We are talking a lot here about the Energy Storage as the next largest application of lithium technology after electric cars which makes Solar And Wind integration into the Smart Grids of the future possible. In the future, this market will even overtake the EVs consuming more lithium batteries.

According to McKinsey, we have a totally new economics in place provided by the cheaper lithium batteries available for the Home Storage and Utility Storage Systems. Now we have the report from the ground in China by CNESA: The China Energy Storage Alliance - showing exactly what is happening in the country which is increasing its Energy Storage 10-fold in the next few years.

Energy Storage projects are growing in scale in China, new energy policies emphasise the strategy approved on the state level within 13th Five Year Plan. Power systems are granted more marketing opportunities for Energy Storage implementations. Chinese lithium battery makers are targeting foreign energy storage markets. BYD has just announced its systems available in the UK for the Home Storage.

And the most important is that the real money is flowing into Lithium Batteries R&D and production facilities. New specialised Energy Storage companies are entering the market and we will have to learn new names here after studying how Warren Buffett's BYD is leading the Lithium Race in China.

As you remember, Security of Lithium Supply is a very big part of this New Energy Plan in China and we can see latest moves consolidating the lithium industry and driving the new competition for the sources of lithium raw materials.

New Energy Plan: China Installs One Large Wind Turbine And One Football Pitch Of Solar Panels Every Hour.

"We all know that The Switch is happening, but we do not really appreciate how fast it is going now. ReNewEconomy provides us with the very impressive facts about the Renewable Energy boom in China. It is all a part of The New Energy Plan and I will provide some links to the fascinating progress China is making with Electric Cars. It is also a part of this strategic initiative to built the new manufacturing base of the 21st century and leapfrog the ICE-age technology straight into the post carbon world. Lithium Technology allows us to store electricity and use it when we want it now. Cheap batteries change everything and make it all possible. Lithium is the magic metal at the very heart of this Energy rEVolution. Read more."

International Lithium At Wentworth 2016 Presentation.

Lithium 2.0: "New Lithium Top 5" Consolidation And Security Of Supply: FT "China's Tianqi Moves On Chile's SQM."

"FT reports that further round of competition for the security of lithium supply is driving the new wave of consolidation among our "New Lithium Top 5". With all political troubles in Chile Argentina is rising to the top lithium destination in the world now. Chinese Tianqi and Ganfeng were competing for the stake in SQM. Now we can see that Tianqi will pay 51% premium to get 2.6% for more than $200 million dollars in SQM. This move opens the doors to acquire more than 20% stake in SQM. I will be following on more details of this deal. Read more."

"Now you can better understand why the security for lithium supply becomes crucial for the industry leaders. Ganfeng Lithium and Tianqi have made it to the "New Lithium Top 5" this year and even pushed FMC down in the 5th place, according to Joe Lowry. Tianqi controls with Albemarle Talison Lithium - a source of lithium raw material from hard rock mining in Australia. Now with Tianqi front running for the 23% stake at SQM - a source of lithium raw material from brine in Chile, we will have a new round of competition for the security of lithium supply. Reflecting on its political problems in Chile SQM moves to Argentina in J/V with Lithium Americas and Albemarle has just announced plans for the lithium exploration in Argentina.International Lithium is building the vertically integrated lithium business with $4.5 Billion market cap giant from China Ganfeng Lithium, which is financing J/V operations in Argentina and Ireland. Below you can find more links on the Lithium Battery and raw materials space to make your own conclusions."

Security Of Lithium Supply: Battery Maker Helping Power China Electric Car Boom Plans IPO.

"While we are all (apart from short sellers) enjoying the news coming out from Tesla about its Gigafactory progress the real Lithium Race and cut-throat competition are happening in China. Warren Buffett's BYD is going after Panasonic with its aggressive plans for lithium battery Megafactories all over the world and now Bloomberg reports that CATL is going after BYD.

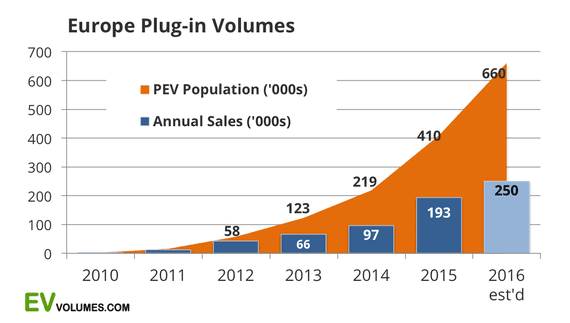

This competition will bring the prices for lithium batteries down to the Holy Grail for electric cars of $100 per KWh. Then battery for Tesla Model 3 or GM Bolt will be costing just $6k and we can start seriously talking about all cars becoming electric. We will have now the entry into the mass market for EVs with the first two electric cars with over 200 miles range and priced under 40k: GM Bolt and Tesla Model 3. Next step we can talk about my magic formula for all cars to become electric 20/200: when $20k buys you BMW 2 series type electric car with 200 miles range.

Even without this coming lower prices for the electric cars based on mass volume production of lithium batteries we are pushing 1,000,000 sales of EVs this year alone already! Bloomberg provides the new insight into Lithium Battery market and I will have to update a lot of numbers in my Lithium 2.0 Launch, starting with Tesla which now will produce at Gigafactory 1 50 GWh of lithium batteries already in 2018 and 150 GWh by 2022!

Now you can better understand why the security for lithium supply becomes crucial for the industry leaders. Ganfeng Lithium and Tianqi have made it to the "New Lithium Top 5" this year and even pushed FMC down in the 5th place, according to Joe Lowry. Tianqi controls with Albemarle Talison Lithium - a source of lithium raw material from hard rock mining in Australia. Now with Tianqi front running for the 23% stake at SQM - a source of lithium raw material from brine in Chile, we will have a new round of competition for the security of lithium supply. Reflecting on its political problems in Chile SQM moves to Argentina in J/V with Lithium Americas and Albemarle has just announced plans for the lithium exploration in Argentina.

International Lithium is building the vertically integrated lithium business with $4.5 Billion market cap giant from China Ganfeng Lithium, which is financing J/V operations in Argentina and Ireland. Below you can find more links on the Lithium Battery and raw materials space to make your own conclusions. Read more."

CNESA:

Nine Updates on China’s 2016 Energy Storage Industry

In the first half of this year we observed some positive signs: China’s increasing electricity system reforms, the rise of the “energy internet,” and growing activity in frequency regulation and peak-load shifting in China’s North. We also saw some less positive developments such as increases in wind and solar curtailments. Good and bad alike, all of these developments underline the importance of energy storage in a wide array of fields, from renewable energy, distributed generation and microgrids, as well as in setting electricity prices. From the beginning of 2016 to present, China’s energy storage industry took steps forward in project planning, policy support, and increasing product capacity.

Here are nine highlights:1) LARGE-SCALE STORAGE PROJECTS INCREASED

According to CNESA’s project database, storage project installations continued to increase. In the first half of 2016, newly operating projects totaled 28.5 MW, principally focused on renewable energy grid integration in Northwestern China. The nine newly operating projects include Golmud (Tibet) City Solar Storage Station and Kelu Electronics Solar Storage in Yumen, Gansu province.In addition to the projects in operation, in the first half of 2016, China also announced storage project construction plans adding up to over 400 MW in scale (CNESA project database). System integrator companies Samsung, Dalian Rongke, Narada Battery, were the main enterprises involved. Technologies involved include Li-ion, flow, and lead storage batteries. Principal applications were peak-load shifting and frequency regulation, large scale renewable energy grid integration, and commercial microgrids. CNESA forecasts that these projects will gain momentum in the upcoming years.

2) NEW ENERGY POLICIES EMPHASIZED ENERGY STORAGE

As China enters its 13th Five Year Planning Period in the midst of the energy revolution, the State Council, National Development and Resource Council (NDRC), and National Energy Administration (NEA) have all geared policy efforts towards adjusting China’s energy systems, innovation of new technology, manufacturing equipment, constructing smart grids, and developing renewable energy. CNESA predicts future policies will be focus on the energy internet, ancillary services, and microgrids, all increasing applications for energy storage technology.Energy storage was mentioned in numerous policy documents including, “Innovation in the Energy Storage Technology Revolution: New Action Plan (2016-2030),” “Outline for the Strategy of Driving National Innovation,” and “Made in China 2025—Plan for Installation of Power Equipment.” Such policy documents clearly outlined roadmaps for development and innovation in the energy storage, project demonstrations, and how to tackle key problems in the industry.

The importance and application value of energy storage technology also appeared in the policy document “Guiding Opinions on Implementing the ‘Internet+’ Smart Energy Development.” Energy storage is related to internet, electricity storage, heat storage, hydrogen cells, and gas storage. Through different forms of storage, electric power, heat, traffic, and oil and gas applications all interconnect.

3) POWER SYSTEM REFORMS GRANTED MORE MARKETING OPPORTUNITIES FOR ENERGY STORAGE

New rounds of electricity system reforms aim at transmission & distribution price reforms, the creation of an electricity market, sell-side reforms, and launching demand response. Increasing the degree of electricity marketization will allow the latent market potential of energy storage to open up, expanding storage business models, and bring about a turning point in the industry. As electricity retailers throughout China are established, the reforms will go into effect, introducing a flexible and diverse pricing system, thus creating spaces for the use of user-sited energy storage.Distributed storage set-ups for industrial users were also a hot topic, as individual investment costs are relatively low. At present, companies like BYD, Zhonhen, and GSL System Integration Technology Co. have already began targeting industrial parks for planning large scale distributed energy storage systems. Optimizing differences in peak and off-peak electricity prices is the primary goal, along with balancing PV use levels, participating in demand response, delaying upgrades to electricity system infrastructure, and providing in ancillary services for profit. Storage use in larger industrial areas to cut from peak consumption and increase off-peak electricity consumption can result in investment returns of five years.

4) ENERGY STORAGE CAN PLAY A CHIEF ROLE IN PROVIDING ANCILLARY SERVICES IN NORTHERN CHINA

In June of 2016, the NEA formally issued a policy in favor of electricity systems peak-load shifting and frequency regulation titled, “Notification on Promoting Energy Storage in China’s Northern Regions Ancillary Services Compensating (Market) Mechanisms Trial Project.” This is the final release of the document after the NEA solicited opinions in May earlier this year.The first part of this document discusses how to formulate substantive policies supporting the energy storage industry, how to employ energy storage in ancillary services cost sharing mechanisms, and how to demonstrate electricity storage technology’s superiority in peak-load shifting and frequency modulation. First of all, the document states that policy must first clearly give stand-alone energy storage an important position in electricity markets. Energy storage also needs a recognized identity in relation to in ancillary services, generator storage, retailers, and electricity users. Next, policy must encourage energy storage diversification construction of concentrated energy storage facilities in smaller districts, buildings, industries, and user-sited distributed storage facilities. Storage’s use in peak balancing, and fast response, will encourage the recognition of its value. Additionally, the document states policy must promote power plant and user-sited storage facilities participating in peak-load shifting ancillary services together with grid companies.

5) RAPID INVESTMENTS IN BATTERY COMPANIES ARE DRIVING ENERGY STORAGE

The rising popularity of electric cars is driving domestic demand for batteries to the point where supply doesn't meet demand. In the first half of 2016, companies like BYD, Lishen, and China Aviation Lithium Battery Co., Hefei Guoxuan High-Tech Power Energy Co., and Optimum Nano, drove the domestic battery industry forward introducing several rounds of investment plans. Lead battery manufacturers such as Menshine, Shuangdeng, and Narada Power represent enterprises also vigorously investing in Li-ion battery systems.According to CNESA’s statistics, in the first half of 2016, domestic enterprises already announced an increase of 120 GWh in newly added production capacity for power Li-ion batteries. If operations begin smoothly, by 2018, the domestic market can potentially be faced with the pressures of a supply exceeds demand scenario. In addition to current applications in electric cars, electric bikes, and the electric tools markets, battery storage will become a key industry for battery manufacturers and focus point in future markets.

6) NEW, SPECIALIZED ENERGY STORAGE COMPANIES ENTERED THE MARKET

From 2015 to the first half of 2016, many new companies specializing in energy storage entered the market, with a combined planned storage capacity exceeding 100 MWh. These new businesses largely aim at developing user storage products, providing energy storage systems solutions services. The newly founded companies comprise two main types:

A) Battery manufacturer and PCS companies launching partnerships with system integrators. Examples include:

a. Sungrow Power and Samsung SDI: The joint venture has already accrued more than $170 million USD in investments In July of 2016 the two officially launched energy storage equipment production. They expect an annual production capability of 2000 MWh in storage equipment.

b. Shenzhen Clou Electronics and LG Chem: The two have set up a new joint venture enterprise, Shenzhen Kele New Energy Technologies Ltd., at a registered cost $3.5 million USD. The planned yearly production capacity is set for over 400 MWh, with assembly lines set to begin operations starting in early 2017

c. EVE Lithium Batteries and Neovoltaic: EVE recently purchased a 12.5% share in Neovoltaic. Neovoltaic mostly focuses on PV storage, energy management services, and internet in the Australian and German markets. This move will help EVE expand its storage user base.

B) Traditional PV enterprises along with PV system integrators opening up storage-focused companies. Examples include:

a. Suzhou GCL Integrated Storage Technology Co.: This company, set up by GCL System Integration Technology, was founded with expected annual production of 500 MWh in battery capacity. At present, they have already developed and are taking orders for their first storage product, the E-KwBe NC-S Series. In the future the company will move toward distributed PV, industrial storage, and grid storage.

b. Trina Energy Storage: Trina Solar established Trina Storage Co. as a system integrator company to provide storage solutions for industrial users as well as public utility grid storage, residential storage, off-grid storage, communications systems, and vehicles.

7) CHINESE COMPANIES TARGET FOREIGN RESIDENTIAL STORAGE MARKETS

In recent years, the distributed residential storage market has developed in countries like Germany, Australia, the U.S., and Japan. Local governments overseas have drawn up storage installation subsidies, tax credits, and other demand response incentive mechanisms in order to expand the storage user base and bring about viable business models.While companies like Tesla, Sonnenbatterie, and LG Chem, release residential storage products all over the word, Chinese storage technology companies are targeting the Australian and German residential storage markets. Since 2016, Shenzhen Clou Electronics, Neovoltaics, China Aviation Lithium Battery Co., GCL Integrated Storage, Pylontech, and Trina Storage, have all released products for residential PV + storage users with capacities ranging from 2.5 kWh to 7 kWh, mainly employing Li-ion battery technology complete with smart energy management systems solutions. Chinese storage enterprises, with technology and production capacity in Li-ion and lead-acid batteries, are looking to establish business partnerships with PV installers and storage system integrators in the Australian, German, and American residential storage markets.

8) CHINESE REGIONAL GOVERNMENTS HAVE TAKEN MEASURES TO SUPPORT THE GROWING DOMESTIC STORAGE INDUSTRY

As the storage market grows, local and regional governments have grasped the importance of the emerging energy storage industry. In 2016 the governments of Dalian City, Qinghai Province, and Bijie City have all initiated planning efforts for the storage industry, preparing for industrialization and constructing demonstration centers.Dalian City (Liaoning Province)

In March of 2016, the Dalian City local government issued a policy document “Dalian City People’s Government Opinions on Advancing the Energy Storage Industry,” declaring the city a research and manufacturing center of vanadium-flow and Li-ion batteries. The policy outlines a supply chain involving local materials preparation and system integration, estimating that both the storage and related industries worth at nearly 50 billion CNY. In April of 2016, the NEA approved Dalian’s National Chemical Storage Peak Load-Shifting Station demonstration project, with a scale of 200 MW/800MWh. This signifies the first time that the NEA has approved a national scale chemical storage demonstration project and ensures enormous benefits for Dalian’s flow battery industry.

Qinghai Province

In the 13th Five-Year Plan, Qinghai Province will classify lithium batteries as a “key industry.” The province has confirmed that its lithium reserves constitute over 80% of the entire national supply. At present, Qinghai Province plans to construct a vertical supply chain including lithium extraction from salt pools, synthesis of lithium carbonate, and manufacturing of positive and negative electrode material, membranes, power and storage batteries, power control systems, and electric vehicles. The government also plans to expand the electric vehicle user base in the cities of Xining and Haidong. They list primary storage applications as combining the PV and wind operations in Haixi, Hainan, and Haibei.

Bijie City (Guizhou Province)

Beginning in 2014, China began its first compressed air storage/multiple energy source demonstration project in Bijie City, Guizhou Province with 1.5 MW capacity. Next, in 2016, Bijie also became the site of China’s first large scale physical storage national research and development center, the first of its kind to be established in Bijie. After construction is completed, it will be the largest in Asia, gearing to produce world-class research.

8) ELECTRIC VEHICLE BATTERY RECYCLING PRESENTS BOTH OPPORTUNITIES AND RISKS

As electric vehicles become more and more widespread, a large scale influx of retired batteries can also be expected in upcoming years. In 2016, China’s Ministry of Industry and Information Technology issued “Policy on Uses for Recycled Electric Vehicle Batteres (2015 edition)” pointing out that producers should be responsible for implementing systems to recycle and reuse electric vehicle batteries. Electric vehicle manufacturers should take on primary responsibility for the recycling of used batteries, while battery manufactures should take responsibility for after-sales service systems. Vehicle and Li-ion battery manufacturers alike have both started paying close attention to the battery waste chain.According to the CNESA research team, domestic power battery enterprises have already began technology research and demonstrations with the battery waste chain in mind. Confronted with the enormous market capacity of second-life batteries, the domestic battery industry has many questions that need to be answered yet, such as how to set reasonable market prices, how to choose suitable applications, how to establish quality standards.

All in all, considering proven application value, strengthening in supporting policies, as well as increasing industry investment, the present developments in the domestic storage industry are stable and favorable. We look forward even more progress in the remainder of the year.