I find it quite symbolic that Oil Price has published this article by James Stafford. Our lithium story is getting on the investors' radar screens, the process is slow and masqueraded by the carnage in commodity sector. People and companies who are building their portfolios cannot imaging more opportune time: Elon Musk and Warren Buffett are making the broad market appeal for electric cars and solar energy, but lithium market itself is still full of smoke and mirrors. And now just wait for the official confirmation from Apple about electric iCar to spark all electric cars market and hedge funds start fishing upstream all supply chain. This is where Lithium comes into play as the strategic commodity, where security of supply is the most important now. The disparity in commodity and technology valuations creates great opportunities for those who can think long-term and cherry pick the best assets at the rock bottom valuations. Where to go: always do your DD and follow the smart money from industry insiders. I will provide links for your research and share all publicly available information about International Lithium and our strategic partner Ganfeng Lithium. Please do not hesitate to contact myself on any of the social media platforms or at

International Lithium. We are here to make this rEVolution happen. Dump The Pump.

Mr Li Chairman of Ganfeng Lithium and Mr Klip President of International Lithium.

This is where we are going: International Lithium is building the supply chain for Ganfeng Lithium and is part of this vertically integrated lithium battery business in China. Ganfeng Lithium finances J/V projects with International Lithium in Ireland and Argentina and we have the very encouraging news coming out. Western Lithium has taken out Lithium Americas with Cauchari lithium brine project and as you can see on the map below we have just a very few Salars left without ownership by major lithium player.

Read more.

Oil Price:

By James Stafford

The age of electrification across the transportation sector, the solar panel revolution, and Tesla’s battery gigafactory are igniting a battle for the cheapest battery. That will transform lithium into a boom-time mineral and the hottest commodity on the energy investor’s radar.

It has been easy to take lithium for granted. This wonder mineral is the backbone of our everyday lives, popping up in everything from the glass in our windows to our mountains of electronics.

And while investors have long appreciated the steady rise in demand for this preferred mineral, the number of new applications continues to multiply. Smart phones, tablets, laptops, and other consumer electronics demand more lithium. But the largest driver for future lithium use will be in electric vehicles and home batteries for solar panels. That has lithium on the verge a boom for which supply can no longer be taken for granted.

Not since the shale boom have we seen a market transformation of such significance. Lithium has long been used for a variety of mundane purposes, and while the variety is spectacular—with applications in everything from glass, ceramics and greases to a line-up of industrial process—it has flown under the radar for most investors.

Supply has always largely managed to keep pace with steadily rising demand for lithium, and while the mineral is slated for growth with or without the ‘battery explosion’, Tesla’s gigafactory will spark a phenomenal spike in demand that will be no less exciting than the shale boom.

Not only will battery gigafactories change an already attractive lithium demand picture, but the suppliers themselves will change, making way for newer entrants—with more foresight and better technology--that will provide some of the best investment opportunities in the sector.

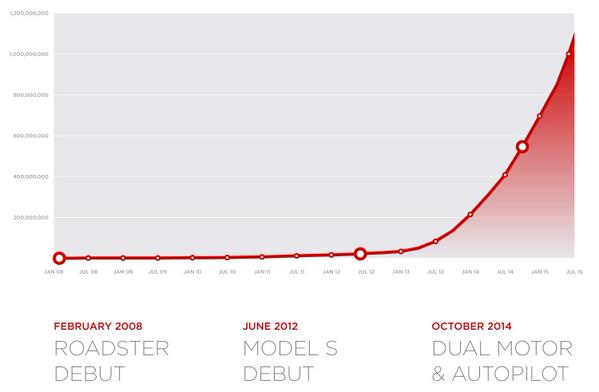

The lithium story cannot be told without first telling the Tesla story. Tesla Motors (NASDAQ:TSLA) is developing a cheaper line of electric cars for release later this decade, and to achieve this it is constructing a $5-billion

gigafactory to build 500,000 electric cars with the objective of lowering the cost of batteries by at least 30 percent.

Moreover, around one-quarter of the plant’s capacity may be for Tesla’s stationary storage business, which also sells backup batteries for homes, businesses and utilities—all fueled by lithium.

According to Tesla’s brainchild, Elon Musk, demand for stationary storage batteries has skyrocketed to the point that an expansion of the gigafactory may have to be considered before it is even built.

Musk is eyeing a “complete transformation of the entire energy infrastructure of the world to completely sustainable zero carbon,” and what he’s talking about here is lithium-battery production on a mind-blowing scale. Tesla is planning to produce more lithium-ion batteries in this factory than in the entire global marketplace combined.

Lithium—the lightest and most versatile of the metals—is the backbone of this exploding battery market. Lithium is already a key part of our everyday lives, but as batteries become the rule of the day in a new global energy picture, demand for lithium is soaring—and we are only at the beginning of this curve.

Battery manufacturers across the board are moving to lithium because it has the highest electric output per unit weight. And nowhere will this demand soar more than with the production of hybrid, plug-in hybrid and electric vehicles used by everyone from Toyota (NYSE:TM), Honda (NYSE:HMC), Nissan (NYSE:NSANY), Renault (EPA:RNO), and Mitsubishi (NYSE:MSBHY), to Ford (NYSE:F), Chevrolet and GM (NYSE:GM). And of course Tesla Motors. Without lithium, there will be no gigafactory. In fact, this factory alone will need

15,000 tons of lithium carbonate a year just to get started.

We are on the edge of a profound competition over batteries as Tesla drives down lithium-ion battery production costs, lowers the benchmark and increases cost competition. The response will be new entrants to this market, and competing battery gigafactories.

Tesla’s competitors will make this one of the biggest battles of the century—a battle the entirely depends on lithium supply. Tesla’s biggest rival will likely be Build Your Dreams (BYD), the Chinese automaker backed by Warren Buffet. Already, BYD is building electric buses on American soil and has global gigafactory ambitions. By the end of the year, according to Reuters, BYD should have 10 GWh of battery production capacity, which it expects to increase to 34 GWh by 2020 with a new factory in Brazil—about the same capacity as Tesla’s.

Other Tesla rivals rushing to the battery production scene will be iPhone manufacturer Foxconn and LG Chem, which is already one of the top three battery makers. Samsung is also hot on the trail, having just acquired Magna’s battery production division.

According to Credit Suisse, the lithium industry is “poised for significant volume growth,” which could lead to shortages of supply. As a result producers of lithium are set to enjoy significant earnings throughout the decade.

Even before Tesla’s gigafactory – and its rivals – entered the picture, global lithium consumption had doubled in the decade before 2012, driven largely by its use in lithium-ion batteries for cell phones and power tools. Then electric cars hit the scene in earnest, further boosting demand for lithium, while Tesla’s gigafactory is expected to use up as much as 17 percent of the existing lithium supply, according to

Fortune magazine, citing Goldman Sachs.

For investors who are just catching on to the lithium battery revolution, the best way to play the game is to look past the traditional lithium producers. In this boom scenario, investors will be looking at companies with the lowest market caps, solid management and highly prospective deposits.

Currently, lithium is not traded as a commodity; rather, it is managed through a kind of oligopoly situation where there are three or four major suppliers globally and they have rather successfully managed supply and demand for lithium over the past decades. Because of this, everything is priced on a contract basis.

“The problem is that these three or four major suppliers have been responsible for supply and demand but they are not going to be able to meet new demand for lithium,” Dr. Andy Robinson, a Ph.D. in Geochemistry and the COO of

Pure Energy Minerals (OTMKTS:HMGLF), told Oilprice.com.

As Robinson points out, however, not all lithium is equal. It’s sold in different types for different prices. For instance, lithium carbonate sells for around $6,000 per ton and is used to make some of the materials for new battery technology. However, many of the new battery technologies—particularly those used by Tesla—use lithium hydroxide as the starting material, which trades at around $2,000 more per ton than lithium carbonate.

And lithium found in salty water, or brines, is by far the most cost effective. According to Dr. Robinson, “brine is the best way to produce lithium because it’s so cheap, as nature has done all the hard work in rendering the lithium into a form that is easy to extract from the ground. All you have to do is drill a few wells and pump the liquid brine.”

Furthermore, there are only a few places in the world where lithium is present at high enough concentrations in these salty brines and the most famous is in the Atacama Desert, in the “Lithium Triangle” of Bolivia, Argentina and Chile. Supply here is

threatened by corruption and politics, making it difficult to capitalize on burgeoning demand.

When Tesla’s gigafactory comes online, everyone will be looking for cost-effective lithium sources closer to home, which brings us full circle to the state of Nevada, where Pure Energy Minerals has the

only potential future brine resource in North America. The only other brine resources are located in China, are much smaller and are controlled by Chinese companies.

Lithium is increasingly the tech of choice for battery banks across the board, and when Tesla’s gigafactory is

producing batteries one year from now, the winners in this emerging battery boom will be those behind the lithium, and those following the brine.

By James Stafford of Oilprice.com"

Following sales reports on June US electric car sales, Europe electric car sales, and China electric car sales, I thought it would be interesting to compare the powerhouses (and throw Canada on top of the US to make it “North America” since it’s all basically one economic region). So, below is a chart and table comparing (and also adding up these regions).

Following sales reports on June US electric car sales, Europe electric car sales, and China electric car sales, I thought it would be interesting to compare the powerhouses (and throw Canada on top of the US to make it “North America” since it’s all basically one economic region). So, below is a chart and table comparing (and also adding up these regions).