It was a very difficult year.

"Here we are talking about the FED and the megatrends which are manifesting themselves. Time is collapsing and spinning out of control. Time is a function of Energy. Money is compressed Energy. Gold is Real Money. Elon Musk talks about aliens building pyramids. Joe Rogan is connecting the dots after Pentagon’s UFO revelations. Failed genetic experiment, slaves to dig out Gold for gods? Have we grown too far to separate religion and God?Judging by the social media and screens - no, we look like the same monkeys with a grenade in one hand and instruction how to use it in another. Can these monkeys read? Nobody cares. Others did it on purpose.This is where we come to the main message for those of you who are still here."

"Our society is at the bifurcation point. We will either transgress into the higher level of consciousness really fast or all our world will be teared apart by ourselves."

"Time is collapsing and spinning out of control. We are all reminded about the very brutal and fragile reality of life. Sanity and common sense become the last precious things left for so many. Doves are crucified and even black crows are crying for peace..."

It was a very important year.

The Fourth Turning is here with all its threats and opportunities. The future is already here, not everyone can see it yet, but the megatrends are manifesting themselves. Energy rEVolution. Decentralised Solar and Wind Energy generation with Energy Storage.

Time is collapsing and spinning out of control. Time is a function of Energy. Money is compressed Energy. Gold is Real Money. Gold is the store of Energy. Solid values in uncertain times.

"Now it is imperative to save as many as we can. The whole generation is being slaughtered at the Crypto Slaughter House. Who will invest in the real future? Will people continue to "farm" after the collapse of this Crypto Tulip Bubble? We reap what we sow. To go ALL UP we need a lot of strategic metals for the Energy rEVolution: Lithium, Copper and Silver."

"There is no Gold 2.0 - there are more than 5,000 years of human history with Gold. We have another confirmation of the unique status of Gold - as the ultimate hedge for all portfolios constructed with equities, bonds and Crypto assets."

We are moving forward, one step at a time, making our best to build this world into a better place. We can all help - do NOT be evil, just around you. Thank you for joining us. All your support is very much appreciated. Stay safe. Help. Others.

TNR GOLD CORP.

> The Green Energy Metals Royalty and Gold Company.

"TNR Gold Corp. is working to become the green energy metals royalty and gold company.

Our business model provides a unique entry point in the creation of supply chains for critical materials like energy metals that are powering the energy rEVolution, and the gold industry that is providing a hedge for this stage of the economic cycle.

Our portfolio provides a unique combination of assets with exposure to multiple aspects of the mining cycle: the power of blue-sky discovery and important partnerships with industry leaders as operators on the projects that have the potential to generate royalty cashflows that will contribute significant value for our shareholders.

Over the past twenty-six years, TNR, through its lead generator business model, has been successful in generating high-quality global exploration projects. With the Company’s expertise, resources and industry network, the potential of the Mariana Lithium Project and the Los Azules Copper Project in Argentina among many others have been recognized.

TNR holds a 1.5% NSR Royalty on the Mariana Lithium Project in Argentina, of which 0.15% NSR Royalty is held on behalf of a shareholder. Ganfeng Lithium’s subsidiary, Litio Minera Argentina (“LMA”), has the right to repurchase 1.0% of the NSR Royalty on the Mariana Project, of which 0.9% is the Company’s NSR Royalty interest. The Company would receive CAN$900,000 and its shareholder would receive CAN$100,000 on the repurchase by LMA, resulting in TNR holding a 0.45% NSR Royalty and its shareholder holding a 0.05% NSR Royalty.

The Mariana Lithium Project is 100% owned by Ganfeng Lithium. The Mariana Lithium Project has been approved by the Argentina provincial government of Salta for an environmental impact report, and the construction of a 20,000 tons-per-annum lithium chloride plant has commenced.

Mariana Lithium Project* measured and indicated resource: 4,410,000 T of LCE and 49,700,000 T of potash with the additional inferred resource: 786,000 T of LCE and 9,260,000 T of potash.

(Updated Mariana Lithium Project measured and indicated resource: 6,854,000 T of LCE with the additional inferred resource: 1,267,000 T of LCE – Company news release, July 14, 2021)

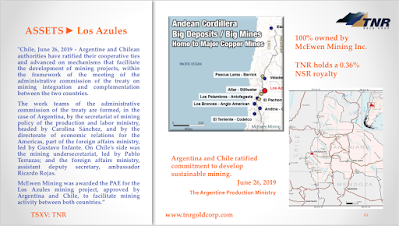

TNR Gold also holds a 0.4% NSR Royalty on the Los Azules Copper Project, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder. The Los Azules Copper Project is being developed by McEwen Mining.

Los Azules Copper Project** indicated resource: 10.2 B lbs copper, 1.7 Moz gold and 55.7 Moz silver with the additional inferred resource: 19.3 B lbs copper, 3.8 Moz gold and 135.4 Moz silver.

TNR also holds a 7% net profits royalty (“NPR”) holding on the Batidero I and II properties of the Josemaria Project that is being developed by Lundin Mining. Lundin Mining is part of the Lundin Group, a portfolio of companies producing a variety of commodities in several countries worldwide.

TNR provides significant exposure to gold through its 90% holding in the Shotgun Gold porphyry project in Alaska. The project is located in Southwestern Alaska near the Donlin Gold project, which is being developed by Barrick Gold and Novagold Resources.

Shotgun Gold Project*** inferred resource: 705,960 ounces Au at 1.06 g/t, mineralization appears to be open at depth and along the strike.

The Company’s strategy with the Shotgun Gold Project is to attract a joint venture partnership with a major gold mining company. The Company is actively introducing the project to interested parties.

At its core, TNR provides a wide scope of exposure to gold, copper, silver and lithium through its holdings in Alaska (the Shotgun Gold porphyry project) and royalty holdings in Argentina (the Mariana Lithium project, the Los Azules Copper Project and the Batidero I &II properties of the Josemaria Project), and is committed to the continued generation of in-demand projects, while diversifying its markets and building shareholder value.

* “NI 43-101 Technical Report Update of Lithium Brine Mineral Resources; Mariana Project, Salar de Llullaillaco, Argentina” dated January 12, 2020. Prepared by Geos for Ganfeng Lithium.

** “NI 43-101 Technical Report – Preliminary Economic Assessment Update for the Los Azules Project, Argentina” dated October 16, 2017. Prepared by Hatch for McEwen Mining.

*** “NI 43-101 Technical Report on the Shotgun Gold Project, Southwest Alaska” dated May 27, 2013. Prepared by Nicholas Wyck and Allan Armitage for TNR Gold."

TNR Gold Shares Video Update on Ganfeng's Mariana Lithium and Partial NSR Sale to Lithium Royalty Corp. for US$9,000,000

"Now we can discuss my quote from our News Release: "TNR Gold Monetizes Royalty Holding On Ganfeng's Mariana Lithium By Partial NSR Sale To Lithium Royalty Corp For USD$9,000,000", and better understand why we can have potentially another unique entry point opportunity into our TNR Gold GEM Royalty Story provided by the ruthless Mr Market.

The future valuation of TNR Gold NSR Royalty on Mariana Lithium will depend on the Lithium price and the amount of production by these facilities. Lithium prices in China hit a new all-time high above USD$85,000 per T of LCE spot price and Ganfeng inaugurated Mariana Lithium construction last June with their USD$600 million investment plan to develop "Phase 1" facilities for 20,000 T of Lithium Chloride annual production starting in 2024.

With 0.45% NSR on Mariana Lithium left after Ganfeng would exercise their 1% NSR buyback right the potential future undiscounted pre-tax cash flow for TNR Gold generated from only this Royalty holding can represent the annual amounts which are higher than the total market cap of the Company today."

TNR Gold Extols its NSR Royalty at McEwen Mining's Los Azules Copper After Rio Tinto Investment

TNR Gold in the Alaskan Elephant Country: "NOVAGOLD, Barrick Gold Drill 30.68g/t Gold Over 42.28 Metres at Donlin Gold, Alaska"

My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin.Kirill Klip, Executive ChairmanTNR Gold Corp.

The Full Circle: TNR Gold Discusses "Wonderful" News - Update On Batidero I And II Property Royalties Of Lundin MIning’s Josemaria Copper-Gold Project

“Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.