Joe Lowry has published a very interesting article about the lithium market, major producers and rising Chinese powerhouses in lithium industry. You can find now more details on International Lithium strategic partner Ganfeng Lithium. Apple Electric iCar and Warren Buffet BYD move into energy storage to chase Elon Musk with his Tesla Gigafactory bring Lithium back onto the radar screens of investors now.

Lithium Technology potential was demonstrated by Elon Musk with Tesla Model S, now is time for urban mobility solutions to save China and India from horrible air pollution. And our own cities will benefit as well for our kids! Foxconn is talking about $15k EV and Boston Power about even $8k price tag. The future will tell whether they can succeed, but we are at the tipping point for mass market for electric cars already. Our strategic partner Ganfeng Lithium has signed an MOU to acquire the stake in Boston Power and among the suppliers to Warren Buffett backed BYD in China. Europe is the very important export market for Ganfeng Lithium and we are very pleased at International Lithium to advance the Avalonia Lithium J/V project in Ireland. Our team is on the ground now preparing for the drilling on the newly discovered targets.

Seeking Alpha:

The End Of The Lithium 'Big 3'

Joe Lowry

Most people writing about the lithium industry refer to Albemarle/Rockwood (NYSE:ROC), Chemical & Mining Co. of Chile (NYSE:SQM) and FMC as the "Big 3" lithium companies. The concept of the "Big 3" in lithium was valid for almost two decades but now is as antiquated as the idea of the "Big 3" automakers.

The lithium industry structure currently has one "super power", two former members of the "Big 3" that still participate, a newcomer starting-up (Orocobre (OTCPK:OROCF)), and a rising group of producers in China that have captured most of the recent growth in the market.

The "super power" is Rockwood Lithium, which was recently acquired by Albemarle (NYSE:ALB). Rockwood's strong global presence in the upstream lithium business (spodumene, lithium carbonate, lithium hydroxide, etc.) and their clear leadership position in the downstream lithium business (butyl lithium and a broad portfolio of other organic lithium products) puts them in a class by themselves. Albemarle clearly saw great value and potential synergy with other business units in acquiring Rockwood. Rockwood will continue to grow within Albemarle. Whether the acquisition price Albemarle paid for Rockwood is justified is a separate question.

Despite their large capacity and low cost reserves in the Atacama Desert, SQM remains a lithium producer with a "by-product" mentality. SQM produces a reasonably high quality lithium carbonate product and a basic industrial grade lithium hydroxide. SQM also sells partially treated lithium brine as a feedstock for conversion to value added lithium products in China. Lithium is less than 10% of SQM's sales. Several years ago, SQM attempted to move into the downstream lithium business but quickly realized they were better served by remaining focused in the more commodity like segments of the lithium market leveraging their low cost position. In recent years SQM's lithium carbonate production has not reached former peak levels despite the growing global market. Seeking Alpha."

Not too many years ago FMC was the #2 lithium company in the world with leading positions in key product lines such as lithium hydroxide and lithium chloride. After several years of operational issues in Argentina negatively impacting volumes and costs, FMC's market share has declined. FMC's current strategic intent for their lithium business is unclear. After more than a decade of positioning the lithium business as a specialty chemical unit, in early 2013 FMC suddenly rebranded lithium within their newly created Minerals Division. A year later FMC announced the planned spin-off of the Minerals Division. Within months the spin-off plan was scrapped and the main Minerals asset (the soda ash business) was sold separately effectively leaving lithium an orphan in the FMC portfolio. Lithium now constitutes less than 5% of FMC sales and as one analyst following FMC wrote in December, 2014: "the lithium business does not warrant much discussion".

China Rising

On the other side of the world, two things have been happening: 1) most of the growth in the lithium market has been in China and 2) a couple of publicly traded Chinese lithium companies have captured most of that growth and become global industry players in the process.

Sichuan Tianqi Lithium shocked the lithium world in late 2012 by outbidding Rockwood for global spodumene leader Talison. Tianqi's strategy to control a significant lithium resource and become the leader in the upstream China lithium market was clear. Tianqi's currently planned acquisition of Galaxy Resource's (OTCPK:GALXF) lithium carbonate plant in Jiangsu province to supplement their capacity in Sichuan province further demonstrates the execution of their growth plan.

While Tianqi got headlines outbidding Rockwood for Talison another company, Jiangxi Ganfeng Lithium, has quietly employed a very different strategy - growth via sourcing rather than owning their raw material source. Ganfeng focused first on the downstream market - becoming the largest metal producer in the world and a major regional player in the butyl lithium business. Now they are growing their upstream presence globally having recently built the world's largest lithium hydroxide plant.

Ganfeng's lithium raw material comes from various sources including Chilean brine and Australian spodumene while they seek the right moment to develop their own resource.

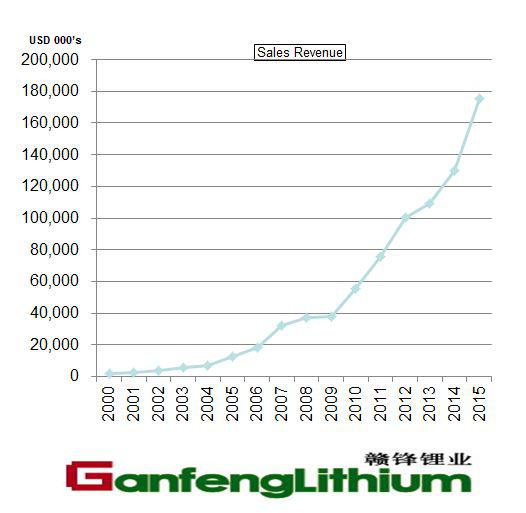

Stated in U.S. dollar terms, Ganfeng currently has a market capitalization of $1.2 billion and their sales growth is something never previously seen in the lithium world - rising from ~ $1 million in 2000 to an estimate of ~ $180 million in 2015.

While Ganfeng's and Tianqi's projected 2015 sales may still be a bit lower than SQM and FMC, it is clear that their growth trajectory makes them the worthy of discussion as "major players".

Another company in China, Sichuan Yahua, has recently acquired two small lithium companies and intends to make significant investment in growing their lithium business. This company should also be considered a potential major.

Albemarle's Rockwood Lithium unit will remain the world's leading lithium company for the foreseeable future; however the fact the Rockwood holds the minority interest with Tianqi in the 51/49% Talison JV speaks volumes about the change in the lithium industry structure.

The ranking of the companies below Rockwood in the lithium world is likely to change in the coming years; however one thing is clear: the former members of the "Big 3" no longer control the market.

No comments:

Post a Comment