but history can teach us about manias and "irrational exuberance" spilling over from chasing Crypto Dragons into real assets and solid values that some junior miners can represent in the marketplace."

"Only the patient investors who still can read, analyse and use the powerful organic intelligence tool - calculator, will be rewarded by the ruthless Mr Market. Only you can decide what to do after your own research and due diligence."

"We are getting closer to The Next Catalyst for Gold. The whole new generation of investors has to learn the hard way history lessons. They must find real, solid values after being used, disillusioned and thrown away by "The Ponzi on Steroids". "The Thousand and One" digitized scams known to humans remain scams even on the blockchains."

"There is no Gold 2.0, there are over 5,000 years of humankind's history with Gold. Investors are tired of losing money by chasing Crypto Dragons and Bitcoin Dreams in the Tether Metaverse."

My Vision for TNR Gold and Strategy: Share Buyback, Potential Valuations, and Shotgun Gold Project Spinout

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

Today I would like to present our strategy for the Shotgun Gold Project in more detail for all our shareholders.

"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

TNR Gold – AmeriGold – Shotgun Gold

The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path to moving this project forward using current geological and geophysical research to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time.

Our strategy presented to potential strategic partners involves the creation of a JV with one of the major gold mining companies. Our partner will be investing very substantial capital in the development of the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders will benefit from the strategic partner’s capital being invested “in the ground” and industry expertise, including operations in Alaska.

Management is investigating the best value creation strategies for the Shotgun Gold Project and has established the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project JV operations after the contemplated potential spinout from TNR Gold.

This article is for information only and provides publicly available information, as well as my personal vision and valuation matrix of TNR Gold. I am the largest individual shareholder of our Company. Nothing in this blog post constitutes investment advice, offer or solicitation of the sale of any securities. As always, please carefully read all our legal disclaimers and conduct your own due diligence.

Thank you for your support of TNR Gold!

Tesla Nicola rEVolution and Gold.

No comments:

Post a Comment