Guest post:

Daimler, The End Of The Internal Combustion Engine And The Curious Case Of Plug-In Hybrids.

"The “Osbourne Effect” - when you cancel or defer an order of a product because you fear it soon to be obsolete. More precisely, the phenomenon is attributed to its namesake only when it is an actual announcement of an upcoming project that is what actually impacts existing sales of a current model.

This consumption behaviour, or at least the more general behaviour of lower sales due to expectations of an impending future, is also present on the supply side, where the supplier frets concerning assigning resources to what, either in whole or in part, is believed to be obsolete development (a concept that is positively encapsulated in the phrase “Never Reinforce Failure”).

The “Osbourne Effect” is why you rarely see Big Auto, or any company for that matter, make what would otherwise be premature announcements in regards to the development of a revolutionary product.

True, market-changing R&D is rarely announced prior to immediate release – or at the announcement of a scheduled release - to the public. So to understand a company’s upcoming products, and the true net present value of its current releases, you have to put the pieces together yourself.

Daimler’s historic decision to halt future gasoline engine development past September 2019 is a stark demonstration of this concept. Daimler smells obsoletion; it is mindful of the fact that ICE car sales peaked in 2017. Compare this to EV sales, particularly with the Covid19 pandemic, and how they are already well on track to beat 2019 sales.

Committing fully, with a healthy ‘Kiai’ is key, and Daimler knows this when looking at Tesla. Tesla’s envious performance when compared to the Prius of Toyota is again demonstrative of two strategies – where one was focused on the future without concern of legacy assets, the other conducted business under a determination not to rock the boat or its business model.

German sensibility has compelled Daimler to face the music and commit its developmental resources towards the future.

On the topic of Germany, we already see Volkswagen, in late June, completely dedicating a German plant towards EV production. Volkswagen’s actions alone in 2020 serve as a case study for quality management in which Volkswagen shows us how to truly conduct a successful market pivot.

First, it consolidated stakes in EU battery manufacturers where EV sales were strong (having outperformed China during the lockdown). Then, it looked to the future and, like many, its eyes fell upon China – making Gangfeng Lithium a strategic partner, before acquiring a stake in Guoxan High-Tech Co. and securing Anhui Jianghuai Automobile Group at the same time.

Having seized a stake all the way up and down the entire supply chain, VW showed another flourish of genius – it modularised its own model design in terms of battery compatibility, thus allowing it to juggle suppliers. There are few better ways to drive battery cost down than organically integrate the tenants of competition and financial Darwinism in your own supply chain. The consideration alone is graceful, but practically it empowers VW with the ability to promise a new EV model to come every year, for the next five years, at price points projected to aggressively hound down traditional ICE cars.

Dedicated production retooling amongst manufacturers will only drive the competitive price of EVs down, and we all comprehend by now that the traditional ICE market survives only by dint of time until the majority of #EVs reach true cost parity. On the topic of Volkswagen, a case study on the Golf model alone already shows that an electric Volkswagen Golf is cheaper to own than its gasoline/diesel counterpart.

It is important to understand that one EV company’s sales do not actually compete with the sales of another EV company; a “Tesla killer” is not necessarily demanded by the market for EVs to carry the day. It is still unfortunate to see industry professionals writing for credible publications fail to understand the true condition on the ground, as it were.

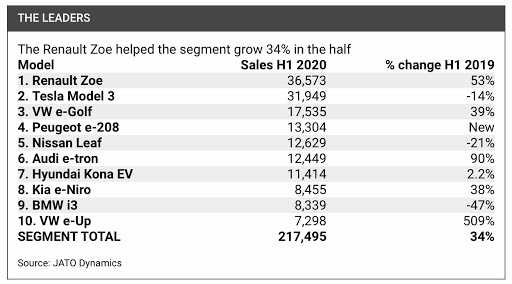

To fact, Europe’s best selling electric vehicle isn’t a Tesla - it is, in fact, Renault’s Zoe comfortably nimble hatchback. Starting at 32,000 euros the Zoe has been touted, and indeed perceived, as an ideal second car for European families. It is also curious to see some consultancies tout a 53% quarterly increase as ‘underperforming’ and again demonstrates a systemic lack of attention to detail from traditional professional establishments when it comes to the EV industry.

It is counter-intuitive to realise that as long as the market supply of EVs remains in a condition of undersupply, any EV purchase steals away from the ICE market more than it does from its EV competitors. It is the ICE car that is left unsold and obsolete in the long run when a particular EV purchase is made, as opposed to a competitor’s EV model which will nonetheless be eventually snapped up under production current conditions.

The only exception to this is perhaps with Hybrid models. Many considered Hybrids to be a sort of best-of-both-worlds approach when it comes to traditional logistical considerations favouring ICE engines while still providing the markable benefit of EV development. Certainly, all considered Hybrids to be at the very least a stepping stone of sorts that would have a market lifespan far in advance than the data we are seeing now suggests. That is the curious case at hand here; pure electric models seem to already be committing fratricide of sorts by driving a decline of hybrid (specifically plug-in) models across global markets.

Looking at U.K. regulations alone, (the 3rd biggest EV market in Europe after Norway and Germany), the country has prioritised fully electric models over plug-in hybrids since its late 2018 subsidy changes. The subsidy cuts introduced affect plug-in hybrids much more than they do fully-electric models.

In France especially, a more specific analysis focusing on the Volkswagen Golf shows plug-in hybrid vehicles are often the most expensive to run over four years, in part due to the higher purchase price of vehicles that in effect have two engines and resulting in lower government incentives.

If the French condition becomes universal, many have remarked that hybrid electric vehicles should be viewed in the same lens as Fax machines; a practical stopgap measure during revolutionary progress that may nonetheless forever persist due to its boons of redundancy and appeal to traditionalism. For now, with the data at hand, this remains pure speculation in regards to the value of diversification vs commitment.

To sum up the historic events of the first half of 2020 in regard to EVs:

We have Fisker going public with a new electric car after $50M dollars raised alongside a reverse takeover which is expected to bring $1 billion dollars to start production. We have Rivian, backed by Amazon & Ford, raising $2.5B dollars. We have the United States military, of all things, releasing official word that the next generation Humvee should be electric, with the justification that lithium EVs in the military “significantly reduce the logistical tail of the motor pool in the field” and drastically lower thermal signature of vehicles.

The Switch, the Electric Revolution, is here and tangibly so. You have buoyant EV sales during a market under pandemic lockdown and under nightmarish conditions for any consumer product. You have VW and GM fully committing to securing their battery supply chains, pledging new electric models annually. For buyers, purchasing EVs has become a case of viral conversion, and we have all been shown a memorable example of inexorable viral spread.

Big Auto remembers Blackberry, Kodak and Blockbuster."

Konstantin gives us today the opportunity to dive into the main drivers of the ongoing rEVolution and how legacy automakers are coping with the crisis in the industry. The Switch is here, Tesla is pushing all automakers to change or die quite literally. Lithium is the magic metal in the very heart of this rEVolution.

$12 Trillion industries of Energy and Transportation will depend on $3 billion Lithium market more and more. At the moment the Lithium market seems to be totally separated from all excitement and electricity in the air intoxicating the happy Robinhood crowd which is chasing bankrupt ideas and insolvent companies. "Opaque Lithium Kingdom" is still under consolidation. Strongest companies are getting stronger and picking up pieces of all other companies and the best projects they can find on their terms.

All weak players will be wiped out. Ganfeng Lithium is marching on building their own global Lithium raw material resources empire. Ganfeng's 100% ownership of Mariana Lithium is now closer with "Proposed budget 2020: US $25M" when the other JV partner "has decided to temporarily cease to make contributions to the Mariana Joint Venture" again.

TNR Gold is plugged into the Energy rEVolution with our NSR Royalty Holding on Mariana Lithium - JV under the management by the giant from China Ganfeng Lithium. Now you can better appreciate the real magnitude of Mariana Lithium Project after the increase in Lithium resources of more than 250%. I am very pleased to see that this new proposed very significant budget will be moving the project into the next stage of the development. In their 2019 Annual Report, Ganfeng Lithium published: "The feasibility study on Mariana Lithium was completed in 2019, and environmental assessment and construction of the project are planned to be conducted".

No comments:

Post a Comment