Keith Kohl has published a very good summary about the investing in lithium. Please visit the provided links to find out more information about him and his personal recommendations. Please read my legal disclaimer and note, that our companies or myself are not endorsing it and this post is for the information purpose only, as usual. You can find more information about lithium market and its major players from my previous entry today:

International Lithium And Ganfeng Lithium: "The End Of The Lithium 'Big 3'.

"Joe Lowry has published a very interesting article about the lithium market, major producers and rising Chinese powerhouses in lithium industry. You can find now more details on International Lithium strategic partner Ganfeng Lithium. Apple Electric iCar and Warren Buffet BYD move into energy storage to chase Elon Musk with his Tesla Gigafactory bring Lithium back onto the radar screens of investors now. Read more."

Energy & Capital:

Lithium Investing

Tomorrow's Energy is a Metal

Keith Kohl

Did you know that tomorrow's oil is actually a metal?

I know it sounds pretty crazy, but the truth is, starting in the very near future (it's actually already begun, and I bet you're carrying evidence of this in your pocket right now), the majority of our energy will be delivered not through fossil fuels but through a very special metal.

As you may have already guessed, this is no ordinary metal.

It's the lightest of all metals known to man, and it's also used in alloys to strengthen and lighten things like aircraft wings.

But it's in its atomic structure that the true power of this one-of-a-kind element lies.

You see, it's a key component of modern batteries — particularly the rechargeable kind.

That piece of evidence you're carrying around in your pocket? It's your cell phone. There are billions out there today, and each and every one of them contains some of this metal.

Moreover, those big hybrid car batteries that you probably hear about — they all depend on this metal to function.

And with the market for large, rechargeable batteries now hitting record growth figures and even more growth expected for at least the next decade, this element is rapidly becoming one of the most important industrial metals there is.

It's called lithium, and there's more demand for it right now than at any time in history.

What's driving this demand?

To put it as plainly as I can: almost everything.

Broad Spectrum Demand

From cell phones to portable computers to tablets and all the way up to hybrid and pure electric vehicles, everything that needs a compact, rechargeable power sources relies on lithium the way you and I rely on water and oxygen.

Not since the adoption of gasoline as a general power source has any commodity been this universally needed.

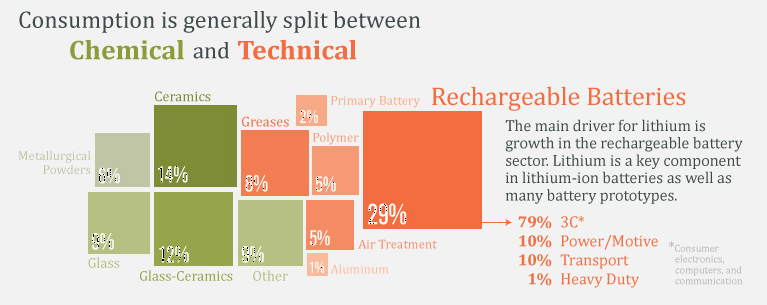

These charts only tell part of the story of where it's going.

So to say that we're in a lithium bull market is understating it. This is what some people in my industry call a "super-trend"... Not at all unlike the oil mania of the early 20th century or the housing mania of the earlier 21st century.

Only unlike both of those two, this one is nearly universal in terms of its implications and the sectors it will affect moving forward.

Don't Limit Your Profits

The conclusion is simple: Lithium is THE energy investment of the 21st century, more so than any other — including oil, natural gas, nuclear, solar, as well as any and all of the industries that support those.

And with Tesla's "Gigafactory" now being built and promising to nearly double the entire world's rechargeable battery production capacity, you better believe that demand is only now starting to ramp up.

So how do you leverage this Everest-sized trend into the best possible profits?

Well, most investors would find a lithium producer, buy some stock, and sit on it.

And while this may be a valid and perfectly effective method of riding lithium gains for years to come, there's another way…

Brains... Not Bravery

It's a method that only the most experienced, most seasoned investors typically use... but implemented properly, this method of investing in an escalating commodity could return 5, 10, even 50 times the gains of investing in a major lithium producer.

You do this by finding a lithium producer that's just bringing its operations on-line for the first time.

Even better than that, you find a lithium explorer that's just now discovering new lithium deposits.

Sound risky?

Well, sometimes it is, but not when this company is exploring and planning to mine in the world's richest-known lithium region: Argentina's "lithium Triangle."

Also, risk tends to dissolve away when this company is trading at historical lows just as its exploration program is going into high gear.

And finally, risk tends to all but vanish when you're coming out of the deepest market lows in more than 15 years — which the Canadian venture markets (where this company is listed) are currently doing.

As an oil and gas guy, you won't find me writing about batteries too often, but in cases like this, I would be remiss to stay quiet.

Energy is energy, and in the coming decades, lithium's importance will be growing more and more.

When I see young, aggressive companies that can maximize my profit potential on such a clearly indisputable economic trend, all bets are off.

And this is precisely what's happening with this microcap mining exploration company.

With properties located smack-dab in the middle of the richest lithium reserves anywhere in the world, and with huge new demand coming from Tesla's Gigafactory (which is being built, conveniently, just a stone's throw away from this company's North American property), this investment is the kind that will make even a die-hard oil guy like myself switch teams.

Just a few days ago, my colleague Alex Koyfman published a detailed report on this company, its projects, and, most importantly, its prospects for 2015.

I'm convinced that when you get done reading it, you'll never think of energy the same way.

To get risk-free, instant access to this report right now, click here.

Until next time,

Keith Kohl"

No comments:

Post a Comment