Last Friday we had quite a special event on the TSX Venture Exchange represented by the CDNX chart above. Somebody big and "anonymous" was hammering junior miners one after the other into the ground running all the stop-loss limits.

During such a massacre, crypto bros would not turn a brow, at least according to their YouTube video testimonies, "Just Buy the Deep"... But the junior mining crowd was running scared selling what was left of their dreams into the falling market. As usual, many will be surprised that their stop-loss limits were executed at levels not even close to the limits.

When CDNX was sold almost into MA 200 and there was enough blood running on Bay Street, somebody big and still "anonymous" started buying everything good that scared retail was selling. Welcome to the jungle. Just another day at the TSX Venture Exchange.

Only time will tell whether this Friday Massacre Raid on the CDNX will turn into Summer of Love for Junior Miners. I can only share the sweet memories of how I was buying in July many years ago Tenke Mining at CAD $2.50 adding to my position being built from below CAD 50 cents... later Tenke Mining was bought out by Lundin Mining for CAD $20.

Updated CDNX chart on July 11, 2024.

The smart money continues to buy oversold stocks on CDNX during the summer doldrums.

"We are making the full circle here. I have started my investment journey in mining a very long time ago by now. I was very fortunate and lucky to buy my first Gold below $300 and Silver below $5. My best investment run in mining so far was in Tenke Mining with Lukas Lundin.I started my position in Tenke Mining below CAD 50 cents and later my stake was acquired as part of Lundin Mining's acquisition of Tenke Mining for CAD $20 dollars. Sweet memories. Following Lukas Lundin and his success, I found TNR Gold and the rest is history in my chronicles on this blog.Now TNR Gold is plugged into the Tesla Energy rEVolution with our NSR Royalty Holdings on the entire emerging giants in Argentina: Mariana Lithium with Ganfeng and Los Azules Copper, Gold and Silver with McEwen Mining."

You have to do your homework properly and find the best companies to participate in this generational investment opportunity. Your success will be defined in the end by the price you paid and the performance of the stock you have chosen. We have another unique entry point into the junior mining space to ride these Gold and Real Assets Bull Markets.

"How to spot the next M&A target? What if you learn that insiders of major Royalty companies have bought personal stakes in a small but very promising company holding royalties in lithium, copper, gold and silver projects under development by industry leaders like Ganfeng Lithium, Rio Tinto, McEwen Mining and Lundin Mining?"

"Maybe you are already as well in a very good company with your investment by now. But first, let’s dive into Royalty companies and their business models."

"The concept of long-term investing and holding your positions until the fruition of your investment thesis was trashed by the crypto bros by their "HODL" in recent years. Probably because the longer you hold any crypto digital scam - the more confirmations you get that they are working exactly the same way as "The Thousand and One" known to humans old scams."

"But how other way can you enjoy Apple growing all the way up? Just a couple of years ago every crypto ape was laughing at Warren Buffett and some potheads from the media were calling SBF the "next Warren Buffett" and "JP Morgan" of Crypto, now SBF is calling his mum from jail."

Chart by Nicholas Winton

"There is Magic, but you have to be the Magician. You have to make the Magic happen." That beautiful Dragonfly Doji candle printed by CDNX on Friday indicates that the smart money is accumulating the best names among junior miners on TSX Venture after Scared Retail was selling in total despair.

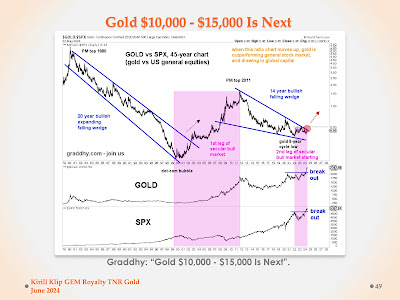

Fundamentals for Gold, Green Energy Metals and Commodities are supporting this point of view and last time I checked Central Banks were buying Gold and not Nvidia. On the links below you can find my latest thoughts on our main metals of interest: Gold, Silver, Copper and Lithium. And how we are building TNR Gold into The Green Energy Metals Royalty and Gold Company to realise the real potential of valuation for our assets for all our shareholders despite all efforts by naughty and ruthless Mr Market shaking our tree.

No comments:

Post a Comment