“I believe the Shotgun gold project could become one of the main satellite gold projects of the Donlin gold camp,” says Kirill Klip, the chief executive and largest shareholder of ().

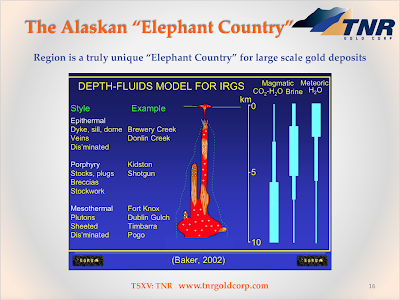

Shotgun is the flagship asset of TNR, and is located to the south of Donlin, just inside the boundary of the famous Tintina gold belt which arcs right across Alaska.

It’s a gold belt that has proved prolific in delivering up sizeable discoveries over the years, and now boasts a serious number of major producing mines, including at their forefront, the Pogo mine, owned by Northern Star Resources () and the Fort Knox mine, owned by Kinross ().

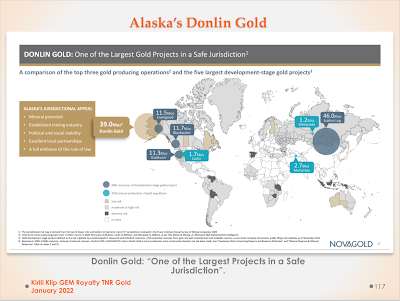

But Donlin takes things to another level again.

With its 39mln ounces of gold grading well over two grams per tonne, it’s one of the largest open pit deposits anywhere in the world.

Not surprising then that one of the biggest names in the industry, Barrick Gold (), is playing a crucial role in bringing it on, alongside partner NovaGold ().

Will these two stay as partners for the duration, or will Barrick step in and buy out NovaGold?

Or, for that matter, will a third party, like Newmont, show up late at the party and try to initiate some sort of division of the spoils with Barrick along the lines of the current hard-won arrangement in Nevada?

These are matters for speculation just at the minute, but it might not be long before we see tangible corporate action.

And it’s not altogether out of the question that Shotgun will get caught up in it too.

After all, TNR has plenty of form in forming strong alliances with the world’s leading mining companies.

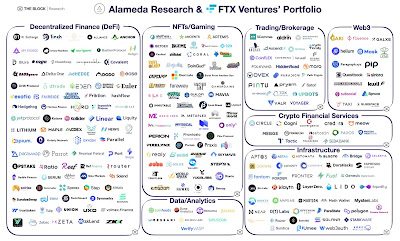

In an earlier phase of its existence it made two major discoveries in Argentina, the Los Azules copper project, now being brought forward by McEwen Mining (TSE:MUX), and the Mariana lithium project, now being brought forward by Ganfeng Lithium. After some adroit deal-making TNR managed to retain substantial royalties in these projects, such that when they come on stream it’s likely that Los Azules will contribute upwards of US$3.5mln per year to the TNR coffers, with Mariana providing a further US$1mln. However, the latter estimate was made by the analyst before Ganfeng announced an increase of the lithium resource at Mariana of more than 250%.

This background of successful deal-making with majors ought to provide TNR with a real advantage when it comes to assessing options for Shotgun in the coming months.

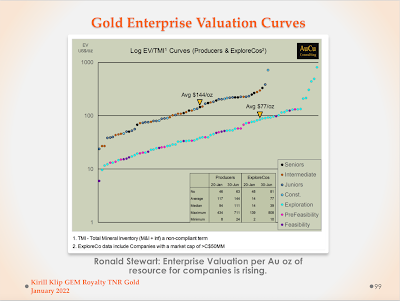

To some degree, it’s a fairly simple exercise for investors to form an idea of what the future holds, but in the case of Shotgun Klip is keen that TNR ends up retaining a 25% interest, rather than just a royalty.

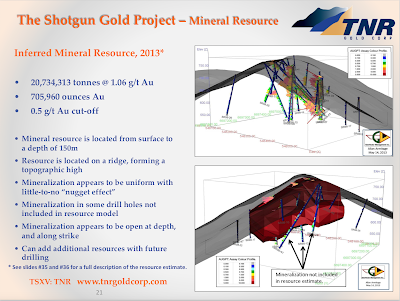

In this, he does have some room for manoeuvre, because Shotgun isn’t just another piece of prospective ground. Rather, the project already boasts an inferred resource of over 700,000 ounces of gold at Shotgun Ridge, and shows every sign of being able to deliver a markedly larger total than that, once the next major exploration programme delivers its results.

Shotgun Ridge is just one of multiple gold target areas controlled by TNR Gold. ‘Shot’, ‘King’ and ‘Winchester’ add to the collection to form a distinct gold district with five separate targets identified so far

When that will be though is the big question.

To take Shotgun up to the next level, Klip is clear that a major exploration spend is required – upwards of US$5mln and ideally closer to US$10mln. On one scenario he could go into the market and raise that money himself.

But here’s where his position as a major shareholder in the company becomes key.

“Even a US$5mln raise would be very dilutive to all our shareholders at this stage and will not guarantee success,” he says.

“We need to bring US$10mln in to drill the project very strongly.

The first US$5mln to take the project from the current 700,000 ounce resource up to the two million ounce mark, the rest to drill out the five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”

At Shotgun the thinking is that there may be upwards of five million ounces of gold in the ground, and there is precedent. At this stage the geology shows remarkable similarity to Donlin.

An academic study conducted in 2001 by Lang & Baker specifically identifies both projects as ‘major porphyry granite related gold deposits’ related to a singular widespread magmatic gold mineralising event that constitutes this horseshoe-like region.

The implication is that both projects arose from the same geographical kitchen sink, leading to the reasonable supposition that they should possess similar favourable geological properties.

“We are talking about a high tonnage bulk system,” says Klip. “There are no nuggets, it’s very uniform.”

Shotgun’s particular boon is in the details. Shotgun’s mineralisation has been shown to possess little-to-no ‘nugget effect’. A high ‘nugget effect’ means high variability between samples that are closely spaced. ‘No nugget effect’ implies a tight and uniform mineralisation of a bulk tonnage gold system. So there’s no need to dig up empty rock space as one does when chasing a vein so the stripping ratio for any mine will be low, keeping costs down.

Among the notable intercepts already banked, the company boasts 242 metres grading 1.25 grams gold per tonne, 209 metres at 1.02 grams, and just under 47 metres at 1.14 grams.

What’s more, the gold that’s been identified thus far sits at the top of a ridge, meaning that the stripping ratio for any mine will be low, which in turn will keep costs down.

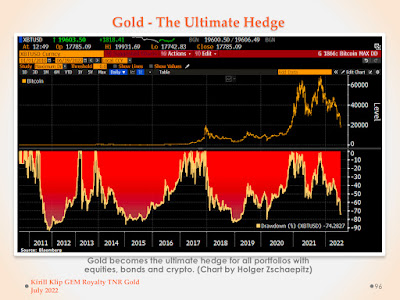

“I’m in the business to get the maximum out of this new gold bull market. We’ve been waiting for it for nearly ten years after 2011. I just need to get the best deal,” says Klip

“We are not dreamers. We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”

Not for him as a shareholder the dilutive effects of repeated equity fundings to support exploration. His favored option – of bringing a major in – would in the end, he calculates, mean that current shareholders end up retaining more of the project, and hence more of the value, in the long-term.

Will the strategy work?

Well, it already shows every sign of doing so.

“A deal could happen any day,” says Klip.

“Literally. We are seeing interest. But we are not in any hurry. The interest at the moment is from mid-sized companies. I do not like to commit to shallow money with sums that look great on paper but come from parties that lack the appropriate technical and financial depth with consistent follow-through in the years following the deal. We hold the high ground. We want to be patient and attract the best of the best, like we did with Ganfeng Lithium years ago - one of the top gold major company to make sure that we can get the absolute most of Shotgun’s resources in development.”

For now, the company is actively introducing Shotgun Gold to potential partners and is much more open to drilling the entirety of these prospects in a strong fashion so that it can expand the known area of mineralisation and conclusively assess the project’s top-end valuation.

And it’s in this context that the royalty portfolio cleaves once more into view. These are serious assets, and they promise cashflow in the near-term. There’s significant value in the company on their strength alone. All of which means that TNR isn’t like some other juniors, desperately lurching from one equity raise to the next simply to keep going. There’s far more to it than that. In fact, there’s a carefully thought out strategy that looks likely to reap significant benefits for shareholders in the near-to-medium term."

Please read my legal disclaimer. There is NO investment advice on any Kirill Klip feeds and blog. Always consult a qualified financial adviser before any investment decisions.

Do Your Own Research.